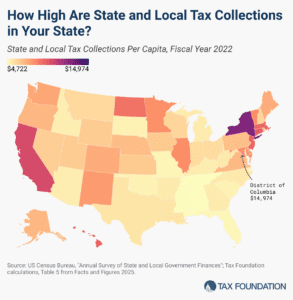

State and Local Tax Collections Per Capita by State, 2025

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read