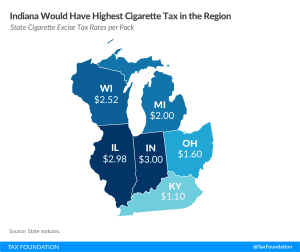

Indiana Lawmakers Consider Cigarette Tax Increase

While increasing taxes on cigarettes may limit demand, a 200 percent hike may also result in a number of unintended consequences, such as increased smuggling.

2 min readOur dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

While increasing taxes on cigarettes may limit demand, a 200 percent hike may also result in a number of unintended consequences, such as increased smuggling.

2 min read

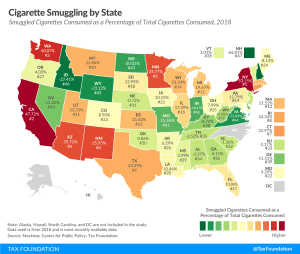

New York already suffers from significant smuggling of untaxed tobacco products—smuggled cigarettes accounted for 53 percent of cigarettes consumed in the state in 2018—and further increasing tobacco taxes is likely to make matters worse.

3 min read

Excessive tax rates on cigarettes in some states induce substantial black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources. New York has the highest inbound smuggling activity, with an estimated 53.2 percent of cigarettes consumed in the state deriving from smuggled sources.

13 min read

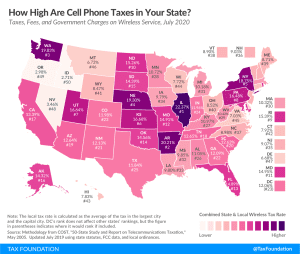

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read

What do election results mean for the future of the federal tax code? What role will tax policy play in curbing the economic effects of the COVID-19 pandemic? How should policymakers address the federal deficit and could a carbon tax be part of that solution? How much of President-elect Joe Biden’s pre-election tax plan will actually come to pass?

New Jersey’s tax design adds another element to the ongoing experiment with legal recreational marijuana in the states.

3 min read

Voters in four states, Arizona, Montana, New Jersey, and South Dakota, approved ballot measures legalizing recreational marijuana.

7 min read

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

Even in 2020, jack-o’-lanterns and fake skeletons have popped up in neighborhoods as they do every October, although Halloween may look and play out differently this time around.

4 min read

Zoom Video Communications announced that, come November, the company will start collecting and remitting local utility and communications taxes in California, New York, Maryland, and Virginia.

5 min read

They may not draw as much attention as elections for office, but Election Day 2020 will also feature a number of important votes on tax-related ballot initiatives in states around the country. What are the ballot measures taxpayers should be paying attention to this year and what could they mean for the future of state tax policy? Tax Foundation Vice President of State Projects Jared Walczak and Senior Policy Analyst Katherine Loughead break down measures ranging from recreational marijuana legalization in New Jersey and Montana to income tax increases in Illinois and Arizona.

What can the U.S. do to raise the revenue needed for infrastructure upkeep and accurately internalize the costs associated with road usage?

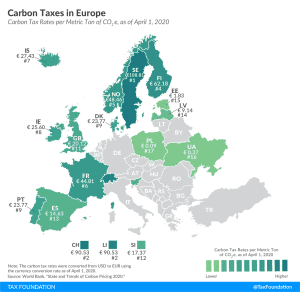

17 European countries have implemented a carbon tax, ranging from less than €1 per metric ton of carbon emissions in Ukraine and Poland to over €100 in Sweden.

3 min read

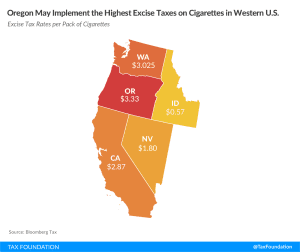

Oregon’s Measure 108 introduces a risk of increased tax avoidance and evasion activity as consumers of the products often procure cigarettes from lower tax jurisdictions. At $3.33 per pack, Oregon would have the highest excise tax on cigarettes in the region.

5 min read

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

Making the Tax Cuts and Jobs Act’s individual provisions permanent combined with a carbon tax can be a revenue-neutral trade and increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

23 min read

Legalizing recreational marijuana is a hot topic in many states where the state budgets are in disarray because of the coronavirus pandemic and new revenue sources are being sought.

7 min read

A recent OECD report on 2020 tax reforms reveals an increase in the number of environmentally-related tax policies, including gas taxes, carbon taxes, and taxes on electricity consumption.

5 min read

Implemented in 1991, Sweden’s carbon tax was one of the first in the world. Since then, Sweden’s carbon emissions have been declining, while there has been steady economic growth. Today, Sweden levies the highest carbon tax rate in the world and its carbon tax revenues have been decreasing slightly over the last decade.

21 min read