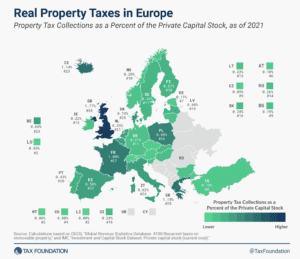

Property and Transfer Tax: If It Moves, Stop Taxing It.

Portugal’s turnover tax on real property transfers places a serious drag on economic growth by making it harder for people to relocate for better jobs and living conditions while constraining investment into the development of housing and buildings.

5 min read