Peruvian “Solidarity Tax” Unlikely to Offset Deficit Spending

While it is important that Peru find ways to offset its deficit spending, a temporary wealth tax may introduce more problems than it solves.

5 min read

While it is important that Peru find ways to offset its deficit spending, a temporary wealth tax may introduce more problems than it solves.

5 min read

In many cases, when two single workers combine their incomes and file jointly, the progressive tax system penalizes the secondary earner by subjecting their wages to a higher marginal tax rate.

25 min read

Countries around the world have implemented and continue to implement emergency tax measures to support their economies during the coronavirus (COVID-19) crisis.

5 min read

Despite a balanced budget and and revenue shortfalls arising from the coronavirus crisis, the D.C. Council will consider proposals to raise income taxes to fund newly proposed spending projects.

5 min read

To prevent confusion and to ensure taxpayers receive the full benefit of the extended federal deadline, states should consider extending first- and second-quarter estimated tax payment due dates to July 15 or later.

9 min read

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min readThe HEROES Act adds to the confusion and instability already inherent in the tax code with multiple expiring provisions and reduced filing guidelines.

4 min read

The HEROES Act would make notable expansions to all three dependent-related credits, increasing maximum credit amounts, refundability, and income eligibility phaseouts. Practically, this means that certain filers could expect to receive a larger refund for each additional hour of work, eligible dependent, and dependent care expenses if the bill became law.

5 min read

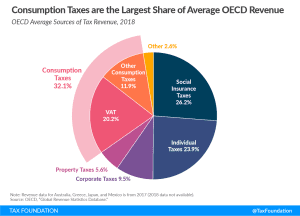

While the current crisis has caused consumption to drop dramatically, it is generally true that income taxes are more volatile than consumption taxes in an economic downturn and income taxes tend to be more harmful to economic growth than consumption taxes and property taxes.

3 min read

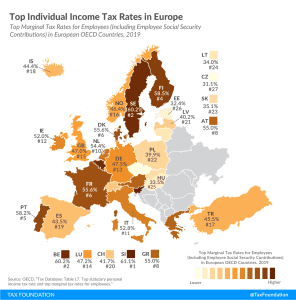

A higher tax burden on labor often leads to lower employment rates and wages. That’s important for policymakers to remember as they look for ways to help their economies recover from coronavirus-induced shutdowns. If their goal is to encourage employment, policies that lower the tax burden on labor could prove a powerful tool.

20 min read

Alabama and Missouri are considering excluding the CARES Act Economic Impact Payments from being taxed and exclude them from state income tax calculations.

2 min read

Virginia enacted a biennial budget, which includes a new excise tax on “skill games.” Meanwhile, Arizona and Connecticut announced plans to convene in special sessions later this year while Oklahoma gets the green light to use rainy day fund money to close budget gaps.

4 min read

When businesses and taxpayers look to the government for relief, it is paramount that lawmakers do their best to craft transparent and coherent legislation that is the least confusing for all.

4 min read

Have you ever wondered where the money comes from to build roads, maintain a national defense, or pay for programs like Social Security? Taxes.

Discover the three basic tax types—taxes on what you earn, taxes on what you buy, and taxes on what you own. Learn about 12 specific taxes, four within each main category. Develop a basic understanding of how these taxes fit together, how they impact government revenues and the economy, and where you may encounter them in your daily life.

Discover why there are better and worse ways for governments to raise a dollar of revenue. Compare the economic impact of the three basic tax types—taxes on what you earn, buy, and own—including three specific taxes within each category. Learn about the basics of “dynamic scoring,” one tool economists can use to compare the economic and revenue impact of different tax policies.

Identify some of the most common tax myths and tax policy misconceptions and learn how to separate fact from fiction. Discover why tax refunds shouldn’t be celebrated, why you should pay your income tax bill, and why certain deductions are wrongly labeled “loopholes,” among other useful facts. Improve your ability to counter misleading arguments about the tax code.

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

2 min read

California extends tax filing and payment deadline to July 31 for a broad spectrum of business taxes as Virginia keeps May 1st tax filing deadline.

5 min read