Who Pays Tariffs? Americans Will Bear the Costs of the Next Trade War

Rather than hurting foreign exporters, the economic evidence shows American firms and consumers were hardest hit by tariffs imposed during President Trump’s first-term.

5 min read

Rather than hurting foreign exporters, the economic evidence shows American firms and consumers were hardest hit by tariffs imposed during President Trump’s first-term.

5 min read

The French Revolution provides insight into the relationship between a government and its citizens and serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

If Republicans want a successful year for tax reform, they must put aside the extensive demands for niche provisions and, instead, approach this debate with a principles-first mindset.

The House Budget Committee has released a budget resolution that specifies large reductions in both taxes and spending over the next decade, paving the way to extend the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially cut other taxes.

6 min read

The Trump administration appears to be moving in a “reciprocal” policy direction despite the significant negative economic consequences for American consumers of across-the-board tariffs on goods coming into the US. However, the EU’s VAT system should not be used as a justification for retaliatory tariffs.

6 min read

As Kansas policymakers consider ways to provide long-term property tax relief, a well-structured, exemption-free levy limit would be a structurally sound and effective reform to consider.

8 min read

In this episode, Adam Hoffer, Director of Excise Tax Policy at the Tax Foundation, joins Kyle Hulehan to unpack the intricacies of sports betting tax policy during one of the biggest betting events of the year—Super Bowl 59.

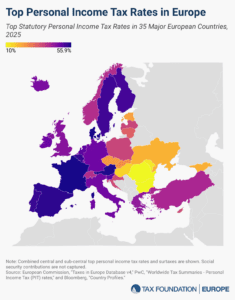

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) levy the highest top personal income tax rates in Europe.

4 min read

While many Scandinavians get mailed comprehensive pre-filled tax returns and only have to check whether they are correct, the average German taxpayer spends 9 to 10 hours and over €100 filing their tax return.

7 min read