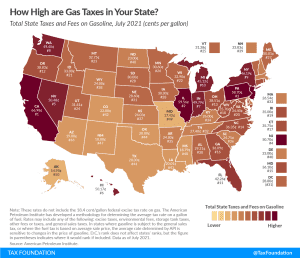

Gas Tax Rates by State, 2021

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg).

3 min read

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg).

3 min read

Reducing the tax gap is, on the margin, a good way to raise revenue, but is not without costs. Policymakers should consider compliance costs for law-abiding taxpayers as well as administrative costs for the IRS when evaluating measures to reduce the tax gap.

33 min read

As economies are starting to recover and growth is expected to rebound in the region during 2021, Asian and Pacific countries should start exploring changes to their fiscal tax policies while carefully evaluating the optimal time for eliminating fiscal stimulus and temporary tax relief.

4 min read

Even as lawmakers in eleven states have cut income taxes this year, the D.C. Council has responded to surpluses and growth by voting to include substantial income tax increases in the budget.

7 min read

The media has reported on how wealthy taxpayers who own sports teams lower their tax liability by deducting the cost of purchasing a sports team over 15 years. Contrary to claims that deducting the cost of a sports team from taxable income is a “loophole,” such deductions are a normal and proper part of the income tax system.

3 min read

New data clearly points to an increase in tax complexity for multinationals in the OECD as well as globally. The OECD’s ongoing efforts to reform the international tax system will likely further add complexity to the international tax environment.

3 min read

Taken together, the proposed reforms would further solidify North Carolina’s position as a leader in sound tax policy and as a state whose tax code is among the most conducive to generating long-term economic growth.

7 min read

In most states, tax incentives abound, usually offered as a way of promoting new investment or attracting certain industries by shielding them from the full impact of otherwise high tax rates.

6 min read

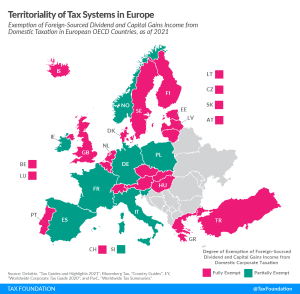

19 European OECD countries employ a fully territorial tax system, exempting all foreign-sourced dividend and capital gains income from domestic taxation. No European OECD country operates a worldwide tax system.

3 min read

Intellectual property is a key driver in the current economy. Among other things, intellectual property includes patents for life-saving drugs and vaccines and software that runs applications on phones and computers.

5 min read