Risks to the U.S. Tax Base from Pillar Two

A growing international tax agreement known as Pillar Two presents two new threats to the U.S. tax base: potential lost revenue and limitations on Congress’s ability to set its own tax policy.

39 min read

A growing international tax agreement known as Pillar Two presents two new threats to the U.S. tax base: potential lost revenue and limitations on Congress’s ability to set its own tax policy.

39 min read

Bermuda, long celebrated for its pristine beaches and offshore financial services, is embarking on a journey to recalibrate its tax mix. Spurred by the OECD’s Pillar Two initiative, the island will introduce its first-ever corporate income tax in 2025.

4 min read

The United Nations (UN) is preparing to flex its muscles on international tax policy. Several developing countries say the OECD’s approach favors richer countries at their expense, and the UN hopes to fix this.

5 min read

Canada is planning to join the club of countries that, in the past 3 years, introduced a digital services tax (DST) despite U.S. opposition and concerns expressed by Canadian businesses.

4 min read

For policymakers in Germany, corporate taxation stands out as a promising area for reform. See Germany tax reform and Germany tax proposals.

5 min read

The technical rules that were once solely the province of tax wonks in D.C. and Paris are being brought out into the public sphere.

5 min read

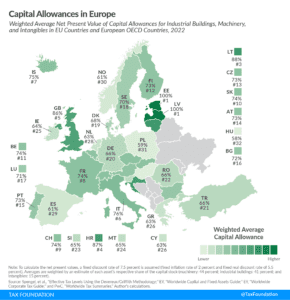

Capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

Simplifying international tax rules will not solve all the challenges that stand in the way of healthy cross-border investment, but eliminating unnecessary provisions would be a positive pivot relative to the trajectory of recent years. It’s high time that policymakers stopped pursuing ever more complex rules and started the hard work of simplification.

6 min read

Enhancing the European Union’s competitiveness is necessary, but the European Commission’s latest attempt is the wrong approach.

4 min read

The European Commission proposed a new source of revenue as part of its second basket of own resources: a “temporary statistical own resource based on company profits.” This is an attempt to bolster the EU’s budget as it repays its debt.

5 min read

Given that wealth taxes collect little revenue and have the potential to disincentivize entrepreneurship and investment, perhaps European countries should repeal them rather than implement one across the continent.

4 min read

The JCT analysis raises some useful questions for the U.S. domestic debate over Pillar Two. The Treasury Department should examine its support for an agreement that will reduce its own revenue intake. But it is also worth noting that the principal mechanism for the revenue reduction—the foreign tax credit—is a policy already baked into U.S. law, including the Republican-enacted global minimum tax from 2017. The OECD deal merely takes advantage of this longstanding feature.

6 min read

The National Foreign Trade Council’s survey shows that the private sector recognizes the economic value of treaties as an instrument to increase tax certainty and decrease distortions.

4 min read

As the UTPR is a new concept, it is worth explaining what it is and why Rep. Smith cares about it. In a sentence, the Undertaxed Profits Rule (UTPR) is a looming extraterritorial enforcement mechanism for a tax base the U.S. has not adopted.

6 min read

The legislation follows from the bipartisan concern regarding tax policies adopted by other countries specifically targeting U.S. businesses or the U.S. tax base.

6 min read

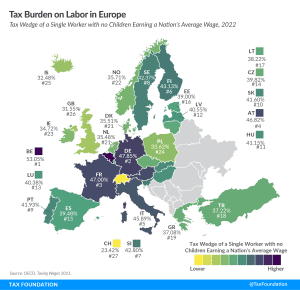

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

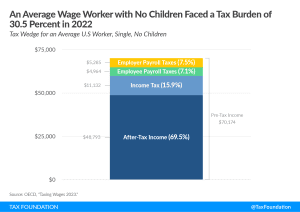

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes.

4 min read

When it comes to EU-level tax policy ideas, competitiveness seems to be less of a priority than raising revenue or pursuing social objectives.

4 min read

While some temporary policies can help in a crisis, policymakers should focus their efforts on sustainable policies that support growth and the resilience of businesses (and government coffers) over the long term.

6 min read

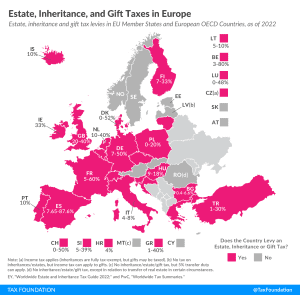

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

3 min read