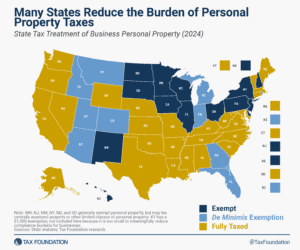

Personal Property De Minimis Exemptions Slash Compliance Burdens at Trivial Cost

All policy choices involve trade-offs—but occasionally, the ratio of costs and benefits is shockingly lopsided. Adopting a de minimis exemption for tangible personal property (TPP) taxes is just such a policy: one which massively reduces compliance and administrative burdens at trivial cost.

18 min read