Tax Trends at the Dawn of 2020

From remote sales tax collection to taxes on marijuana and vaping products, we recap the top state tax trends from 2019 and break down which ones you should watch for in 2020.

38 min readOur dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

From remote sales tax collection to taxes on marijuana and vaping products, we recap the top state tax trends from 2019 and break down which ones you should watch for in 2020.

38 min read

The proposed budget reflects a growing trend as policymakers across the country look to excise taxes as long-term solutions to budget woes. While excise taxes can be a part of the revenue picture, they are not a sustainable revenue source due to their narrow base, which is easily affected by changes in consumer behavior or market conditions.

2 min read

This year was a significant one for state tax policy, and the wide range of changes taking effect January 1, 2020, reflects the scope and intensity of that activity. With states continuing to grapple with issues like the taxation of international income and collections obligations for remote sellers and marketplace facilitators, the coming year is unlikely to be any quieter.

23 min read

Our new report outlines various policy recommendations for Kansas to consider in order to begin a robust and bipartisan conversation about modernizing the state’s tax code to suit a 21st century economy.

15 min read

Wireless taxes, fees, and surcharges make up over 20% of the average customer’s bill–the highest rate ever. Illinois has the highest wireless taxes in the country at over 30%, followed by Washington, Nebraska, New York, and Utah. How high are cell phone taxes in your state?

36 min read

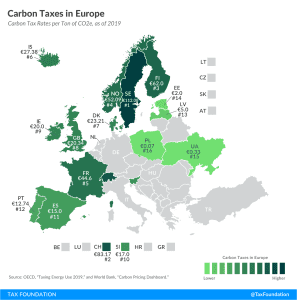

In our new report, we explore the design implications of a carbon tax and provide estimates for revenue, economic, and distributional effects of three potential carbon tax and revenue recycling proposals. Each proposal faces different trade-offs and achieves different policy goals.

23 min read

Election Day 2019 will feature notable tax-related ballot measures in California, Colorado, New Mexico, Pennsylvania, Texas, and Washington. Once the polls close tonight, beginning with Pennsylvania and Texas at 8 PM EST, we will begin tracking the results as they come in.

4 min read