The North Carolina General Assembly reached a budget agreement this week. Though the budget was due on July 1, negotiations continued into September. The hold-up was partially based on Governor McCrory's calls for additional funds for incentive programs and the Senate's reluctance to authorize them.

A few months ago, I wrote that the Senate's first compromise was a step in the right direction, strengthening some of the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reforms enacted in 2013 that moved the state from 44th to 16th in our State Business Tax Climate Index. This week, what looks like the final compromise has appeared, and while the budget gives additional funding to incentives (including a reintroduction of the historical preservation credit and an expansion of the JDIG program), the package as a whole represents another round of broad-based tax reductions for North Carolinians. Governor McCrory said today that he will sign the package.

Here’s a summary of tax changes and economic development items, courtesy of McGuireWoods LLP (I’ve bolded the important ones):

- $3 million for the OneNC Small Business Fund.

- $30 million for the Film and Entertainment Grant Fund.

- $2.5 million a year for Rural Economic Development Grants.

- Funds the Job Maintenance and Capital Development (JMAC) Fund.

- Expands the JDIG program.

- Reduces the personal income tax rate from 5.75% to 5.499% in 2017.

- Increases the 2016 standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. by $500, totaling $15,500 for married filers.

- Extends the historic preservation tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. , which had sunset at the end of 2014.

- Restores tax deductions for medical expenses and expands the tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage interest, and charitable contributions. for all people. The policy ended during the 2013 tax reform and was for senior citizens only.

- Expands the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. base. Instead of the Senate’s proposed sales tax redistribution plan, the money from the expanding sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. will go to rural counties that do not fare well under the current tax distribution system, for economic development and public education.

- Allows local governments to charge a municipal vehicle tax, up to $30 per vehicle. Currently, the tax is capped at $5.

- Continues the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate reduction trigger, which [may drop to 3 percent in 2017, dependent on net general fund tax collections exceeding $20.975 billion in a future year].

- Beginning in 2016, phases in single sales factor over three years.

- Repeals the bank privilege tax in 2016.

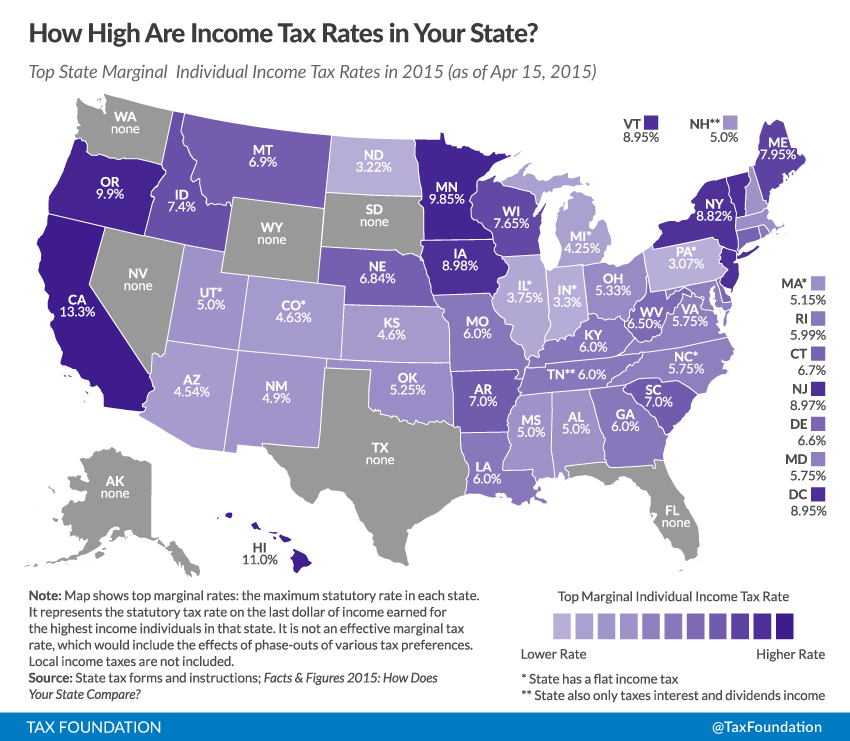

There is a lot to like in this package. The further reduction in the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. from 5.75 to 5.499 percent makes North Carolina even more regionally competitive. It brings the rate lower than neighboring Virginia, which has a top rate of 5.75 percent, and keeps the state below South Carolina, at 7 percent, and Georgia, at 6 percent (see current rates below).

The individual income tax rate matters for small businesses, which are often organized as S-corps and LLCs, which file through the individual income tax, not the corporate income tax. The rate of course also matters for wage-earners and their take-home pay.

The increase in the standard deduction gives an additional tax cut for lower income individuals, while retaining North Carolina’s simple single rate system that is the hallmark success of the 2013 tax reform.

Finally, the reduction of the corporate income tax rate to 3 percent, once fully phased in, will give North Carolina the lowest corporate income tax rate of any state that levies the tax. This has the potential to pay large dividends in the future as the state economy expands financial service centers, research and development operations, and corporate headquarters within the state.

Follow Scott on Twitter.

Correction: This post originally indicated that the corporate tax rate could fall to 3 percent by 2016, when in fact the effective date would be January 1, 2017 if the revenue trigger is met. This schedule is the same as what was put in place in the 2013 tax reform package, but the trigger requirements have been altered in this year's budget. This editorial in the Carolina Journal details how the corporate tax rate trigger was slightly weakened. The error is corrected above.

Share