All Related Articles

Tax Treatment of Nuclear Energy Should Be Simplified, Neutral, with Renewable Energy Sources

Tackling climate change and shifting the economy towards renewable energy has been a key part of the Biden administration’s agenda. However, this effort must first confront an overly complicated and non-neutral tax code, particularly in how it treats nuclear energy, for the White House to reach its ambitious goals.

6 min read

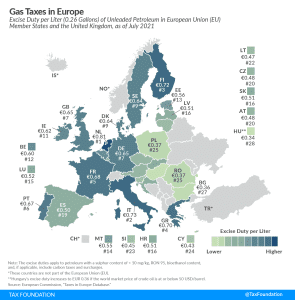

Gas Taxes in Europe, 2021

5 min read

Striking Right Balance for Cryptocurrency Reporting Requirements in Bipartisan Infrastructure Package

While it makes sense to ensure cryptocurrency transactions are treated similarly to other financial assets, the nature of these requirements as written are potentially unworkable.

3 min read

Pennsylvania Considers the Equivalent of a $2 Per Gallon Gas Tax

A vehicle miles traveled (VMT) proposal gaining steam in Pennsylvania would be the equivalent of a state gas tax of more than $2 per gallon, and that’s not all the Commonwealth is considering.

7 min read

The Bipartisan Infrastructure Plan Avoids Tax Increases, Undermines User-Pay Principle, and Misses Chance to Modernize Obsolete Programs

The good news is that lawmakers avoided raising taxes to cover the cost of the new spending and instead used some reasonable fees and asset sales. The bad news is that half of the offsets come from unused, debt-financed COVID-19 relief funds and the economic return on many of these investments is questionable.

7 min read

How Did We Ever Agree to Fund Infrastructure Investments?

As lawmakers explore funding mechanisms for additional federal infrastructure investment, they should focus on permanent, sustainable, and transparent revenue options that conform to the benefit principle. Permanent user fees, appropriately adjusted to restore and maintain their purchasing power, would serve as ideal revenue sources for federal infrastructure investments.

5 min read

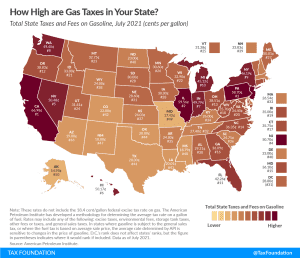

Gas Tax Rates by State, 2021

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg).

3 min read

Dynamic Scoring of Infrastructure Spending Proposals Offsets Small Portion of the Cost

While it is good that policymakers are taking the impact of the economy on tax revenue seriously, it is important to remember that the dynamic effect of increased spending would only offset a small portion of the total spending. In other words, new spending—like tax cuts—rarely pays for itself.

3 min read

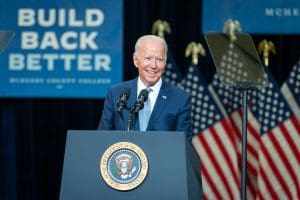

The Impact of the Biden Administration’s Tax Proposals by State and Congressional District

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

State Tax Changes Taking Effect July 1, 2021

Thirteen states have notable tax changes taking effect on July 1, 2021, which is the first day of fiscal year (FY) 2022 for every state except Alabama, Michigan, New York, and Texas. Individual and corporate income tax changes usually take effect at the beginning of the calendar year for the sake of maintaining policy consistency throughout the tax year, but sales and excise tax changes often correspond with the beginning of a fiscal year.

11 min read

Details and Analysis of President Biden’s FY 2022 Budget Proposals

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

Expensing Is Infrastructure, Too

The Biden administration has suggested several tax increases for his infrastructure plan. Public infrastructure can help increase economic growth, but by raising taxes on private investment, the net effect on growth may be negative. However, tax options like retaining expensing for private R&D investment or making 100 percent bonus depreciation for equipment permanent would be complementary to the goals of infrastructure spending.

5 min read

Infrastructure Funding for Highways Digs into Issues of Outdated Taxes and Narrow Bases

As spending priorities are dividing lawmakers trying to negotiate among the various federal infrastructure plans, less time is being spent on the funding of one of the key components—our highways, both current and future taxes and fees. One of the current taxes, a federal excise tax on heavy commercial vehicles and trailers, is an important revenue generator, but its flawed tax design has a negative impact on investment and leads to unstable revenue.

4 min read

Broad-Based Taxes on Consumption and User Fees Are Efficient Ways to Raise Federal Revenue for Infrastructure

Rather than relying on damaging corporate tax hikes, policymakers should consider user fees and consumption taxes as options for financing new infrastructure to ensure that a compromise does not end up being a net negative for the U.S. economy.

2 min read

Details and Analysis of President Biden’s American Jobs Plan

Details and analysis of the American Jobs Plan tax proposals. Learn more about the major tax changes in the proposed Biden infrastructure plan.

9 min read

Explaining the GAAP between Book and Taxable Income

A recent study identifies dozens of large companies that paid no income taxes in 2020. While such studies get headlines and may seem shocking, the reality is much more mundane.

5 min read

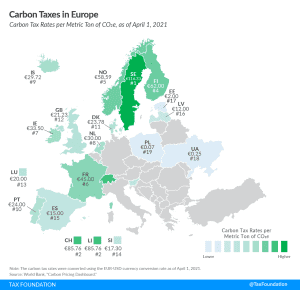

Carbon Taxes in Europe, 2021

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETS), and carbon taxes.

3 min read

Financing Infrastructure Spending with Corporate Tax Increases Would Stunt Economic Growth

The Biden administration’s American Jobs Plan proposal to fund infrastructure spending relies on a bet that the benefits outweigh the costs of a higher corporate tax burden. Using the Tax Foundation model, we find that this trade-off is a bad one for the U.S. economy, resulting in reduced GDP, less capital investment, fewer jobs, and lower wages.

3 min read

Reviewing Options to Raise Tax Revenue and the Trade-offs for Economic Growth and Progressivity

There’s a useful contrast between two revenue options related to President Biden’s infrastructure push. The president’s American Jobs Plan includes a proposal to raise the corporate tax rate to 28 percent. Meanwhile, historically, the gas tax is the main revenue source for transportation funding.

8 min read