Featured Articles

All Related Articles

Digital Taxation around the World

The outcome of the digital tax debate will likely shape domestic and international taxation for decades to come. Designing these policies based on sound principles will be essential in ensuring they can withstand challenges arising in the rapidly changing economic and technological environment of the 21st century.

58 min read

The Impact of BEPS 1.0

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

Excise Duties on Electricity in Europe, 2024

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

Facts & Figures 2024: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Considering Tax Reform Options for 2025 (and Beyond)

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

Sources of US Tax Revenue by Tax Type, 2024

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

Sources of Government Revenue in the OECD, 2024

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

Virginia Considers Expanding Its Sales Tax Base to B2B Digital Services

Expanding Virginia’s sales tax base to include B2B digital transactions could lead to tax pyramiding, hide the true cost of government, and make the sales tax system much less neutral and transparent.

5 min read

Costly Inputs: Unraveling Sales Tax’s Impact on Businesses

Sales taxes go beyond a few extra bucks at the register. It’s not just about what you pay, but who pays. What are the implications of state sales tax bases across the U.S.?

Mind the Gap, Please! How Portugal Could Reform Its VAT System

Portugal’s value-added tax (VAT) policy is a treasure trove of tax oddities. Thankfully, VAT base broadening is an ideal instrument to give the Portuguese government the fiscal room to implement pro-growth tax reforms

5 min read

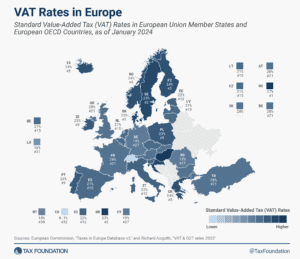

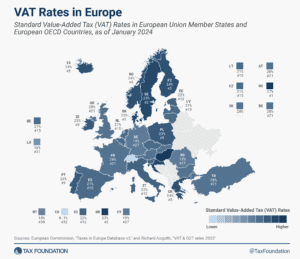

VAT Rates in Europe, 2024

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

Kentucky Sales Tax Modernization: Keeping the Sales Tax on Sales, Not Production

As policymakers continue efforts to improve Kentucky’s tax structure and competitiveness, they should keep in mind that not all offsets are created equal.

59 min read

Tax Files under New Council of EU Presidency: Belgium

In such a determinant semester for Europe, principled tax policy can be an important tool for a more competitive European Union.

5 min read

Spanish Regions Are Not Surrendering Their Tax Competitiveness without a Fight

Spain’s central government could learn some valuable lessons from its regional governments about sound tax policy.

7 min read

Why Moore v. U.S. Won’t Get Us a Consumption Tax Base

At first glance, a ruling for the plaintiffs in Moore might seem to solve some of the timing problems with the U.S. tax system. Unfortunately, upon greater inspection, such a ruling might create new timing problems. And the more rigid the ruling, the harder it would be to fix the timing problems it would create.

5 min read

Is EU VAT Compliance Actually Improving?

While the European Commission focuses on improving VAT compliance, policy is a major contributor to VAT revenue losses. The VAT actionable policy gap is 15.65 percent, more than triple the compliance gap.

5 min read

Movers and Shakers in the International Tax Competitiveness Index

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min read

2023 European Tax Policy Scorecard

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

2024 State Business Tax Climate Index

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

International Tax Competitiveness Index 2023

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read