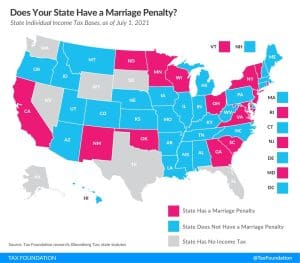

Does Your State Have a Marriage Penalty?

Fifteen states have a marriage penalty built into their bracket structure. Does your state have one?

2 min read

Fifteen states have a marriage penalty built into their bracket structure. Does your state have one?

2 min read

To fully follow the Scandinavian model would require additional taxes that place a higher burden on middle-income earners, but instead, Biden proposes higher taxes on corporations and households making more than $400,000.

3 min read

A vehicle miles traveled (VMT) proposal gaining steam in Pennsylvania would be the equivalent of a state gas tax of more than $2 per gallon, and that’s not all the Commonwealth is considering.

7 min read

While Congress continues to debate how to pay for President Biden’s spending proposals in the fiscal year 2022 budget, it is useful to consider the economic impact of a range of financing options in addition to the President’s proposed tax increases.

3 min read

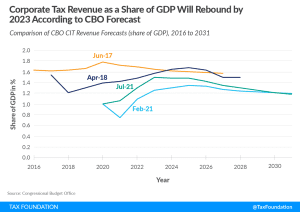

In light of these forecasts, which could be revised upwards further given the pace of growth in the economy and corporate profits, it seems clear that the 2017 tax reform did not substantially reduce the revenue potential of the corporate tax.

3 min read

Louisiana legislators passed a tax reform plan that has received overwhelming support in both the House and Senate, but voters will get the ultimate say on whether that plan succeeds. In light of this, it may be valuable to walk through what is included in these reforms and what effect the changes will have on taxpayers.

5 min read

The good news is that lawmakers avoided raising taxes to cover the cost of the new spending and instead used some reasonable fees and asset sales. The bad news is that half of the offsets come from unused, debt-financed COVID-19 relief funds and the economic return on many of these investments is questionable.

7 min read

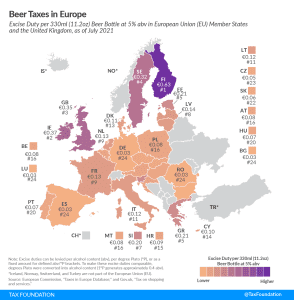

Finland has the highest excise tax on beer in Europe, followed by Ireland and the United Kingdom. Compare beer taxes in Europe this International Beer Day

3 min read

As lawmakers explore funding mechanisms for additional federal infrastructure investment, they should focus on permanent, sustainable, and transparent revenue options that conform to the benefit principle. Permanent user fees, appropriately adjusted to restore and maintain their purchasing power, would serve as ideal revenue sources for federal infrastructure investments.

5 min read