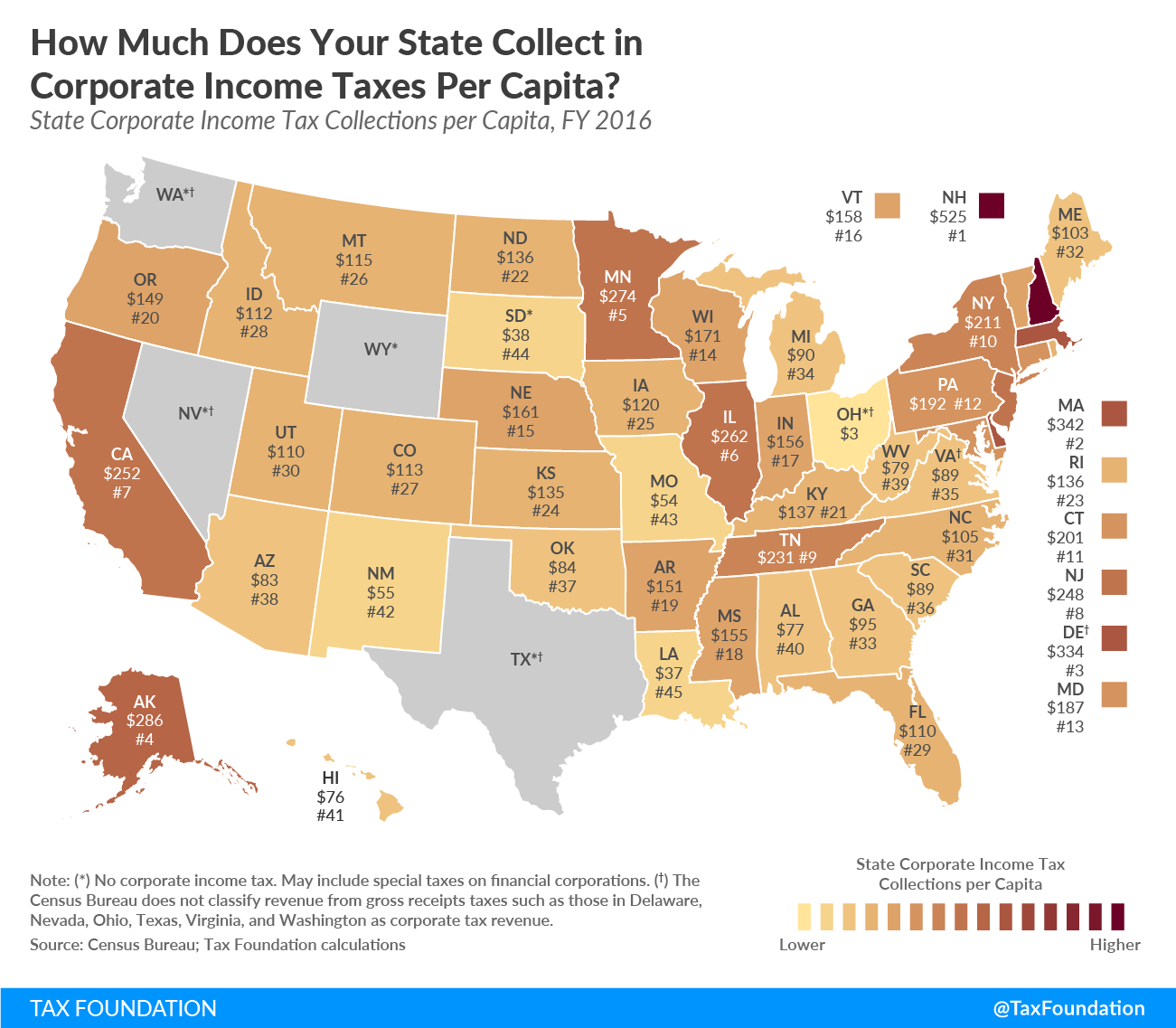

Today’s map shows state corporate income tax collections per capita in the fifty states.

Collections are highest in New Hampshire at $525 per capita and Massachusetts at $342 per capita. Delaware comes next, collecting $334 per capita in corporate income taxes and levying an economically harmful gross receipts tax.

Six states—Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming—do not levy a corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , but four of the six (Nevada, Ohio, Texas, and Washington) levy a gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding. . In some states without a corporate income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , a small amount of corporate income tax collections per capita may be shown due to taxes on specific types of businesses, such as financial institutions, which are sometimes structured as corporations.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeCompared to other sources of tax revenue—such as income, sales, and property taxes—states rely relatively little on corporate income taxes. According to the U.S. Census Bureau, in fiscal year 2015, the corporate income tax generated only 5.3 percent of total state tax collections. One reason for low reliance on corporate income taxes is that many businesses have shifted away from the traditional C corporation structure and are instead structured as pass-throughs, which pay income taxes using the individual income tax system.

For those businesses that are subject to the corporate income tax, it is one of many taxes they pay. In fiscal year 2016, corporate income taxes accounted for only 14.9 percent of all taxes paid by businesses to state governments. Sales, property, unemployment insurance, excise, and payroll taxes are among the other taxes paid by pass-throughs and corporations.

Revenue volatility is another reason states have reduced their reliance on corporate income taxes. Corporate income can vary drastically from one year to the next due to business cycle fluctuations, leading to unstable revenue collections. Finally, corporate income taxes have been shown to be more detrimental to economic growth than other major state tax types, including personal income taxes, consumption taxes, and property taxes, and they are administratively complex for both taxpayers and states.

Note: This is part of a map series in which examine per capita state tax collections

- How High are State and Local Tax Collections in Your State?

- How Much Does Your State Collect in Sales Taxes Per Capita?

- How Much Does Your State Collect in Individual Income Taxes Per Capita?

- How Much Does Your State Collect in Excise Taxes Per Capita?

- How Much Does Your State Collect in Property Taxes Per Capita?