Are Tariffs the Ghost of Christmas Future?

The holiday season is marked by time with friends and family, joy, and gift-giving. But could tax policy make the sticker shock from your shopping list next year tariff-ying?

4 min read

The holiday season is marked by time with friends and family, joy, and gift-giving. But could tax policy make the sticker shock from your shopping list next year tariff-ying?

4 min read

Taxes and their broader impact are generally overlooked in American education. Taxes influence earnings, budgets, voting, and decisions on where to live, but do American taxpayers understand the US tax system?

25 min read

The worldwide average statutory corporate tax rate has consistently decreased since 1980 but has leveled off in recent years. In the US, the 2017 Tax Cuts and Jobs Act brought the country’s statutory corporate income tax rate from the fourth highest in the world closer to the middle of the distribution.

18 min read

Tax avoidance is a natural consequence of tax policy. Policymakers should consider the unintended consequences, both to public health and public coffers, of the excise taxes and regulatory regimes for cigarettes and other nicotine products.

5 min read

What happens to your taxes when the Tax Cuts and Jobs Act expires on January 1, 2026? In this episode, we explore the potential tax hikes facing millions of Americans and the debate over measuring the budgetary impacts of extending tax cuts.

As we prepare for the tax code’s “move,” it’s time to start cleaning out the proverbial attic of our messy system. For the sake of our economy, moves toward growth must win the day.

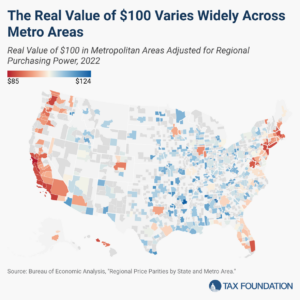

Many policies, such as minimum wage levels, tax brackets, and means-tested public benefit income thresholds, are denominated in nominal dollars, even though a dollar in one region may go much further than a dollar in another. Lawmakers should keep that reality in mind as they make changes to tax and economic policies.

6 min read

Consumers legally wagered more than $100 billion on sporting contests in 2023, creating more than $1.8 billion in state revenue. Sports betting is now legal in 38 states and DC, and the landscape is rapidly evolving.

18 min read

Lawmakers will enter the 2025 fiscal legislative session with an opportunity to build on the successes of the November special session. Efforts should include addressing the outstanding issues within the corporate and sales tax codes that currently hold the state back.

7 min read

If lawmakers are serious about pro-growth policies and fiscal responsibility, they will need to put policies forward that achieve those goals. Simply adjusting the baseline doesn’t reduce actual deficits in the coming years.

7 min read