Unlike a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on a general base (like income or consumption), an excise tax is a tax on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and pari-mutuels (betting), among other goods and activities.

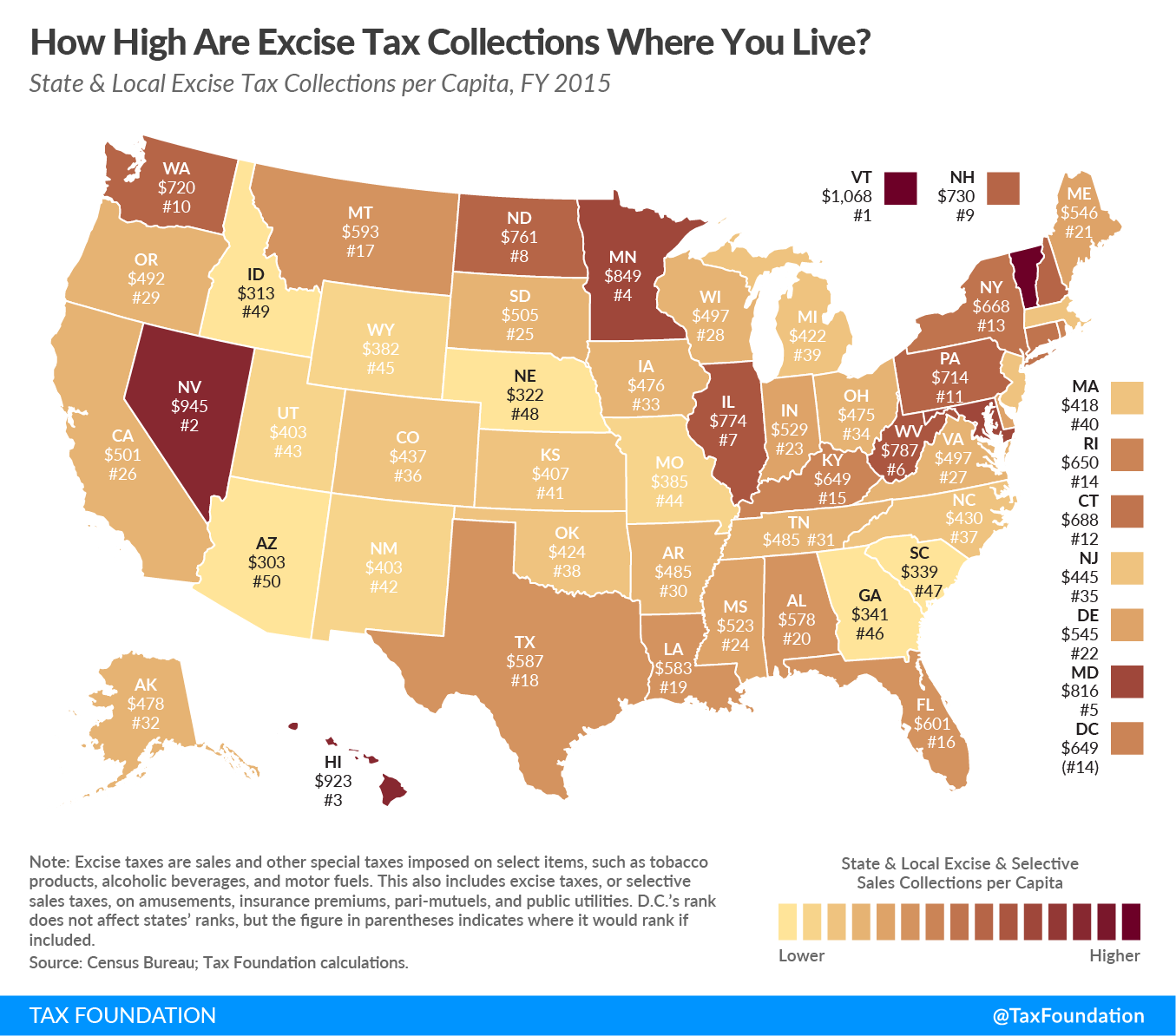

Excise taxes make up a relatively small portion of state and local tax collections—about 11 percent—but per capita collections vary widely from state to state.

Vermont has the highest state and local excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. collections at $1,068 per capita, followed by Nevada at $945 and Hawaii at $923. At $303 per capita, Arizona collected the least in per capita state and local excise taxes, followed by Idaho ($313) and Nebraska ($322).

Historically, state and local taxing authorities have turned to excise taxes as a way to generate revenue quickly. To increase the chances of political viability, many proposed excise taxes come in the form of “sin” taxes on specified activities (such as smoking or drinking or gambling), with advocates touting the perceived public health benefits that result when higher prices lead to reduced consumption. However, since reduced consumption naturally leads to a decline in revenue, the goals of raising revenue while reducing consumption are contradictory.

Beyond this, excise taxes are subject to several notable limitations. Soda taxes have unintended consequences that make any impact on obesity negligible at best. Cigarette taxes are an unstable source of revenue. Excise taxes are levied on a relatively narrow tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , and many are regressive, with a larger share of the tax burden falling on those with lower incomes.

To see how much your state collects in specific excise taxes, check out our recent maps showing state-by-state excise tax rates on cigarettes, e-cigarettes and vapor products, beer, spirits, and marijuana. You can also find data on gasoline taxes, wine taxes, cell phone taxes, and candy and soda taxes in the excise tax section of Facts and Figures.

Note: This is part of a map series in which examine per capita state tax collections

- How high are State and Local Tax Collections in Your State?

- How Much Does Your State Collect in Sales Taxes Per Capita?

- How Much Does Your State Collect in Corporate Income Taxes Per Capita?

- How Much Does Your State Collect in Individual Income Taxes Per Capita?

- How Much Does Your State Collect in Property Taxes Per Capita?