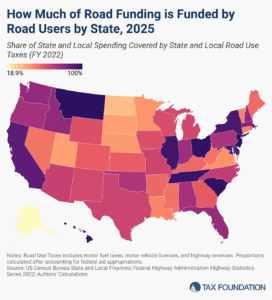

Road Taxes and Funding by State, 2025

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read

In a perilous economic and fiscal environment, with instability created by Trump’s trade war and publicly held debt on track to surpass the highest levels ever recorded within five years, a lot rides on how Republicans navigate tax and spending reforms in reconciliation.

6 min read

President Trump’s 25 percent tariffs on Canada and Mexico is estimated to reduce long-run GDP by 0.2 percent, reduce hours worked by 223,000 full-time equivalent jobs, and reduce after-tax incomes by an average of 0.6 percent—before accounting for foreign retaliation.

26 min read

President Trump has called for permanent extension of the 2017 tax cuts, additional policies including no taxes on tips, overtime pay, and Social Security benefits for retirees, and has also promised higher taxes on US imports through a series of new tariffs.

7 min read

While fixing infrastructure funding has not been a focus of the tax expiration debate, it would be a smart way to pay for at least a small portion of the expiring tax cuts. In recent years, highway funding has exceeded highway revenues, and the introduction of electric vehicles has made the gas tax increasingly obsolete.

7 min read

The House Budget Committee has released a budget resolution that specifies large reductions in both taxes and spending over the next decade, paving the way to extend the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially cut other taxes.

6 min read

As Republicans look for ways to offset the budgetary cost of extending the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially enacting other tax cuts, the latest estimates indicate several trillion dollars could be raised by reducing tax credits and other preferences in the tax code.

5 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

Fiscal pressures are likely to weigh heavily on lawmakers as they craft a tax reform package. That increased pressure could result in well-designed tax reform that prioritizes economic growth, simplicity, and stability, or it could encourage budget gimmicks and economically harmful offsets. Lawmakers should avoid the latter.

8 min read

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

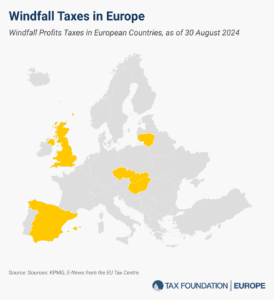

Even though energy prices have declined from their recent peak, the United Kingdom is one of the few countries in Europe continuing to rely on windfall profits taxes to support households with the rising cost of living.

4 min read

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

Spain’s central government is considering making its windfall taxes on energy companies and the banking sector permanent.

6 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

As the geopolitical scene continues to change, policymakers in Europe should focus on lowering effective marginal tax rates to drive much-needed investment and long-term economic growth.

6 min read

Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

7 min read

Estimating the economic effects of different types of taxes informs policymakers about the trade-offs of raising revenue in a given way.

5 min read

Growing levels of waste and pollution, paired with increasing burdens on taxpayers to address environmental problems, have spurned policymakers in the US and abroad to encourage producers to be responsible, either financially or operationally, for the end-life of their products.

34 min read

The flawed design of these windfall profits taxes has created problems in countries that implemented them.

4 min read