All Related Articles

Trump’s “No Tax on Social Security” Proposal Is Unsound and Fiscally Irresponsible

Exempting Social Security benefits from income tax would increase the budget deficit by about $1.6 trillion over 10 years, accelerate the insolvency of the Social Security and Medicare trust funds, and create a new hole in the income tax without a sound policy rationale.

6 min read

How Are Olympians and Attendees Taxed?

The 2024 Summer Olympics are underway, drawing the attention of billions and continuing a tradition dating back thousands of years. But you know what else originated thousands of years ago and affects even more people? Taxes.

3 min read

Pillar Two: Electric Boogaloo

The global tax deal and Pillar Two are shaking up the tax landscape worldwide, introducing a web of complexity and confusion.

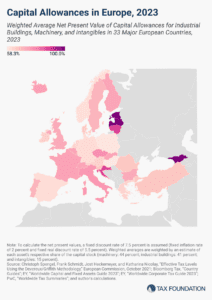

Capital Allowances in Europe, 2024

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read