Facts & Figures 2023: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

As final negotiations occur between the House and Senate, legislators should avoid adopting new policies that would jeopardize Kentucky’s business tax competitiveness.

5 min read

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

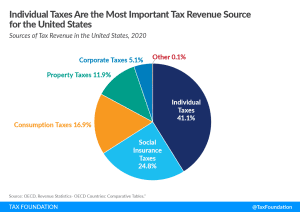

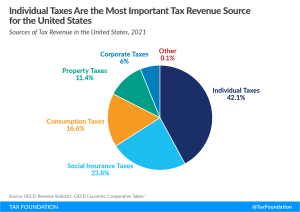

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

At the end of 2022, prices were 14.6 percent higher than they were two years prior. That’s the fastest inflation rate over any two calendar years since the stagflation era of the late 1970s. State policymakers are understandably interested in bringing any tools at their disposal to bear on the problem. And many of them are reaching for tax policy solutions.

7 min read

On the heels of adopting one of the most comprehensive state tax reform packages in years, Iowa lawmakers are back in Des Moines with property tax relief in their sights. But while the issue is worthy of their attention, House File 1 (HF 1) as currently drafted misses the mark.

4 min read

Since 2020, Spain has dropped from 26th to 34th on the International Tax Competitiveness due to multiple tax hikes, new taxes, and weak performances in all five index components.

7 min read

Colombia should consider shifting its planned tax reforms from harmful corporate and individual taxes to less harmful consumption taxes.

5 min read

While there are many ways to show how much is collected in taxes by state governments, our Index is designed to show how well states structure their tax systems by focusing on the how more than the how much in recognition of the fact that there are better and worse ways to raise revenue.

129 min read

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

6 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

West Virginia Amendment 2 would not directly reduce tangible personal property taxes—on cars, inventory, or machinery and equipment. It would, however, empower the legislature to consider such reforms.

4 min read

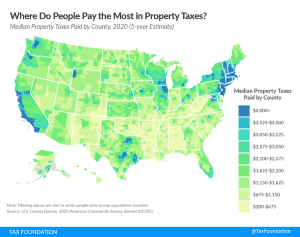

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well.

5 min read

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Given the state’s strong budget surplus and projected continued revenue growth, Wisconsin is in a prime position to enact pro-growth reforms to improve the state’s competitive standing for decades to come.

54 min read

Wyoming’s low taxes are highly attractive, but policymakers are still hard at work helping the state achieve broader economic development goals.

13 min read

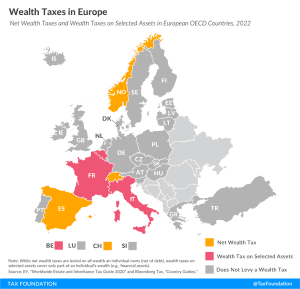

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read