A recent paper by Mohsen Mohaghegh of Ohio State University discusses two main trends related to U.S. entrepreneurs: the decrease in the number of entrepreneurs and the increase in their borrowing. Entrepreneurs have increased their debt holdings relative to their assets over the past three decades. Greater opportunities for financing new investments, rising business costs, and modifications to the bankruptcy code are among the different elements influencing the behavior of entrepreneurs. In addition to these factors, the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. treatment of debt financing may also be contributing to how much debt entrepreneurs are willing to take on.

Using flow of funds data, Mohaghegh shows that the debt-to-asset ratio of entrepreneurial firms has risen from about 0.23 in 1975 to nearly 0.40 in 2007. This means entrepreneurs are taking on more debt relative to their assets than they were previously. Several things are driving this trend: improved access to loans from lenders, reduced overhead costs for firms to borrow, and the way our tax system treats debt financing.

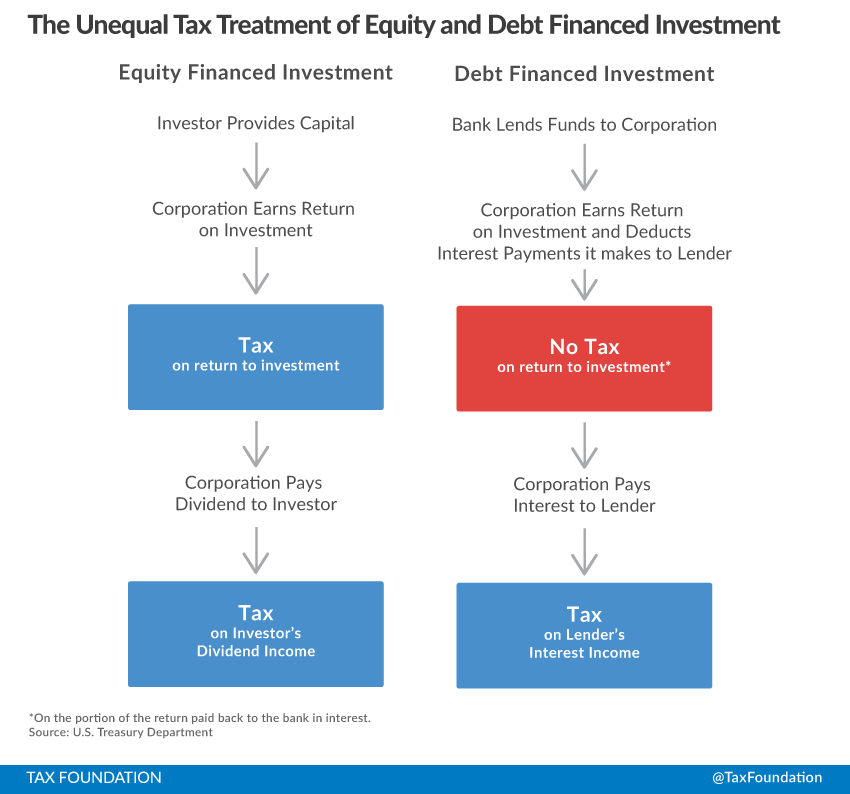

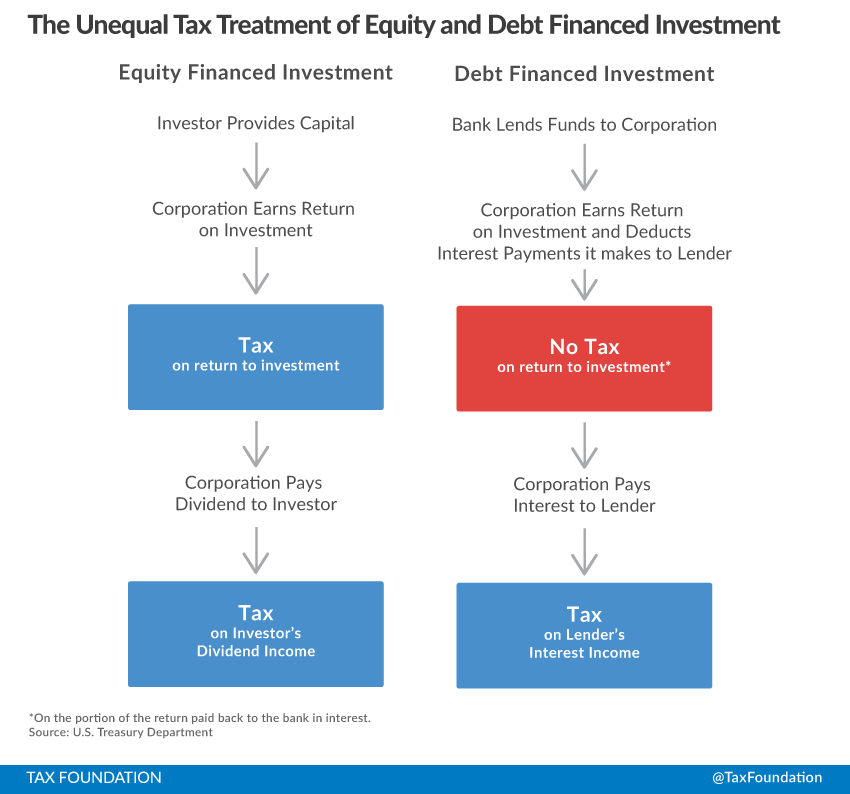

Firms with taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. , including startups, may deduct interest payments on their debt from their gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” . The firm’s tax liability is therefore lower than it would be if interest payments were not deductible. (The lender receives the interest and pays tax on it.) By contrast, a startup financing its activities with equity (i.e., by issuing shares) would not receive any deduction from its income taxes when distributing dividends to its shareholders.

This tax treatment biases corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT). s toward debt financing. Equity-financed investments have a higher effective tax rate, as a return is taxed both when it is earned by the firm and when it is remitted to shareholders. Debt-financed investments only have a tax applied to the lender when they receive interest payments.

This treatment is exacerbated by the way that we tax some business forms. Firms incorporated as C corporations pay corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. on their returns prior to distributing dividends. Shareholders receiving those dividends also pay income tax on their dividend income.[1] This effectively taxes the corporation’s return twice, as this figure illustrates:

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThe poor tax treatment of equity financing for startups structured as passthrough firms is less pronounced. Unlike C corporations, passthrough firms do not have their income taxed twice. Instead, income generated by passthrough firms “passes through” to the owner(s), where the income is taxed at the marginal individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rate. This structure reduces some of the benefits of debt financing when compared to raising funding from issuing new shares, as the difference between the two effective tax rates is smaller.

Passthrough firms may still prefer to finance their activity with debt, as the marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. paid by the borrowing firm may be higher than the rate paid by the lender. This lowers the equilibrium after-tax interest rate for debt financing, making debt cheaper than it otherwise would be for firms looking to raise funds.

The economic distortions generated by the poor tax treatment of equity financing also affects some firms more than others. Startups with physical assets find debt-financing more attractive than startups that rely more heavily on human capital or intellectual property. Physical assets can be more easily liquidated in a default, making debt financing more favorable than it may be for firms with intangible assets.

The situation is more complex for entrepreneurs who experience net operating losses (NOLs) in the course of maturing their business. Unlike taxable firms, startups with debt financing and NOLs have no tax liability to deduct for their interest payments. This could make equity financing more attractive to startups expecting to realize losses before becoming profitable.

Equalizing the tax treatment of debt and equity financing–perhaps as part of broader reform efforts–would help ensure that bad tax policy isn’t contributing to rising leverage by entrepreneurs. The capital structure of entrepreneurial ventures should be guided by financial markets and investors seeking returns to risk, and not swayed by preferences embedded in our tax code.

[1] Shareholders with qualified dividends pay the lower long-term capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rate. Qualified dividends are dividends that are paid by a U.S. corporation or qualifying foreign corporation for stocks which have been held for more than sixty days.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe