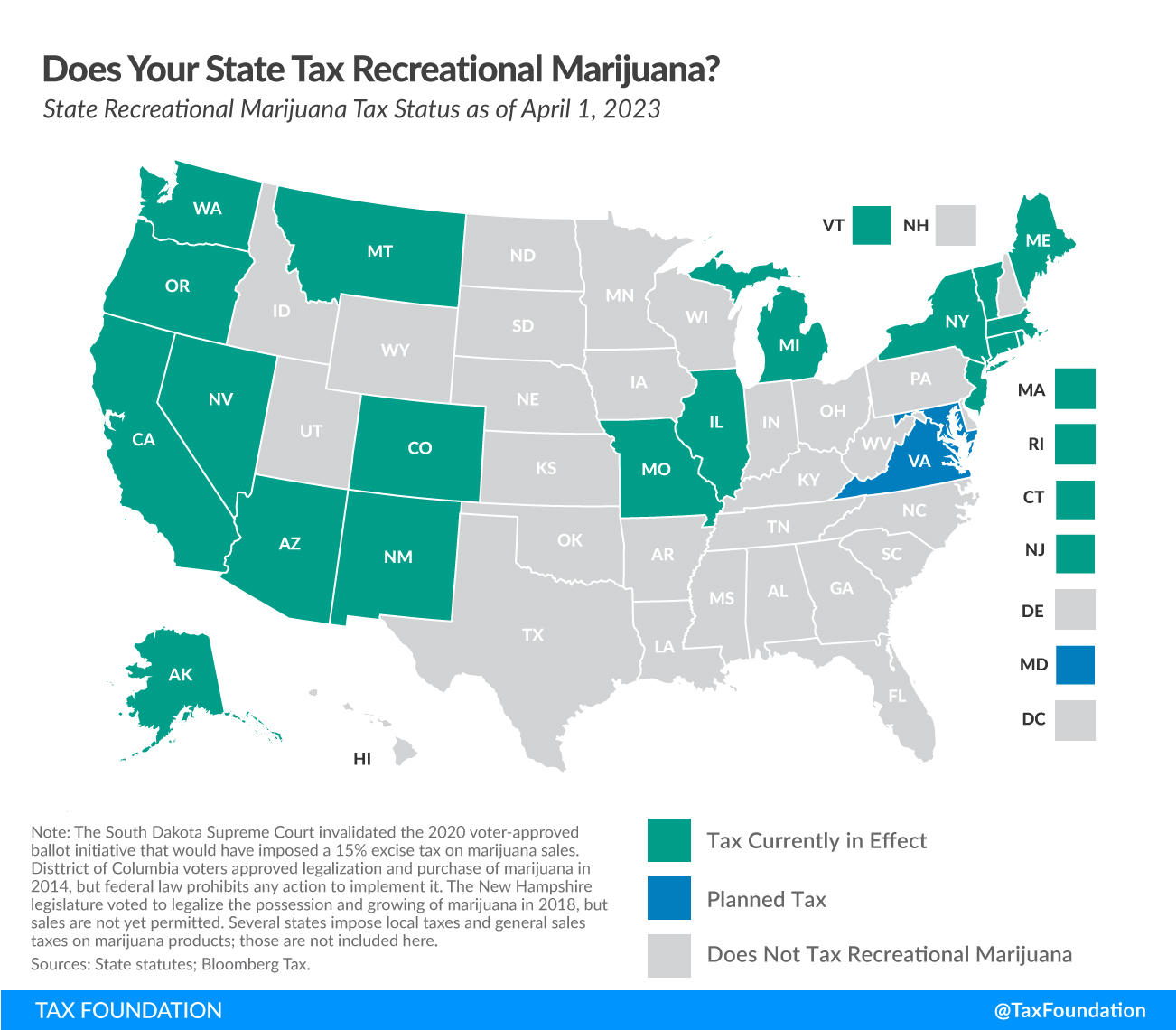

Recreational marijuana taxation is one of the hottest policy issues in the U.S. Currently, 21 states have implemented legislation to legalize and taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. recreational marijuana sales: Alaska, Arizona, California, Colorado, Connecticut, Illinois, Maine, Maryland, Massachusetts, Michigan, Missouri, Montana, Nevada, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, Virginia, and Washington.

Last year, Missouri and Maryland voters approved ballot measures to legalize recreational marijuana sales. Ballot measures to legalize marijuana failed last year in Arkansas, North Dakota, and South Dakota.

The past year saw several states activate legal cannabis markets, with more states poised to open markets in the year to come. Rhode Island, where legal sales began on December 1, 2022, implemented a 10 percent excise tax on retail purchases, with local governments permitted to levy an additional 3 percent excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on retail sales. New York also began legal sales in December after a long process of establishing regulatory and licensing systems following legislative legalization in 2021.

Missouri started legal sales of recreational cannabis in February, less than four months after its successful ballot measures. In the first month, legal cannabis sales exceeded $100 million, setting a pace for over $1 billion in the first 12 months.

Virginia and Maryland have passed legislation to facilitate a legal recreational marijuana marketplace and both states are scheduled to start legal sales on July 1. Virginia will levy a 21 percent excise tax while the Maryland General Assembly passed a bill earlier this month to tax cannabis sales at 9 percent, though final implementation of the legislation is still pending.

The Delaware General Assembly has approved bills that would legalize and tax adult-use marijuana for the second straight year. These bills will head to Governor John Carney (D), who vetoed similar marijuana legislation last year.

The following map highlights state tax policy on recreational marijuana.

Marijuana markets operate under a unique legal framework. Federally, marijuana is classified as a Schedule I substance under the Controlled Substances Act, making the drug illegal to consume, grow, or dispense. Individual states that have legalized consumption and distribution don’t actively enforce the federal restrictions.

Among the many effects this creates, each state market becomes a silo. Marijuana products cannot cross state borders, so the entire process (from seed to smoke) must occur within state borders. This unusual situation, along with the novelty of legalization, has resulted in a wide variety of tax designs.

| State | Tax Rate |

|---|---|

| Alaska | $50/oz. mature flowers; |

| $25/oz. immature flowers; | |

| $15/oz. trim, $1 per clone | |

| Arizona | 16% excise tax (retail price) |

| California | 15% excise tax (levied on wholesale at average market rate); |

| $9.65/oz. flowers & $2.87/oz. leaves cultivation tax; | |

| $1.35/oz fresh cannabis plant | |

| Colorado | 15% excise tax (levied on wholesale at average market rate); |

| 15% excise tax (retail price) | |

| 3% excise tax (retail price) | |

| Connecticut | $0.00625 per milligram of THC in plant material |

| $0.0275 per milligram of THC in edibles | |

| $0.09 per milligram of THC in non-edible products | |

| Illinois | 7% excise tax of value at wholesale level; |

| 10% tax on cannabis flower or products with less than 35% THC; | |

| 20% tax on products infused with cannabis, such as edible products; | |

| 25% tax on any product with a THC concentration higher than 35% | |

| Maine | 10% excise tax (retail price); |

| $335/lb. flower; | |

| $94/lb. trim; | |

| $1.5 per immature plant or seedling; | |

| $0.3 per seed | |

| Maryland (a) | To Be Determined |

| Massachusetts | 10.75% excise tax (retail price) |

| Michigan | 10% excise tax (retail price) |

| Missouri | 6% excise tax (retail price) |

| Montana | 20% excise tax (retail price) |

| Nevada | 15% excise tax (fair market value at wholesale); |

| 10% excise tax (retail price) | |

| New Jersey | Up to $10 per ounce, if the average retail price of an ounce of usable cannabis was $350 or more; |

| up to $30 per ounce, if the average retail price of an ounce of usable cannabis was less than $350 but at least $250; | |

| up to $40 per ounce, if the average retail price of an ounce of usable cannabis was less than $250 but at least $200; | |

| up to $60 per ounce, if the average retail price of an ounce of usable cannabis was less than $200 | |

| New Mexico | 12% excise tax (retail price) |

| New York (a) | $0.005 per milligram of THC in flower |

| $0.008 per milligram of THC in concentrates | |

| $0.03 per milligram of THC in edibles | |

| 13% excise tax (retail price) | |

| Oregon | 17% excise tax (retail price) |

| Rhode Island | 10% excise tax (retail price) |

| Virgina (a) | 21% excise tax (retail price) |

| Vermont | 14% excise tax (retail price) |

| Washington | 37% excise tax (retail price) |

|

(a) As of April 2023, retail sale of recreational marijuana has not yet started. Note: In Maryland, the state General Assembly passed a bill that would implement a rate of 9 percent. District of Columbia voters approved legalization and purchase of marijuana in 2014 but federal law prohibits any action to implement it. In 2018, the New Hampshire legislature voted to legalize the possession and growing of marijuana, but sales are not permitted. Alabama, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Minnesota, Nebraska, North Carolina, South Carolina, Oklahoma, Rhode Island, and Tennessee impose a controlled substance tax on the purchase of illegal products. Several states impose local taxes as well as general sales taxes on marijuana products. Those are not included here. Sources: State statutes; Bloomberg Tax. |

|

The multitude of approaches makes an apples-to-apples comparison of rates difficult. New York and Connecticut have been the first states to implement a potency-based tax per milligram of THC. Most states levy an ad valorem tax on the retail sales price of cannabis sales, even though THC content is significantly more relevant for tax purposes. These ad valorem tax rates range from 6 percent in Missouri to 37 percent in Washington. Marijuana sales prices have been volatile, dropping significantly over time as supply chains increase production. This has created a volatile source of tax revenue for states that apply ad valorem taxes, further suggesting that a specific tax based on the weight of the flower product and THC content in edibles or concentrates would provide a more effective tax structure.

There are still many unknowns when it comes to the taxation of recreational marijuana, but as more states open legal marketplaces and more research is done to understand the externalities of consumption, more data will be available. The design of these taxes will also become more important as federal legislation seeks to potentially change the cannabis marketplace through additional federal taxes and the introduction of interstate commerce.

Share this article