Tax Policy and Economic Downturns

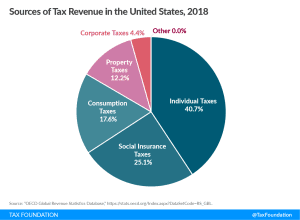

The Great Recession provides some insight into how tax revenues declined during a deep recession. Across OECD countries, revenues fell by 11 percent from 2008 to 2009 with corporate income taxes seeing the steepest decline at 28 percent. Revenues from individual income taxes fell by 16 percent.

4 min read