Testimony: Tax Fairness, Economic Growth, and Funding Government Investments

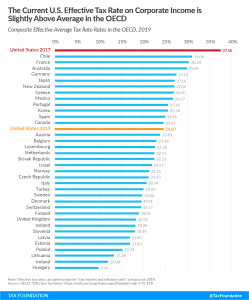

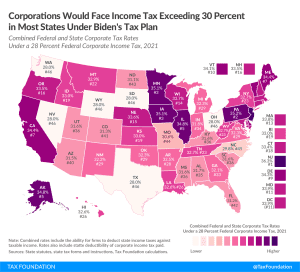

Economic research and Tax Foundation modeling indicate there is a negative trade-off between progressive taxes on capital income—such as the wealth tax, minimum book tax on corporate income, and a higher corporate tax rate—and economic growth.