Vapor products like electronic cigarettes and vape pens have been showing up en masse at gas stations, convenience stores, and stand-alone vapor stores since they entered the market in 2007. Vapor products can deliver nicotine, the addictive component of cigarettes, without the combustion and inhalation of tar that is a part of smoking cigarettes. Thus, their desirability to customers. As such products fall outside of the reach of cigarette taxes, several states and localities have created specific vapor product excise taxes. Nine states and the District of Columbia levy taxes on these products, while several localities levy the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. independently from their states. There is no federal tax on vapor products.

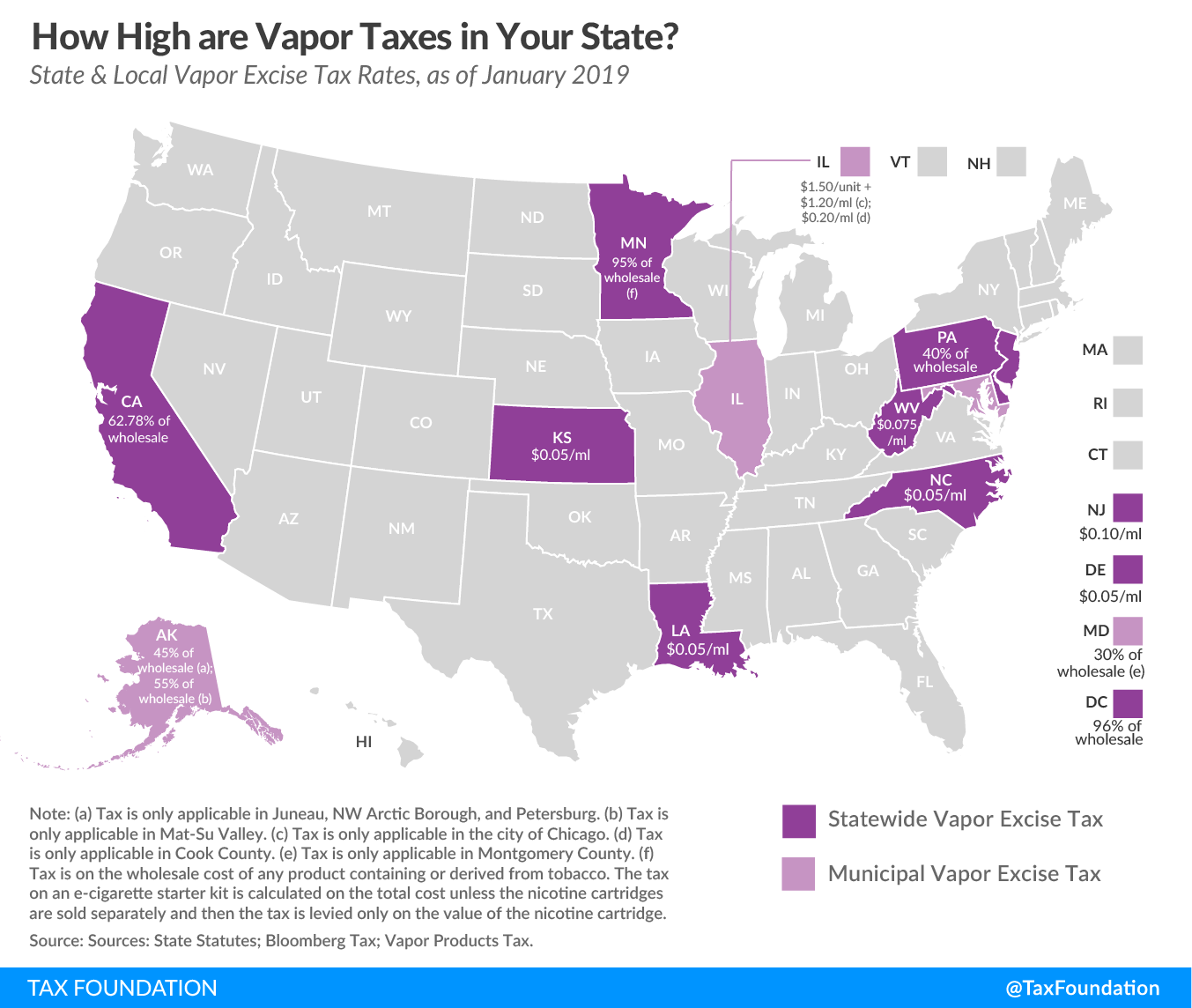

This week’s map shows where state and local vapor taxes stand as of January 1, 2019.

Vapor taxes vary in both tax jurisdiction (whether state or local) and method. Some authorities tax a percentage of the wholesale value, while others tax per unit or milliliter of e-liquid. One notable advantage to taxing the products based on volume (per milliliter) as opposed to price (ad valorem) is that volume taxes do not apply to the delivery device when the e-liquid and electronic device are sold together. As an allegory, this would be like taxing a pipe, when an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. should really only apply to the pipe tobacco.

As the variety of taxing methods and wide range of rates might suggest, there is little consensus on the best way to tax vapor products.

Of those that tax wholesale values, the District of Columbia brings home the bacon with a whopping 96 percent rate, but Minnesota comes in a close second at 95 percent. The lowest wholesale rate is Montgomery County, Maryland’s 30 percent.

Chicago levies the highest per unit tax ($1.50), as well as per milliliter rate ($1.20). Delaware, Kansas, Louisiana, and North Carolina all share the lowest per milliliter rate ($0.05).

The information on the map is taken from the Tax Foundation’s Facts & Figures, which shares tax information from a January 1, 2019 snapshot. Since January, several states have enacted new vaping taxes, although they have not necessarily gone into effect:

- Three states instituted taxes on open system and closed system vapor liquid—Connecticut (10 percent of open wholesale, $0.40/ml of closed), New Mexico (12.5 percent of open wholesale, $0.50 per closed cartridge or pods less than 5 ml), and Washington ($0.09/ml of open and $0.27/ml of closed).

- Three states enacted taxes on wholesale vaping prices—Illinois (15 percent), Nevada (30 percent), and Vermont (92 percent).

- New York passed a new 20 percent retail tax.

There is a broader conversation about the relative risk of vapor products compared to traditional cigarettes that some tax policymakers can consider when develop a new tax structure. Health advocates can point to the argument that vaping is less harmful than cigarettes, and thus should be taxed at a lower rate so as not to discourage vaping as an alternative to cigarettes. Proponents of higher taxes assert that the health risks of vapor usage are unknown and any chance of young people picking up the smoking habit by starting with vaping is not worth the risk.

A sound approach to the taxation of vapor products would avoid discriminating between disposable and rechargeable vapor products.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe