The Future of BEAT

Even when international relations are frayed, there is value in finding ways to combat corporate profit shifting while also fostering a healthy commercial atmosphere and positive trade relations.

7 min read

Even when international relations are frayed, there is value in finding ways to combat corporate profit shifting while also fostering a healthy commercial atmosphere and positive trade relations.

7 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

The One Big Beautiful Bill is now law—but what does it actually do? In this episode, we break down the new tax law’s key provisions, including who benefits, who doesn’t, and what it means for the economy, tax certainty, and the federal deficit.

President Trump made clear that the US wouldn’t accept the global minimum tax (known as Pillar Two) from the OECD in its current form.

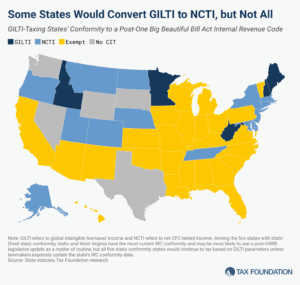

The One Big Beautiful Bill’s changes to the taxation of international income have surprising implications for state codes, yielding tax increases and a revised tax base that, through quirks of state incorporation, bears very little resemblance to the federal base and almost nothing of its purpose.

10 min read

The BEPS project’s 15 actions were decisive responses to real problems in cross-border taxation, offering real benefits but also real costs. A decade of implementation experience has revealed a critical side effect: sharply higher compliance costs for both tax administrations and the business community.

Policymakers continue to debate international tax rules after the US gained agreement on a new approach at the G7 that could result in US anti-avoidance policies existing side-by-side with the global minimum tax.

4 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

Lawmakers should consider maintaining QBAI and applying the several billion dollars from the Senate’s change toward other pro-growth international tax reforms instead.

6 min read

Congress is racing to pass the One Big Beautiful Tax Bill before the July 4 deadline. In this episode, Kyle Hulehan and Erica York break down what just happened over the weekend, what’s actually in the bill, and what comes next as the House and Senate try to reconcile their differences.

Expanding and updating the US tax treaty network—both by forging new agreements and modernizing existing ones—is vital to maintaining the country’s competitiveness in a rapidly evolving global tax landscape.

4 min read

The Senate draft overall makes more changes to international tax policy than the House draft. On net the changes are positive.

8 min read

If Illinois’ budget is enacted as-is, Illinois will newly tax 50 percent of Global Intangible Low-Taxed Income (GILTI) as of tax year 2025, retroactively increasing tax burdens for US businesses and further hindering Illinois’ business tax competitiveness.

7 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Dominika Langenmayr, Professor of Economics at Catholic University of Eichstätt-Ingolstadt, about the future of the EU tax mix.

15 min read

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

5 min read

As lawmakers consider options for budgetary offsets, they should prioritize competitiveness and economic growth, as a heavier corporate tax burden will undermine the core purpose and achievement of the TCJA.

24 min read

As Congress debates expensing and other policies impacting business investment, lawmakers should consider the importance of business investment in research and development (R&D) as a driver for economic growth. Recent studies suggest that the economic benefits of R&D spending are even greater than previously understood.

7 min read

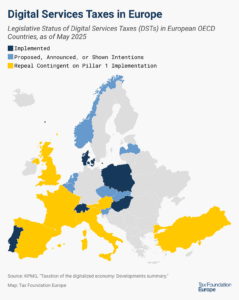

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.