Summary of the Latest Federal Income Tax Data, 2023 Update

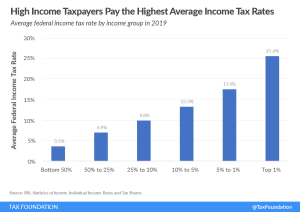

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

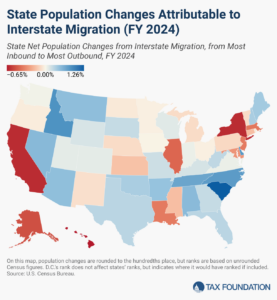

While evaluating new estate tax bills this legislative session, Oregon legislators should consider the state’s competitive tax landscape and interstate migration patterns.

4 min read

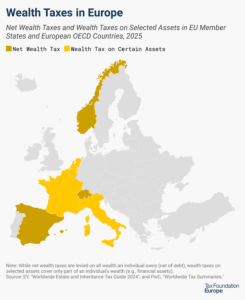

Wealth taxes not only collect little revenue and create legal uncertainty, but an OECD report argues that they can also disincentivize entrepreneurship, harming innovation and long-term growth.

5 min read

The French Revolution provides insight into the relationship between a government and its citizens and serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

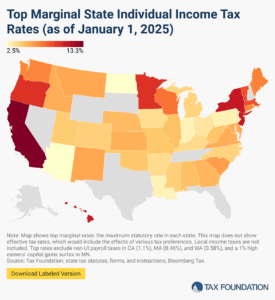

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

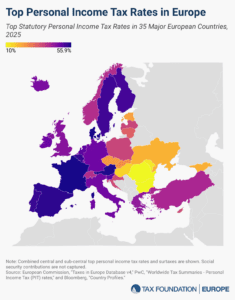

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) levy the highest top personal income tax rates in Europe.

4 min read

Facing a projected $3 billion budget deficit in fiscal year 2026, with forecasts of a growing gap over the next five years, Governor Wes Moore (D) has included about $1 billion in proposed tax increases in his budget proposal.

7 min read

Given the poor state of the budget process and worsening debt trajectory, lawmakers should move boldly and quickly to address the issue, including via a fiscal commission process. Issues to consider should include reforms to both spending and taxes.

42 min read

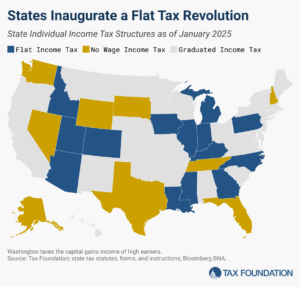

From 2021-2024, within the span of 3.5 years, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

Americans were on the move in 2024, and many chose low-tax states over high-tax ones.

6 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

Taxes and their broader impact are generally overlooked in American education. Taxes influence earnings, budgets, voting, and decisions on where to live, but do American taxpayers understand the US tax system?

25 min read

New IRS data shows the US federal income tax system continues to be progressive as high-income taxpayers pay the highest average income tax rates. Average tax rates for all income groups remain lower after the Tax Cuts and Jobs Act (TCJA).

6 min read

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

A new Treasury study provides data showing that the rich not only pay more than the middle class, they pay more than one-third of their annual income in federal taxes and more than 45 percent when state and local taxes are included.

7 min read

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read

Can tariffs truly replace income taxes in today’s economy? In this episode, we examine the bold and controversial proposal from former President Trump to replace income taxes with tariffs. What would this dramatic shift mean for everyday Americans, particularly those with lower incomes? And would it actually work?

Are tax increases on the horizon in 2025, no matter who takes office? In this episode, we explore why changes to the tax code could hit your wallet, regardless of which party comes out on top.

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

92 min read

On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

17 min read