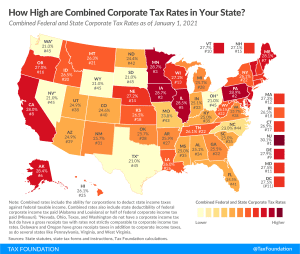

Gross Receipts Taxes by State, 2021

Moving away from state gross receipts taxes would represent a pro-growth change to make the tax code friendlier to businesses and consumers alike, which is especially necessary in the wake of the coronavirus pandemic.

3 min read