A Comparison of the Tax Burden on Labor in the OECD, 2024

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

16 min read

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

16 min read

The recent push to increase taxes on the wealthy has gained significant traction across Europe. This report highlights the obstacles and complex interplay between tax policy and economic behavior, suggesting that simply raising tax rates on the wealthy might not yield the intended social benefits.

42 min read

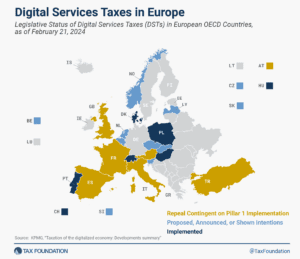

About half of all European OECD countries have either announced, proposed, or implemented a DST. Because these taxes mainly impact U.S. companies and are thus perceived as discriminatory, the United States responded to the policies with retaliatory tariff threats, urging countries to abandon unilateral measures.

4 min read

The outcome of the digital tax debate will likely shape domestic and international taxation for decades to come. Designing these policies based on sound principles will be essential in ensuring they can withstand challenges arising in the rapidly changing economic and technological environment of the 21st century.

58 min read

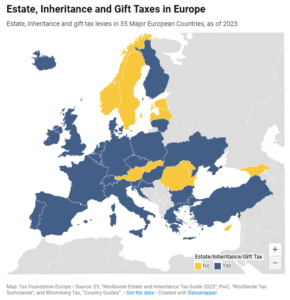

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

2 min read

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

The global economy needs policymakers who are invested in seeing growth recover and avoiding unnecessary barriers to cross-border trade and investment. The challenges countries face will become even more difficult to solve in a stagnant global economy.

If a multilateral solution to remove digital services taxes (DSTs) is not agreed to, then DSTs will continue to spread and mutate with negative impacts on some of the most innovative companies in the world.

As the world of tax policy becomes more interconnected, the Tax Foundation is stepping up, recognizing the pressing need for informed and principled tax policy education in an ever-evolving landscape.

What does it mean to be an American company?

4 min read

Tax-preferred private retirement accounts often have complex rules and limitations. Universal savings accounts could be a simpler alternative—or addition—to many countries’ current system of private retirement savings accounts.

19 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

Historical evidence and recent studies have shown that retaliatory tax and trade proposals raise prices and reduce the quantity of goods and services available to U.S. businesses and consumers, resulting in lower incomes, reduced employment, and lower economic output.

5 min read

Spain’s central government could learn some valuable lessons from its regional governments about sound tax policy.

7 min read

A multilateral agreement that eliminates digital services taxes would be valuable, but not if it introduces more complexity and leaves unanswered many questions about the impacts on the U.S. tax base.

The rules of tax competition are changing with the recent agreement on a global minimum tax and other changes to tax rules around the world, but that does not mean the contest is over.

5 min read

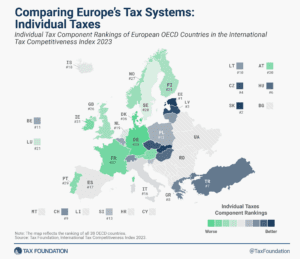

Estonia has the most competitive individual tax system in the OECD for the 10th consecutive year.

2 min read

The UK economy is experiencing an upsurge in business fixed investment following two pro-growth tax changes. In the second quarter of 2023, business investment was 9.4 percent higher than the same quarter last year.

10 min read

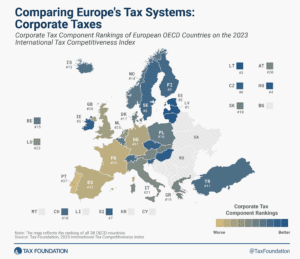

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

2 min read

The OECD recently released a trove of new documents on a draft multilateral tax treaty. The U.S. Treasury has opened a 60-day consultation period for the proposal and is requesting public review and input.

7 min read