Wyoming Voters to Consider Property Tax Changes, but Sound Property Tax Relief Is Not on the Ballot

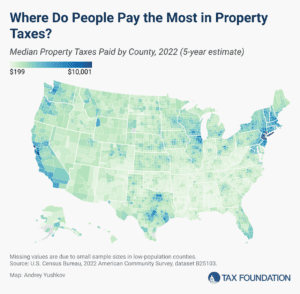

Nationwide, property owners have experienced surges in valuations and are demanding tax relief. Lawmakers are right to find ways to provide it, but should do so with sound tax principles in mind.

5 min read