Tax Files Under New Council of EU Presidency: Czechia

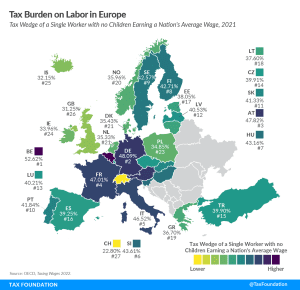

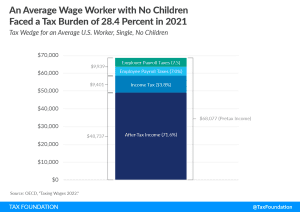

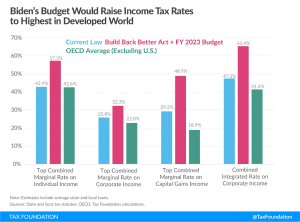

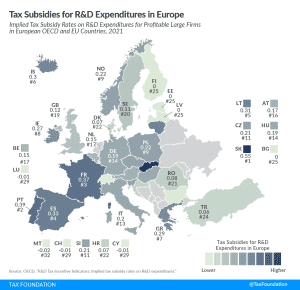

As the Czech EU presidency considers a plan to manage various tax-related files, it would be wise to consider principled tax policy that broadens the tax base and reduces the tax wedge on strategic investment.

4 min read