Key Findings:

- Individual income taxes are a major source of state government revenue, accounting for 36 percent of state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections.

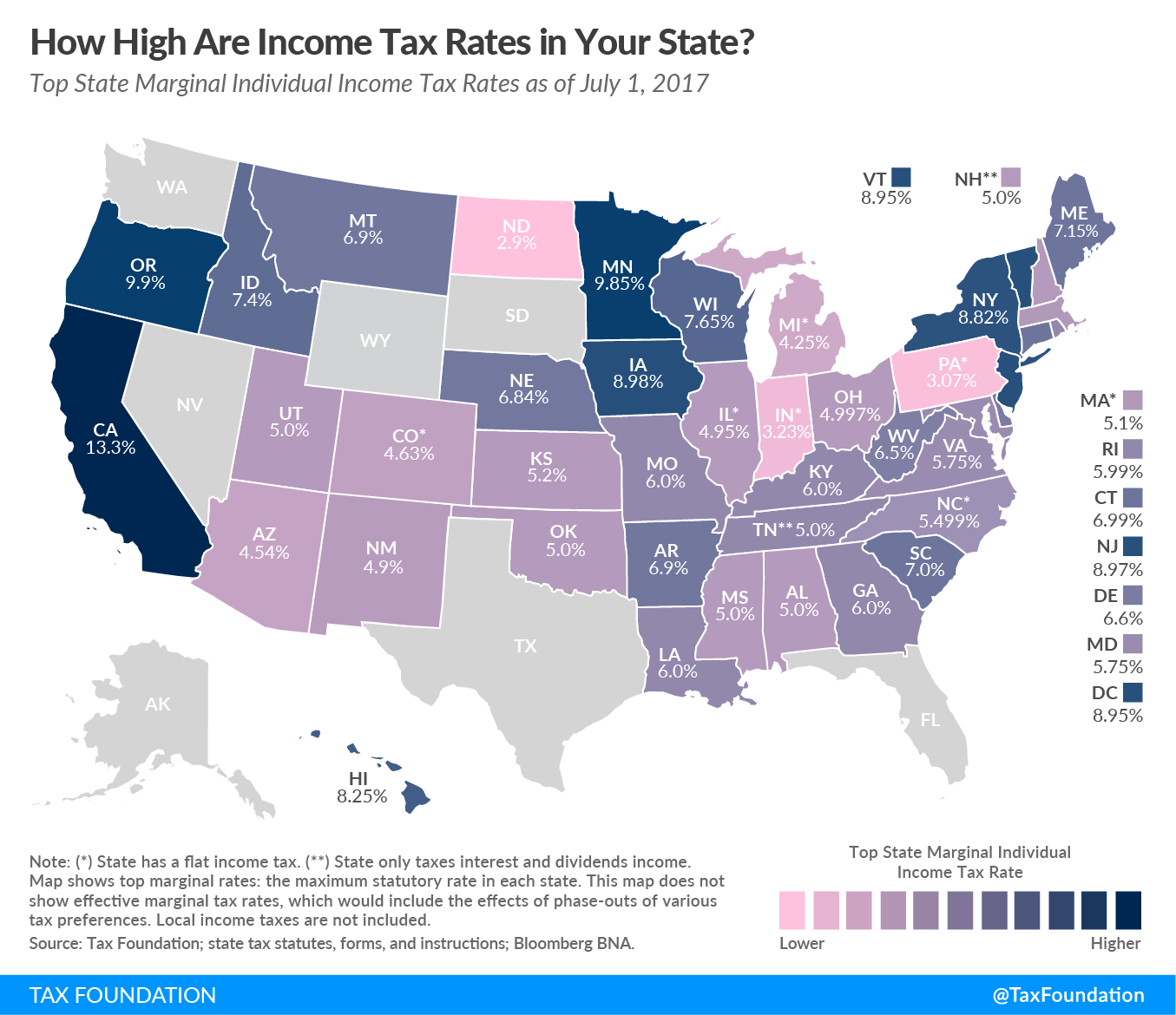

- Forty-three states levy individual income taxes. Forty-one tax wage and salary income, while two states—New Hampshire and Tennessee—exclusively tax dividend and interest income. Seven states levy no income tax at all.

- Of those states taxing wages, eight have single-rate tax structures, with one rate applying to all taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. . Conversely, 33 states levy graduated-rate income taxes, with the number of brackets varying widely by state. California and Missouri each have ten brackets, the most in the country.

- States’ approaches to income taxes vary in other details as well. Some states double their single-bracket widths for married filers to avoid the “marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. .” Some states index tax brackets, exemptions, and deductions for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. ; many others do not. Some states tie their standard deductions and personal exemptions to the federal tax code, while others set their own or offer none at all.

Individual income taxes are a major source of state government revenue, accounting for 36 percent of state tax collections.[1] Their prominence in public policy considerations is further enhanced by the fact that individuals are directly responsible for filing their income taxes, in contrast to the indirect payment of sales and excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. es. To many taxpayers, the personal income tax is practically synonymous with their own tax burdens.

Forty-three states levy individual income taxes. Forty-one tax wage and salary income, while two states—New Hampshire and Tennessee—exclusively tax dividend and interest. Seven states levy no income tax at all. Tennessee is currently phasing out its Hall Tax (income tax applied only to dividends and interest income) and will repeal its income tax entirely by 2022.[2]

Of those states taxing wages, eight have single-rate tax structures, with one rate applying to all taxable income. Conversely, 33 states levy graduated-rate income taxes, with the number of brackets varying widely by state. Kansas, for example, imposes a two-bracket income tax system. At the other end of the spectrum, two states—California and Missouri—each have 10 tax bracketA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. s. Top marginal rates range from North Dakota’s 2.9 percent to California’s 13.3 percent.

In some states, a large number of brackets are clustered within a narrow income band; Missouri taxpayers reach the state’s tenth and highest bracket at $9,072 in annual income. In other states, the top marginal rate kicks in at $500,000 (New Jersey) or even $1 million (California, when one includes the state’s “millionaire’s tax” surcharge).

States’ approaches to income taxes vary in other details as well. Some states double their single-bracket widths for married filers to avoid the “marriage penalty.” Some states index tax brackets, exemptions, and deductions for inflation; many others do not. Some states tie their standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. s and personal exemptions to the federal tax code, while others set their own or offer none at all. In the following table, we provide the most up-to-date data available on state individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates, brackets, standard deductions, and personal exemptions for both single and joint filers.

Notable Individual Income Tax Changes in 2017

Several states changed key features of their individual income tax codes between 2016 and 2017. These changes include:

- Indiana reduced its individual income tax rate from 3.3 to 3.23 percent.[3]

- North Carolina reduced its income tax rate from 5.75 to 5.499 percent as part of a broader tax reform package.[4]

[1] U.S. Census Bureau, State & Local Government Finance, Fiscal Year 2014, http://www.census.gov/govs/local/.

[2] Tennessee Department of Revenue, Hall Income Tax Notice, July 2016. https://www.tn.gov/assets/entities/revenue/attachments/16-05Hall.pdf.

[3] Dan Carden, “Indiana income tax rate declines Jan. 1,” Times of Northwest Indiana, December 28, 2016. http://www.nwitimes.com/news/statehouse/indiana/indiana-income-tax-rate-declines-jan/article_9ba70f60-ae13-5699-b51c-d01bd36bf373.html.

[4] Scott Drenkard, “North Carolina Budget Compromise Delivers Further Tax Reform,” Tax Foundation, September 17, 2015. https://taxfoundation.org/north-carolina-budget-compromise-delivers-further-tax-reform/.

Share