Pleading GILTI: A Guide to the Complicated World of Global Intangible Low Tax Income

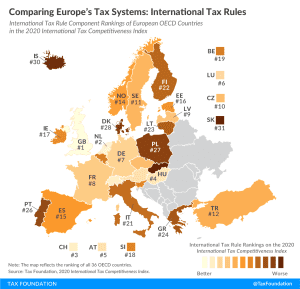

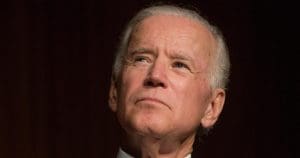

On this episode of The Deduction, we speak with Pam Olson, Tax Foundation Board Member and Consultant on Tax Policy Services at PwC, about the tax on Global Intangible Low Tax Income, or “GILTI.” In 2017, GILTI was implemented as a minimum tax designed to disincentivize U.S. companies from shifting profits overseas, but it doesn’t work how drafters intended, and now President Biden has proposed doubling it.