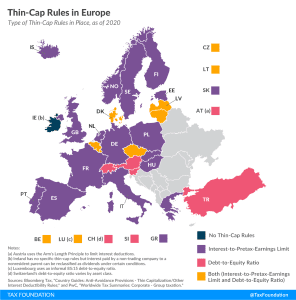

Thin-Cap Rules in Europe

To discourage a certain form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes.

4 min read