The European Union’s ViDA Proposal: Ignoring Principles Does Not Make Tax Policy Fairer

Adopting tax policy based on sound principles like neutrality rather than political expediency is essential for the European Union’s fiscal future.

5 min read

Adopting tax policy based on sound principles like neutrality rather than political expediency is essential for the European Union’s fiscal future.

5 min read

The Tax Cuts and Jobs Act (TCJA) significantly lowered the effective tax rates on business income, but the impact was not the same for C corporations and pass-through businesses.

6 min read

Neutral tax codes don’t play favorites or try to influence personal or business decisions but stick to what they’re best at – raising sufficient revenue through low rates and a broad base.

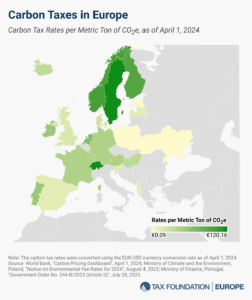

23 European countries have implemented carbon taxes, ranging from less than €1 per metric ton of carbon emissions in Ukraine to more than €100 in Sweden, Liechtenstein, and Switzerland.

3 min read

For over a century, lawmakers have exempted politically favored organizations and industries from the tax code. As a result, the tax-exempt nonprofit economy now comprises 15 percent of GDP, roughly equal to the fifth-largest economy in the world.

41 min read

The all-in Oregon state and local tax rate on large businesses could exceed 56 percent under a proposed ballot measure that purports to impose only a small tax increase on large businesses.

6 min read

To stay competitive in an increasingly mobile post-pandemic world, states and localities must learn from the tax policy successes and failures of their neighbors and communities across the nation.

27 min read

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

5 min read

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

6 min read

Lawmakers should see 2025 as an opportunity to consider more fundamental tax reforms. While the TCJA addressed some of the deficiencies of the tax code, it by no means addressed them all.

8 min read