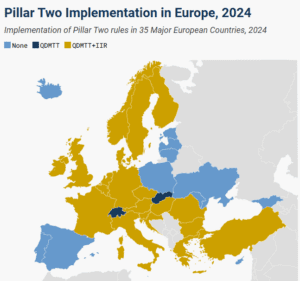

Pillar Two Implementation in Europe, 2024

18 of the 27 EU Member States have implemented both the income inclusion rule and the qualified domestic minimum top-up tax in 2024.

4 min read

18 of the 27 EU Member States have implemented both the income inclusion rule and the qualified domestic minimum top-up tax in 2024.

4 min read

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

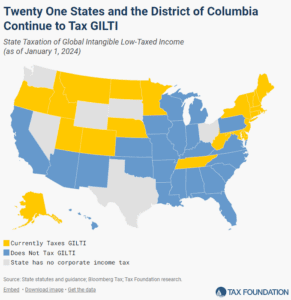

States that tax GILTI increase filing complexity, drive up the cost of tax compliance, and introduce unnecessary economic uncertainty and legal risk. 21 states and DC continue to tax GILTI despite these challenges.

6 min read

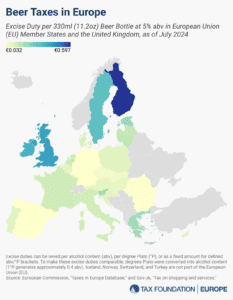

As Oktoberfest celebrations wrap up across the continent, now is a great time to examine beer taxes in the European Union. Hefty beer taxes add to the price of every drink consumed.

5 min read

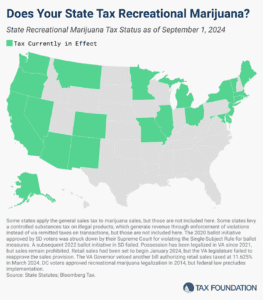

Many states regulate and tax legal marijuana sales and consumption, despite the ongoing federal prohibition. Explore the data here.

6 min read

CBO data shows that the federal fiscal system—both taxes and direct federal benefits—is getting more progressive and redistributive in 2024.

7 min read

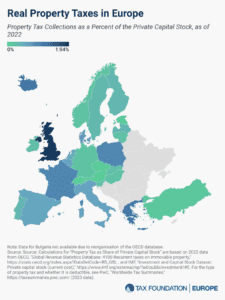

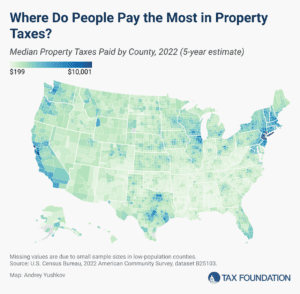

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

3 min read

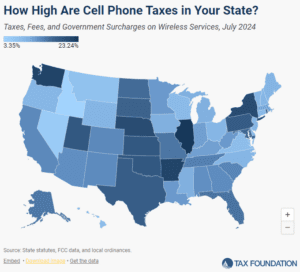

Wireless taxes and fees set a new record high in 2024.

23 min read

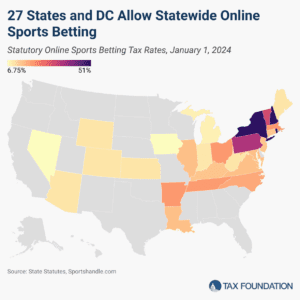

Legal sports betting has grown rapidly since the Supreme Court granted states the ability to establish online sports betting markets in Murphy vs. NCAA in 2018.

3 min read

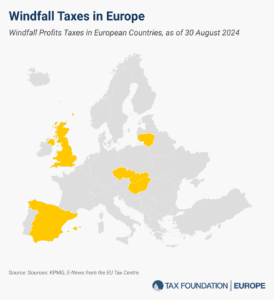

The flawed design of these windfall profits taxes has created problems in countries that implemented them.

4 min read

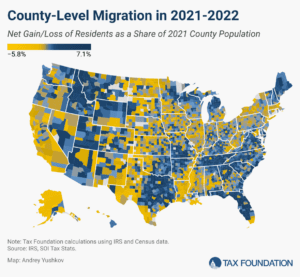

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

Explore the latest EU tobacco and cigarette tax rates, including EU excise duties on cigarettes. Compare cigarette taxes in Europe.

3 min read

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts—especially as a large number of major cities have combined rates of 9 percent or more.

6 min read

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

To encourage greater saving, the US federal income tax provides tax-neutral treatment to some types of saving through a variety of accounts. The type of tax treatment, contribution limits, withdrawal rules, and use cases for contributions all vary by account, leading to a complicated system for households to navigate.

11 min read

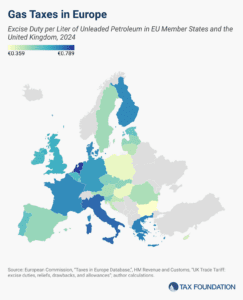

Gas and diesel taxes continue to be prominent policy issues throughout Europe. As the EU undergoes sweeping changes for its green transition, fuel taxes are likely to be a crucial aspect of policy discussions.

3 min read

Americans will spend more than 7.9 billion hours complying with IRS tax filing and reporting requirements in 2024. This is equal to 3.8 million full-time workers doing nothing but tax return paperwork—roughly equal to the population of Los Angeles.

7 min read

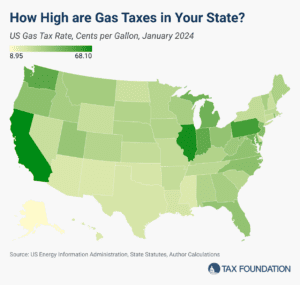

Though gas taxes are intended to serve as user fees and pollution deterrents, they vary widely across states. How does your state’s burden compare?

4 min read

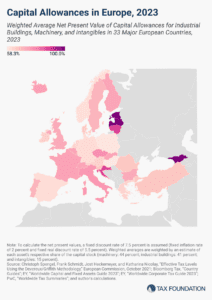

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

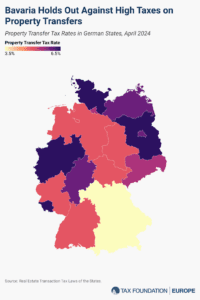

The real estate transaction tax is levied on the gross sales value of a property when it changes ownership, without deductions for investment or purchasing costs. This makes the tax particularly harmful to investment in buildings and structures.

3 min read