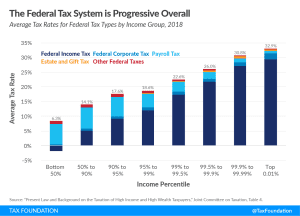

Personal Income Tax Adjusts for Inflation, But It Could Do Better

In times of inflation, a review of the tax code shows that some provisions are automatically indexed, or adjusted, to match inflation, while others are not. And that creates unfair burdens for taxpayers. But it’s not always as simple as just “adjusting for inflation.”

4 min read