All Related Articles

Treasury Minimum Tax Argument Relies on Narrow Interpretation of Current/Proposed Rules

As Congress prepares to rewrite some portion of the current international tax rules, it’s hoped that they are able to achieve a more principled approach and one that is not so subject to obfuscation and misinterpretation.

7 min read

Tax Foundation Response to Ireland Department of Finance Consultation Document: Consultation on OECD International Tax Proposals

The recent effort to change international tax rules has been one of significant contradictions. The proposals have been driven by arguments about the need to raise additional revenues, to stabilize corporate tax rates, or to prevent offshoring. However, upon closer examination, these three arguments fail to capture what is occurring.

Reviewing Wyden’s Reconciliation Tax Policy Proposals

Congressional lawmakers are putting together a reconciliation bill to enact much of President Biden’s Build Back Better agenda. Many lawmakers including Senate Finance Committee Chair Ron Wyden (D-OR), however, want to make their own mark on the legislation.

5 min read

Tax Foundation Comments on the Wyden, Warner, Brown Discussion Draft

The proposed restructuring of the GILTI and FDII regimes makes several changes to the tax base that are largely offsetting, leaving virtually all the revenue potential to be determined by the tax rates on GILTI and FDII and the haircuts on foreign tax credits. Lawmakers should carefully weigh the trade-offs between higher tax revenues and competitiveness.

GILTI of Neglecting Losses

As lawmakers are reviewing international tax rules and determining what to change and update, they should pay attention to the way GILTI interacts with profitable and loss-making companies.

5 min read

Expense Allocation: A Hidden Tax on Domestic Activities and Foreign Profits

While arcane, expense allocation rules are relevant to current debates because they result in a heavier tax burden for U.S. companies under current law than the recently negotiated global minimum tax proposal.

10 min read

International Tax Proposals and Profit Shifting

There are many ways the U.S.’s international tax rules could be changed, reformed, improved, or worsened. Reflexively jacking up taxes on U.S. multinationals does not necessarily accomplish the goal of reducing or eliminating profit shifting, and it would in fact worsen it.

6 min read

Adoption of Global Minimum Tax Could Raise U.S. Revenue…or Not

This interaction between the U.S. proposals and those that may be put into law in foreign jurisdictions should give lawmakers caution when evaluating the revenue potential of changes to GILTI.

7 min read

Four Revenue Scores on Options to Change U.S. International Tax Rules

Changes to international tax rules are likely on the way, and it is therefore important for lawmakers to understand how various reform options would impact U.S. tax burdens on multinational companies. Moreover, policymakers should also recognize the need for prudent policies that do not put U.S.-based multinationals at a competitive disadvantage or severely curtail investment and hiring.

9 min read

Options for Reforming the Taxation of U.S. Multinationals

The Biden administration’s international tax proposals would impose a 7.7 percent surtax on the foreign profits of U.S. multinationals, resulting in a net increase in profit shifting out of the U.S.

60 min read

Survey Shows Growing Tax Complexity for Multinationals

New data clearly points to an increase in tax complexity for multinationals in the OECD as well as globally. The OECD’s ongoing efforts to reform the international tax system will likely further add complexity to the international tax environment.

3 min read

Intellectual Property Came Back to U.S. after Tax Reform, but Proposals Could Change That

Intellectual property is a key driver in the current economy. Among other things, intellectual property includes patents for life-saving drugs and vaccines and software that runs applications on phones and computers.

5 min read

How Biden’s Business Tax Proposals Would Impact Taxpayers Across States

The Biden administration has targeted U.S. businesses, including corporations and passthrough entities, to raise revenue to fund new spending. However, individual taxpayers across America will end up footing the bill.

4 min read

Piling on the GILTI Verdicts

The Biden administration has proposed to significantly increase the tax burden on foreign income through a policy known as Global Intangible Low-Tax Income (GILTI). While the administration’s rhetoric focuses on doubling the tax rate on GILTI from 10.5 percent to 21 percent, this is less than half the story.

5 min read

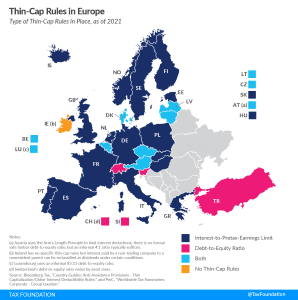

Thin-Cap Rules in Europe

To discourage this form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes.

5 min read

The Impact of the Biden Administration’s Tax Proposals by State and Congressional District

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

New Research Shows Major Changes for U.S. Companies Earning Profits from Ireland

New data show that the recent policy changes that have been implemented by the U.S., Ireland, and dozens of other countries are having an impact. The question for policymakers is whether they will take the time to understand these impacts before jumping to the next project to change international tax rules yet again.

3 min read

Details and Analysis of President Biden’s FY 2022 Budget Proposals

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

Carve-ins and Carve-outs: Open Questions for Global Tax Reform

There has been some confusion about how some parts of the recent G7 agreement on new tax rules for multinational companies might work. The new policies would target the largest and most profitable multinationals and bring in a global minimum tax.

5 min read