All Related Articles

Digital Tax Deadlock: Where Do We Go from Here?

We recently hosted an exclusive webinar discussion to get up to speed on recent digital tax developments and gain insight from leading international tax experts on the OECD’s BEPS project.

9 min read

A Blow to Pillar 1

The U.S. has called for a pause in global digital tax negotiations, dealing a blow to Pillar 1 of the OECD’s international tax project. What happens next could be very harmful for the global economy.

3 min read

Chaos to the Left of Me. Chaos to the Right of me.

The OECD recently announced that the negotiation timeline for new digital tax proposals has now been pushed back to October due to the COVID-19 pandemic, although the end-of-year deadline for the overall project is still in place.

5 min read

Tax Policy After Coronavirus: Clearing a Path to Economic Recovery

Governments at all levels must work to remove the tax policy barriers that stand in the way of economic recovery and long-term prosperity following the COVID-19 crisis. Our new guide outlines several comprehensive options that policymakers can take at the federal and state levels.

26 min read

Is Now the Time for a $100 billion Tax Increase?

Seemingly unconcerned about how the digital project could impact the economy at this crisis moment, officials at the OECD recently released a statement boasting that they are continuing to work “full steam” on their global digital tax project.

5 min read

India Pushes Digital Taxes in a Difficult Time

Even during the coronavirus outbreak, efforts to change the way digital business models are taxed continue. India announced this week that its tax aimed at foreign digital companies, the “equalization levy,” will be expanded.

4 min read

Summary of the OECD’s Impact Assessment on Pillar 1 and Pillar 2

The OECD presented its preliminary impact assessment on the Pillar 1 and Pillar 2 proposals. The impact assessment includes estimated revenue and investment effects presented at a country group level (low-, middle- and high-income countries and investment hubs). The OECD estimates global corporate income tax revenues to increase by 4 percent if both pillars get implemented, equaling $100 billion annually.

4 min read

Bracing for Impact

Though they are limited by both data and assumptions, the OECD will face similar limitations. As policymakers work to fine-tune the proposals under both Pillar 1 and 2 the impact assessment should be a critical part of that discussion.

6 min read

Profit Shifting: Evaluating the Evidence and Policies to Address It

The OECD has been working to assess the impact of their program of work, and it will be critical for this assessment to take into account impacts not only on revenues, but also on growth and investment.

7 min read

FAQ on Digital Services Taxes and the OECD’s BEPS Project

What is a digital services tax (DST)? What countries have announced, proposed, or implemented a DST? What are some of the criticisms of a DST? What are alternatives to a DST? What is the OECD BEPS project and what is its main objective? What is the main objective of OECD Pillar 1? What is the main objective of OECD Pillar 2?

8 min read

The ABCs of the OECD Secretariat’s Unified Approach on Pillar 1

If there is double taxation due to digital services taxes or because a country is unwilling to conform to the structure of the Secretariat’s proposal, the impact would be a net negative for many businesses.

8 min read

Next Steps from the OECD on BEPS 2.0

The continuation of this work is important, but the OECD and policymakers around the world should carefully consider whether these proposals will lead to more certainty, or if they will undermine that goal by simply be a step toward more unilateralism. The impact on cross-border investment will also be a critical issue to consider, and the ongoing impact assessment by the OECD is an important part of the work.

6 min read

OECD Tackling Harmful Tax Practices

Countries around the world often design their tax policies to become attractive targets for foreign investment. These policies can be anything from a system with special preferences for certain industries to a well-designed tax system based on principles of sound tax policy. Systems that are rife with special preferences and complexities can create distortions in local jurisdictions and across the global economy.

3 min read

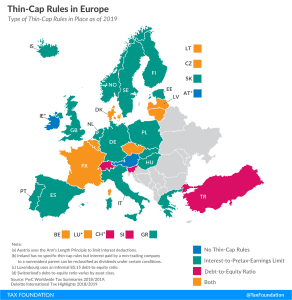

The Economics Behind Thin-Cap Rules

6 min read

Thin-Cap Rules in Europe

2 min read

Summary and Analysis of the OECD’s Work Program for BEPS 2.0

From a broad standpoint, agreement at the OECD will require countries to give up some measure of their own tax sovereignty on policies they have designed to minimize the distortionary effects of the corporate income tax. Over the years tax competition has led to some countries adopting policies that are attractive to businesses because they have a more neutral rather than distortionary approach to taxing corporate income. This project could directly undermine that progress by introducing new levels of complexity and distortion that would ultimately have a negative impact on global trade and growth.

34 min read