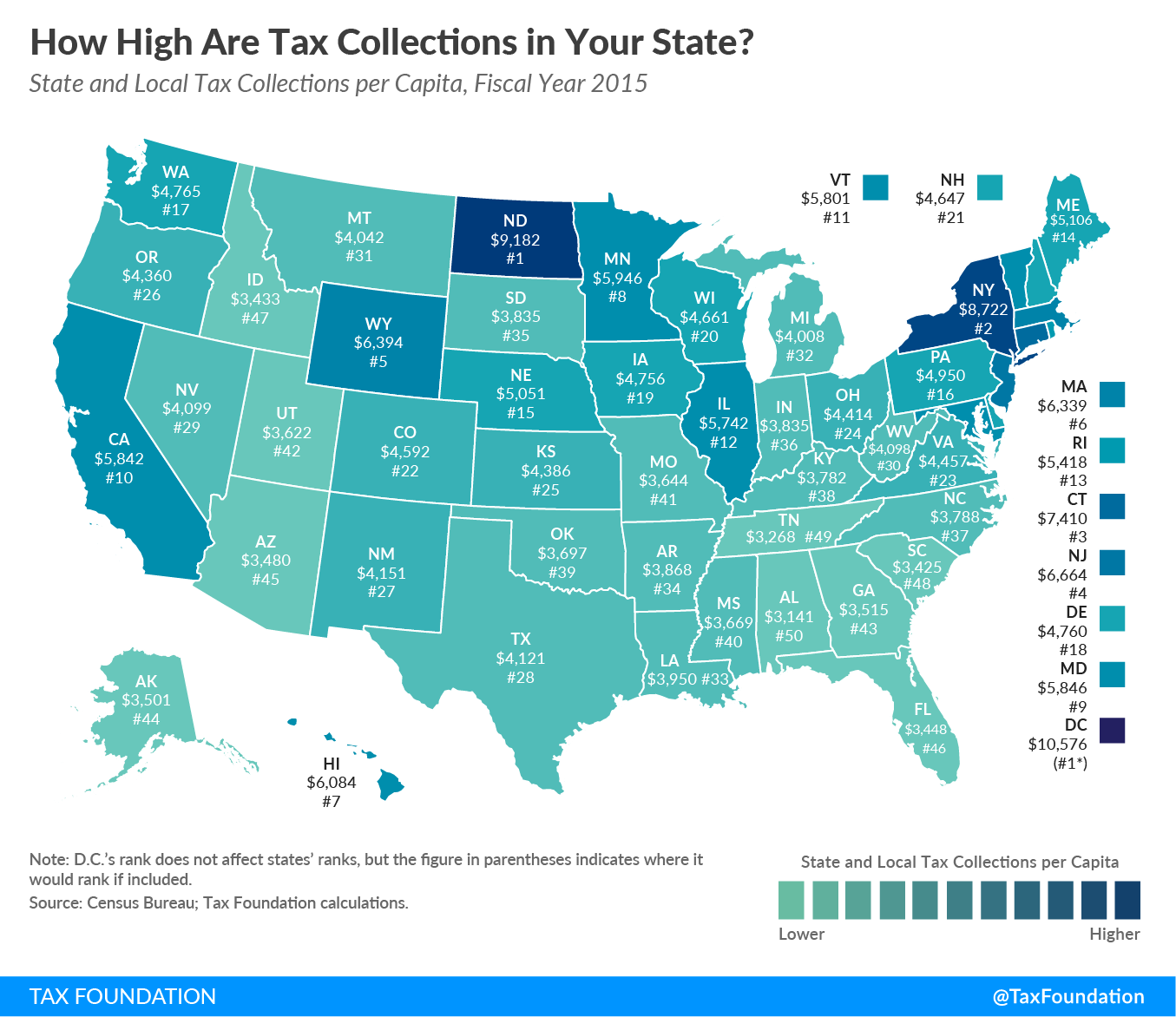

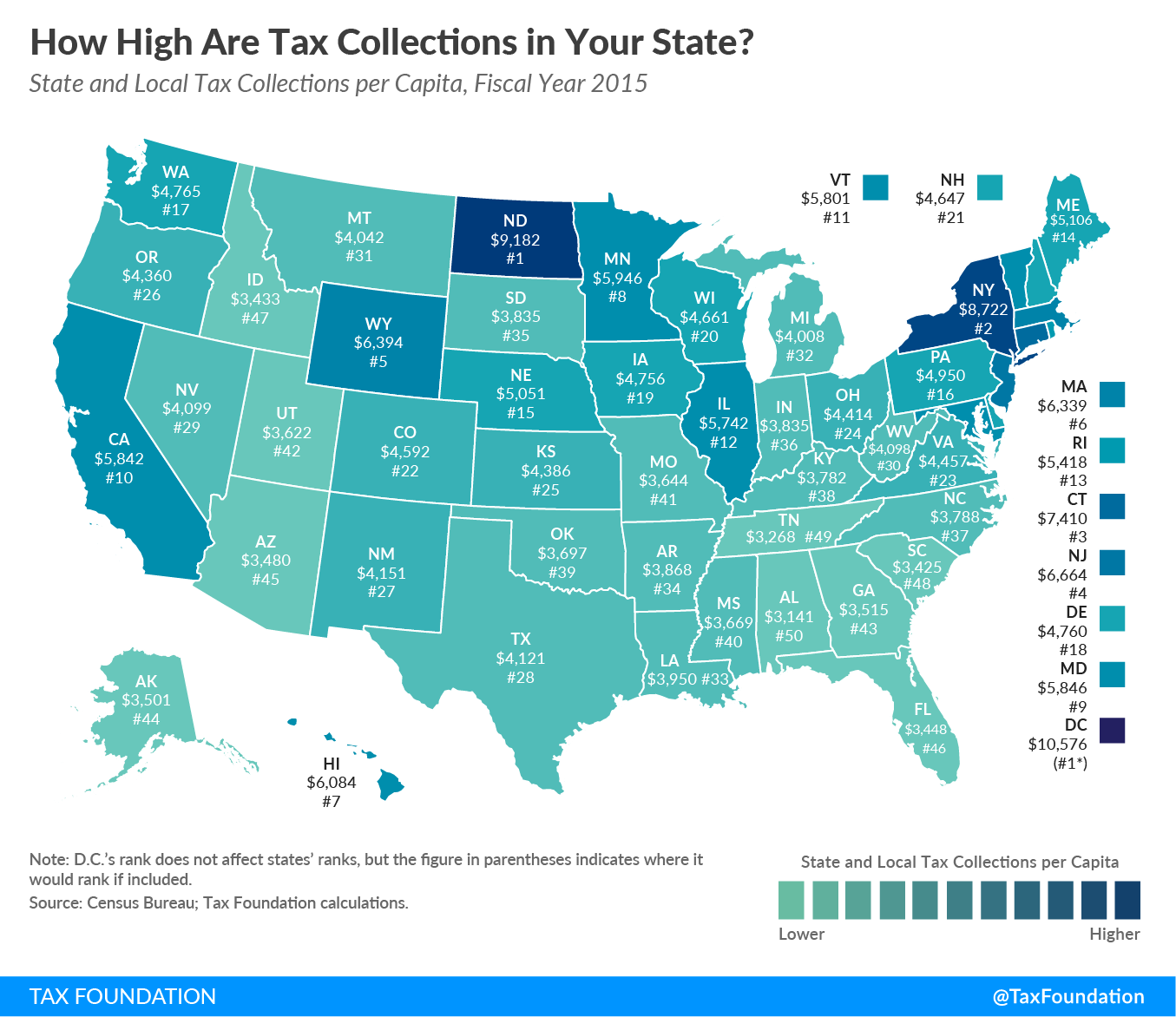

Today’s map shows total state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections per capita in each of the 50 states and the District of Columbia. The District of Columbia’s tax collections per capita ($10,576) are higher than in any state. Among states, tax collections per capita vary widely, from $3,141 per capita in Alabama to $9,182 per capita in North Dakota.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeMany people are surprised to see North Dakota as the state with the highest collections per capita, but this leads to an important conversation about the strengths and limitations of different ways to measure taxes. Taxes can be evaluated according to their marginal rates, effective rates, tax burdens, collections, and so on. While per capita measurements allow comparison across states with different populations, they do not show who is actually bearing the economic cost of the tax (the tax incidenceTax incidence is a measure of who ultimately pays a tax, either directly or through the tax burden. This burden can be split between buyers and consumers, or different groups in the economy. or tax burden).

In the case of North Dakota, because the state relies so heavily on severance tax revenue from oil extraction—and therefore “exports” a substantial share of its taxes to residents of other states—total tax collections per capita are an especially poor representation of the actual tax burden that falls on North Dakota residents.

While companies in resource-extraction industries are legally responsible for paying severance taxes to state revenue departments, companies pass the cost of these taxes along to consumers in the form of higher prices. It is ultimately oil and gas consumers across the country who bear the economic cost of oil extraction taxes in North Dakota. Severance taxes in other states have similar impacts on out-of-state residents. It is important to keep both legal incidence and economic incidence in mind when evaluating the true costs of any tax.

It is also important to note that severance taxes are far from the only example of “tax exporting” that states engage in. Travel taxes—such as hotel, car rental, and meal taxes—also disproportionately impact nonvoting nonresidents who have few means of redress. As a result, states that generate substantial amounts of tax revenue from tourism may also show total tax collections per capita that are significantly higher than the actual tax burden that falls on the in-state population.

To get a better idea of the state and local tax burden per capita in your state, see Table 2 of Facts and Figures 2018.

Note: This is part of a map series in which examine per capita state tax collections

- How Much Does Your State Collect in Sales Taxes Per Capita?

- How Much Does Your State Collect in Corporate Income Taxes Per Capita?

- How Much Does Your State Collect in Excise Taxes Per Capita?

- How Much Does Your State Collect in Individual Income Taxes Per Capita?

- How Much Does Your State Collect in Property Taxes Per Capita?