Sources of US Tax Revenue by Tax Type, 2024 Update

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

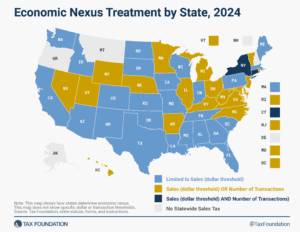

Reforming economic nexus thresholds would not only be better for businesses but for states as well. It is more cost-effective for states to focus on—and simplify—compliance for a reasonable number of sellers than to impose rules that have low compliance and are costly to administer.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

In his FY 2025 budget, Illinois Gov. Pritzker outlined a number of proposed tax changes, including to individual and corporate income taxes, state sales taxes, and sports betting excise taxes.

7 min read

Expanding Virginia’s sales tax base to include B2B digital transactions could lead to tax pyramiding, hide the true cost of government, and make the sales tax system much less neutral and transparent.

5 min read

Sales taxes go beyond a few extra bucks at the register. It’s not just about what you pay, but who pays. What are the implications of state sales tax bases across the U.S.?

One particular provision of the Biden administration’s proposal to ban so-called “junk fees” would have unintended consequences.

5 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

9 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

As policymakers continue efforts to improve Kentucky’s tax structure and competitiveness, they should keep in mind that not all offsets are created equal.

59 min read

Two pieces of tobacco legislation in Michigan have the potential to decrease state tax collections by $320 million per year, deter smokers from switching to less harmful products, and increase illicit trade and crime.

4 min read

Nebraskans need property tax relief and there are sound ways to provide it. However, increasing the sales tax rate to the highest in the country and dramatically increasing cigarette excises is not sound tax policy.

5 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Virginia Governor Youngkin unveiled the contours of a tax reform plan incorporated into his forthcoming budget, which includes three major structural elements: a reduction in the individual income tax rate, a 0.9 percentage point increase in the sales tax rate, and the broadening of the sales tax base to include some “new economy” digital services.

6 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min read

The current patchwork of state laws taxing marketplace facilitators is complex, burdensome, and inefficient. States should work to resolve these issues and standardize the otherwise disparate requirements—with or without an inducement from Congress or the courts.

29 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read