All Related Articles

Reliance on Consumption Taxes in Europe

2 min read

Comparison of Cross-Border Effective Average Tax Rates in Europe and G7 Countries

As policymakers consider ways to facilitate investment, effective average tax rates provide a valuable perspective on where burdens on those activities are high and where they are low.

16 min read

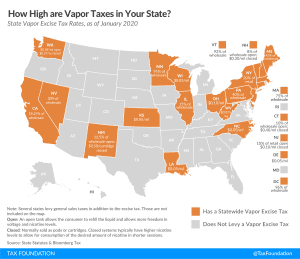

Excise Taxes on Vapor Products Are Trending

While lawmakers are working through the design of vapor tax proposals, they must thread the needle between protecting adult smokers’ ability to switch and barring minors’ access to nicotine products. A good first step is creating appropriate definitions for the new nicotine products to avoid unintended disproportionate taxation based on design differences or bundling.

7 min read

Maryland Legislature Seeks Revenue with Risky Proposals

One notable consequence of high state tobacco excise tax rates is increased smuggling as people procure discounted products from low-tax states and sell them in high-tax states. Smugglers wouldn’t have to look far to find cheaper smokes. All of Maryland’s neighboring states have rates lower than $4 per pack, including Virginia ($1.20) and West Virginia ($0.30). Such an increase would impact the many small business owners operating vape shops around the state and convenience stores relying heavily on vapers as well as tobacco sales.

7 min read

Summary of the Latest Federal Income Tax Data, 2020 Update

The latest IRS data shows that the U.S. individual income tax continues to be very progressive, borne primarily by the highest income earners. The top 1 percent of taxpayers pay a 26.8 percent average individual income tax rate, which is more than six times higher than taxpayers in the bottom 50 percent (4.0 percent).

6 min read

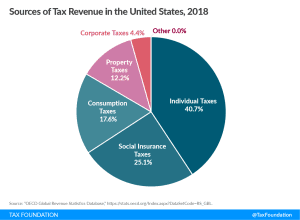

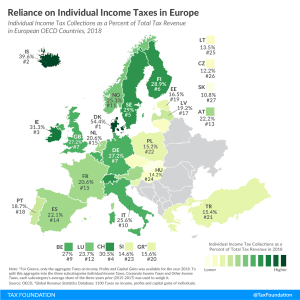

Sources of Government Revenue in the OECD, 2020

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

13 min read

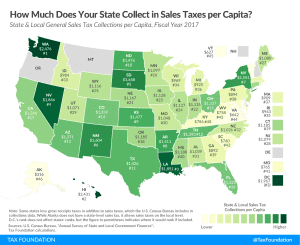

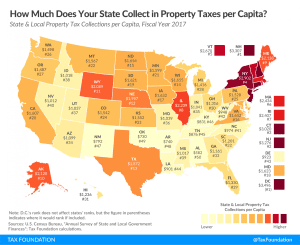

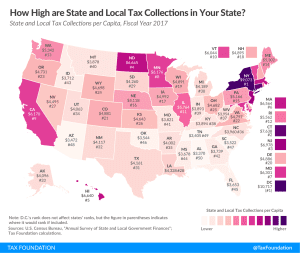

Facts and Figures 2020: How Does Your State Compare?

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read