Tracking 2021 Election Results: State Tax Ballot Measures

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

The Index provides lessons for policymakers when they are thinking of ways to remove distortions from their tax systems and remain competitive against their peers. The further up a country moves on the Index, the more likely it is to have broader tax bases, relatively lower rates, and policies that are less distortionary to individual or business decisions. Going the other way reveals a policy preference for narrow tax bases, special tax policy tools, and rules that make it difficult for compliance.

5 min read

A well-structured tax code (that’s both competitive and neutral) is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

40 min read

Whether spurred by a belief that government is improperly favoring religious institutions, an antipathy to wealthy celebrity pastors, or a hope that taxing houses of worship could bring down personal tax bills, the taxation of religious bodies is hotly debated online, but barely on the radar of actual elected officials. But is that true? How much, if any, tax revenue is forgone, and what do the policies look like?

7 min read

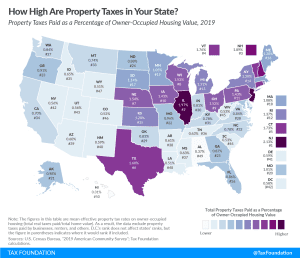

The six counties with the highest median property tax payments all have bills exceeding $10,000—Bergen, Essex, and Union Counties in New Jersey, and Nassau, Rockland, and Westchester counties in New York. All six are near New York City, as is the next highest, Passaic County, New Jersey ($9,881).

3 min read

Because property taxes are tied to housing values, it makes sense that the actual dollar amounts of property taxes tend to be higher in places with higher housing prices. This map takes housing value into account to give a broader perspective for property tax comparison.

3 min read

As Wisconsin emerges from the pandemic, state policymakers have a rare opportunity to reinvest excess revenues in a structurally sound manner that will make the state more attractive to individuals and businesses, promote a quicker and more robust economic recovery, and put the state on the path to increased in-state investment and growth for many years to come.

7 min read

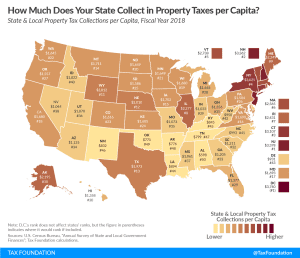

Property taxes are an important source of revenue for local and state governments. In FY 2018, property taxes generated over 30 percent of total U.S. state and local tax collections and over 70 percent of local tax collections.

2 min read

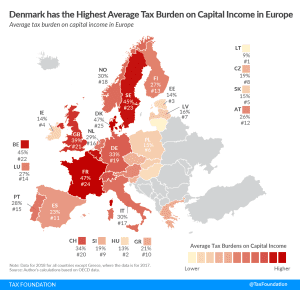

The taxation of capital—at both the individual and the corporate level—is much debated and affects economic growth by lowering the incentives to save and invest.

6 min read

State and local tax policy have always mattered, but the rise of remote work is bringing tax burdens and economic competitiveness to the forefront. It is a development that states cannot afford to ignore.

5 min read

While many of the tax proposals work in tandem, some conflicts continue to exist. If lawmakers were able to repeal federal deductibility, reduce income tax rates, finish the job on inventory taxation, and phase out the capital stock tax, this would represent a marked improvement in the state’s tax climate, eliminating several of the most uncompetitive features of the current code.

6 min read

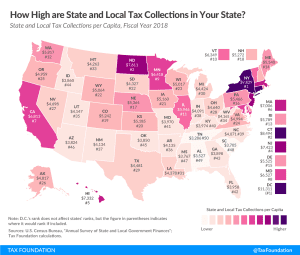

Although Tax Day has been pushed back this year, mid-April is still a good occasion to take a look at tax collections in the United States. Because differing state populations can make overall comparisons difficult, today’s state tax map shows state and local tax collections per capita in each of the 50 states and the District of Columbia.

3 min read

To help countries face the pandemic-related financing needs while reducing inequality, the International Monetary Fund (IMF) has released a series of policy recommendations based on a temporary COVID-19 tax, levied on high incomes or wealth.

4 min read

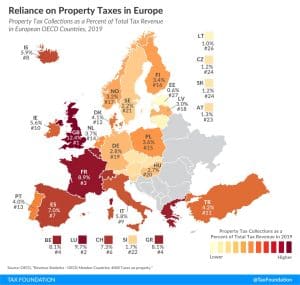

Property taxes are levied on the assets of an individual or business. There are different types of property taxes, with recurrent taxes on immovable property (such as property taxes on land and buildings) the only ones levied by all countries covered. Other types of property taxes include estate, inheritance, and gift taxes, net wealth taxes, and taxes on financial and capital transactions.

1 min read

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

The Nebraska legislature has an excellent opportunity to make progress toward a simpler, stabler, less burdensome, and more competitive tax code.

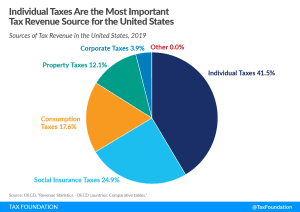

In the United States, individual income taxes (federal, state, and local) are the primary source of tax revenue, at 41.5 percent of total tax revenue. Social insurance taxes make up the second-largest share, at 24.9 percent, followed by consumption taxes, at 17.6 percent, and property taxes, at 12.1 percent.

4 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read