FAQ: The One Big Beautiful Bill Act Tax Changes

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

As Republicans look for ways to offset the budgetary cost of extending the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially enacting other tax cuts, the latest estimates indicate several trillion dollars could be raised by reducing tax credits and other preferences in the tax code.

5 min read

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

17 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

Lawmakers should simplify the tax code so that taxpayers can understand the laws and the IRS can administer them with minimum cost and frustration.

The latest tax gap report from the IRS has generated much media attention—and much misunderstanding.

6 min read

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

45 min read

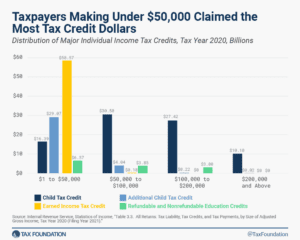

In tax year 2020, taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

6 min read

Explore IRS clean energy tax credits, including Direct Pay, the IRA and CHIPS Act tax provisions, and Section 1603 grant program. See more.

7 min read

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

38 min read

Lawmakers should focus on simplifying the federal tax code, creating stability, and broadly improving economic incentives. There are incremental steps that can be made on the path to fundamental tax reform.

Lawmakers should avoid delivering social and economic benefits through the tax code whenever possible and work to simplify or repeal the tax expenditures already in the tax code.

7 min read

Federal spending, deficits, and debt are at unsustainable levels. The proposed federal budget is laden with redundant programs, obsolete programs, corporate welfare, and nationalized industries. As Congress begins to craft the FY 2024 federal budget, it needs to establish a process of systematically reviewing programs and priorities.

According to our analysis, President Biden’s budget would reduce long-run economic output by about 1.3 percent and eliminate 335,000 FTE jobs. See what tax policies the president is proposing.

17 min read

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

Policymakers face a difficult balancing act this year in what is likely to be an unusual tax extenders season.

6 min read

As we near this year’s “lame duck” session of Congress, there has been renewed interest in reforming the child tax credit as part of a tax deal. Our new analysis highlights the trade-offs that policymakers will face

5 min read