Key Findings

- The Earned Income Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. (EITC) is a refundable tax creditA refundable tax credit can be used to generate a federal tax refund larger than the amount of tax paid throughout the year. In other words, a refundable tax credit creates the possibility of a negative federal tax liability. An example of a refundable tax credit is the Earned Income Tax Credit (EITC). targeted at low-income workers. The majority of benefits accrue to people with an adjusted gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. (AGI) under $30,000, and about a third of benefits accrue to people with an AGI under $15,000.

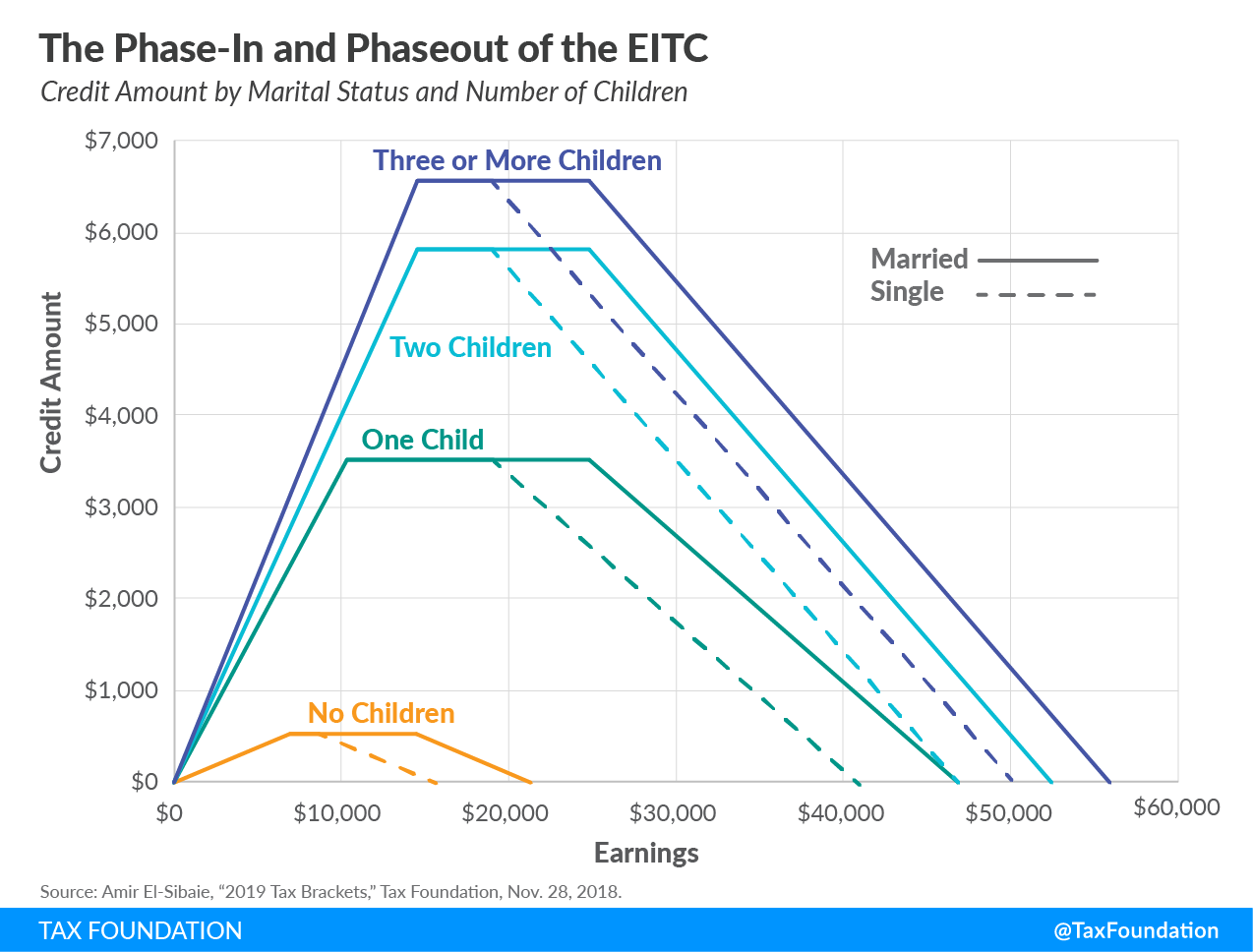

- It has three phases. In the phase-in, each added dollar of earned income receives a matching credit, lowering a worker’s implicit marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. . In the plateau, additional income has no effect on the credit’s size or implicit marginal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate. In the phaseout, extra income reduces the credit, raising the implicit marginal tax rate.

- The EITC is well-targeted towards low-income workers, reducing poverty and counteracting instances of regressivity in the tax code. It also encourages work participation among certain groups.

- However, the EITC has complicated eligibility rules, has a consistently high error rate, can create negative economic incentives for workers, penalizes workers for marrying, and creates disparity between workers with and without children.

- Options to reform the EITC include reducing its complexity, especially through simpler eligibility requirements; eliminating the marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. ; and expanding the credit’s value for childless workers, among others. Policymakers should consider the EITC’s trade-offs when evaluating proposals to expand or reform the credit.

Introduction

The Earned Income Tax Credit (EITC) is used to offset income and payroll taxes for low-income workers. Since it was enacted in 1975, the EITC has undergone several reforms and expansions, becoming a major tax expenditure and anti-poverty policy in the United States. It has two main purposes—to promote work and to reduce poverty—and is only available to those who are employed, in contrast to some anti-poverty programs.

As the EITC has expanded, it has become more important to understand its impact and to recognize its strengths and weaknesses. The EITC is a well-targeted anti-poverty program that counteracts instances of regressivity in the tax code. There is also strong evidence that it encourages workforce participation, at least among particular demographics. At the same time, the EITC is complicated, has a consistently high error rate, and creates a disincentive to work once recipients reach a certain income level. It also imposes a marriage penalty, reducing the credit’s value for married workers, and creates disparity between workers with and without children.

When evaluating proposals to reform or further expand the EITC—for example, Senator Sherrod Brown (D-OH), Representative Bonnie Watson Coleman (D-NJ), and Representative Ro Khanna’s (D-CA) “Cost-of-Living Refund Act” and Senator Kamala Harris’ (D-CA) “LIFT the Middle-Class Act”—policymakers should keep in mind the EITC’s trade-offs.[1] Promoting sound tax policy requires acknowledging both the EITC’s benefits and its drawbacks.

Overview of the EITC

While its goals of encouraging work and reducing poverty might be straightforward in principle, the EITC is a sophisticated program with several parts to its calculation. The EITC equals a fixed percentage of earned income (the credit rate) up to the maximum credit amount, with the value of the credit varying by income, number of children, and marital status. Taxpayers generally receive the credit while filing their taxes, and it is refundable: if the credit reduces a filer’s tax liability below zero, the filer is eligible to receive the remaining credit value as a refund.[2] In other words, not only does the EITC lower a qualifying individual’s tax liability, but any EITC due to the individual in excess of his tax liability is paid directly to the taxpayer. Most households receive the EITC as a refund. In 2016, 27.3 million tax returns claimed the EITC for a total of $66.7 billion, of which $57.1 billion was refunded.[3]

As Figure 1 and Table 1 illustrate, the EITC has three phases, which vary by a worker’s marital status and number of children. In the first phase, each additional dollar of earned income receives a federal matching credit, sharply lowering the implicit marginal tax rates of filers whose incomes are within that range. In the second phase, additional earned income has no effect on the credit’s size or on implicit marginal tax rates for filers whose incomes are on the plateau. In the third phase, additional income reduces the credit, sharply raising the implicit marginal tax rates of filers whose incomes are within the phaseout range. In other words, the phase-in creates a negative marginal tax rate, while the phaseout creates a marginal rate spike.

Figure 1.

|

Source: Amir El-Sibaie, “2019 Tax Brackets,” Tax Foundation, Nov. 28, 2018. |

|||||

| Filing Status | No Children | One Child | Two Children | Three or More Children | |

|---|---|---|---|---|---|

| Single or Head of Household | Income at Maximum Credit | $6,920 | $10,370 | $14,570 | $14,570 |

| Maximum Credit | $529 | $3,526 | $5,828 | $6,557 | |

| Phaseout Begins | $8,650 | $19,030 | $19,030 | $19,030 | |

| Phaseout Ends (Credit Equals Zero) | $15,570 | $41,094 | $46,703 | $50,162 | |

| Married Filing Jointly | Income at Maximum Credit | $6,920 | $10,370 | $14,570 | $14,570 |

| Maximum Credit | $529 | $3,526 | $5,828 | $6,557 | |

| Phaseout Begins | $14,450 | $24,820 | $24,820 | $24,820 | |

| Phaseout Ends (Credit Equals Zero) | $21,370 | $46,884 | $52,493 | $55,952 | |

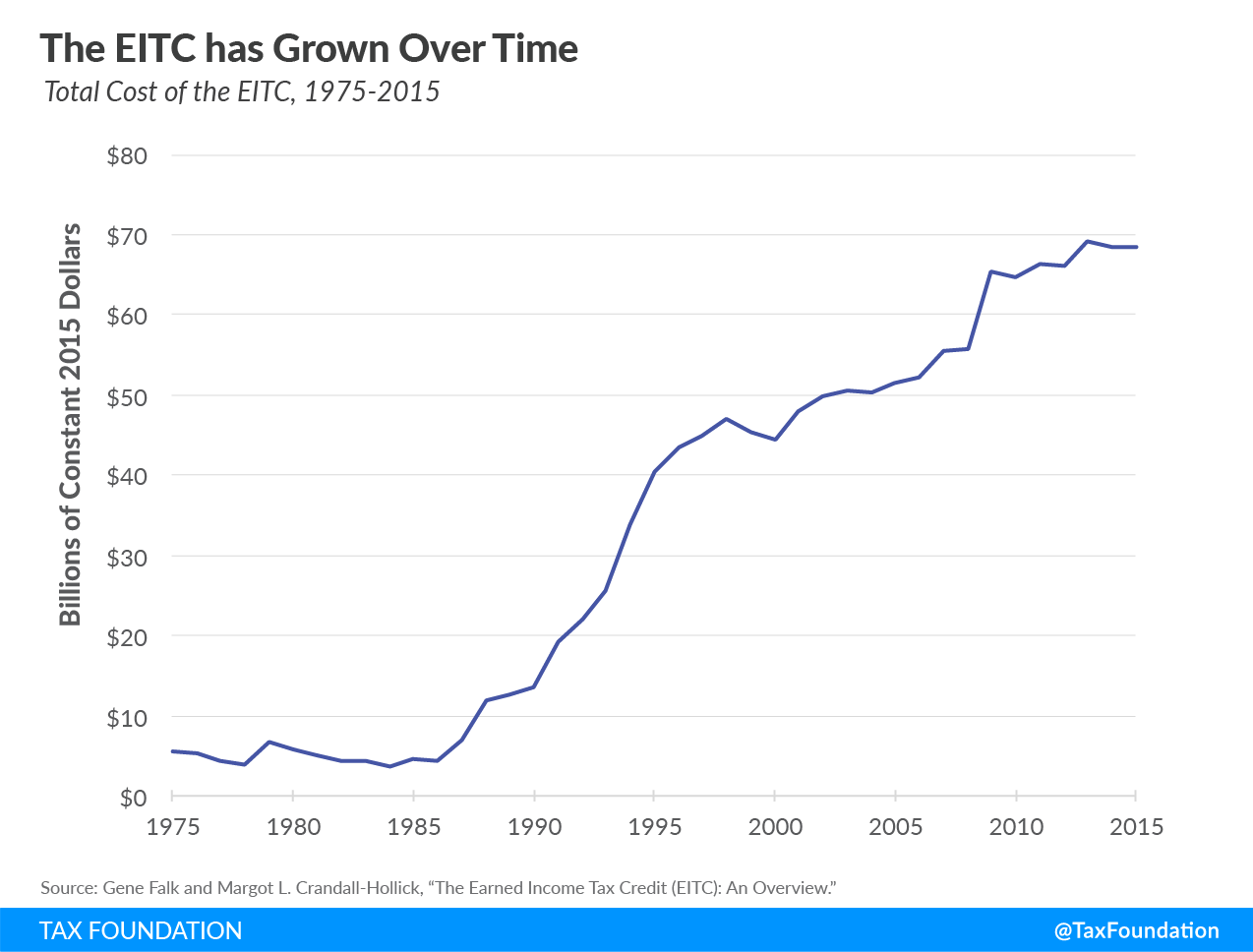

As Figure 2 illustrates, the EITC has grown considerably since its inception, from $5.5 billion in 1975 in constant 2015 dollars to $68.5 billion in 2015. Its cost rose dramatically in 1990, 1993, 2001, and 2009, years in which Congress expanded the program.

Figure 2.

Strengths of the EITC

The EITC has a number of benefits and drawbacks, creating trade-offs for policymakers. The EITC’s primary strengths are that it is well-targeted towards low-income workers and that it promotes entrance into the workforce.

Well-Targeted Towards Low-Income Workers

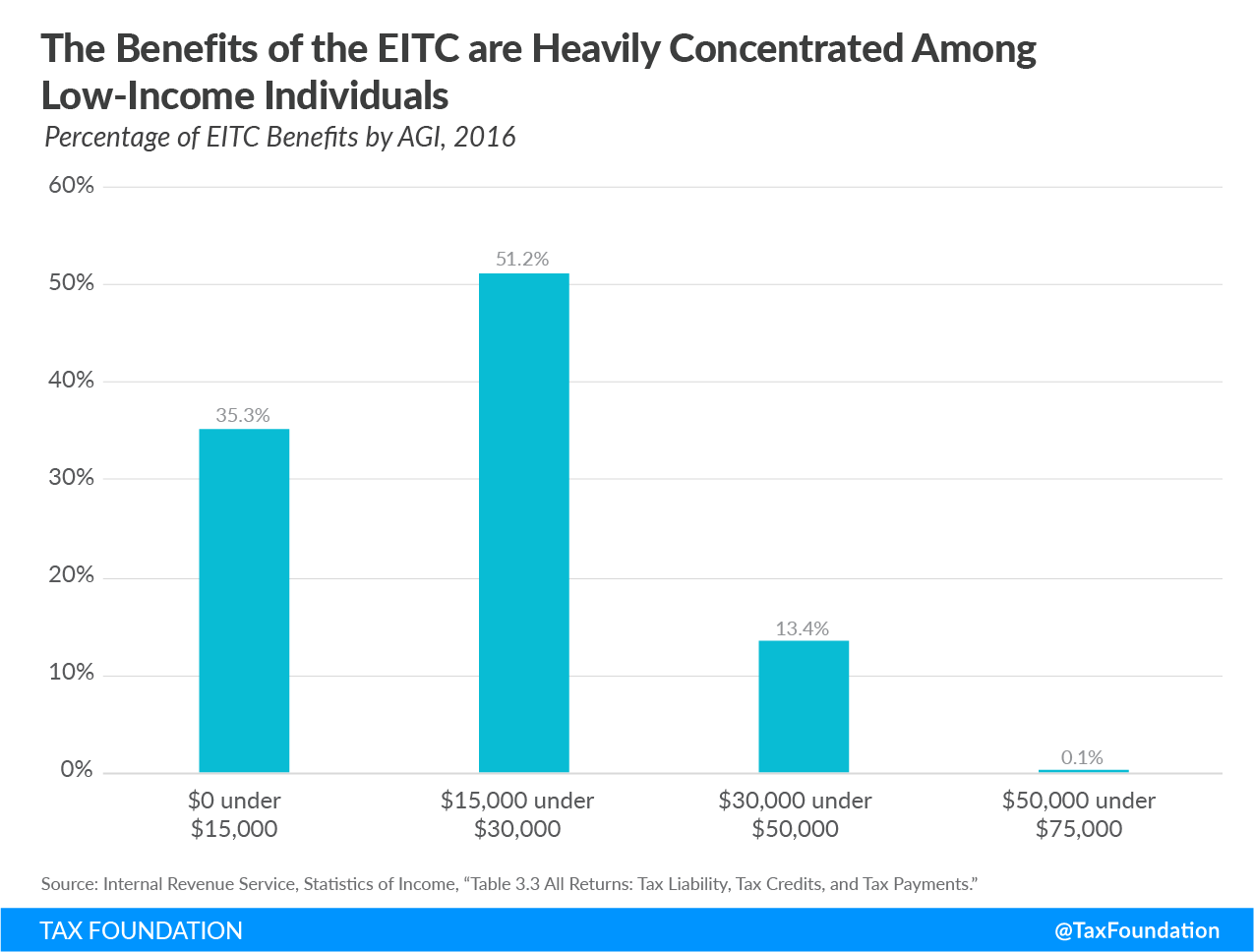

The EITC’s benefits are heavily concentrated among lower-income workers. As Figure 3 illustrates, virtually all the benefits of the EITC accrue to people with an adjusted gross income (AGI) under $50,000, and 86.5 percent of its benefits accrue to people with an AGI under $30,000. This is due to the eligibility requirements of the program.

In 2016, the EITC’s distribution by income group was $23.6 billion to those with AGI under $15,000, $34.2 billion to those with an AGI between $15,000 and $30,000, $9 billion to those with an AGI between $30,000 and $50,000, and $0.3 billion to those with AGI between $50,000 and $75,000. Estimates show that EITC receipt is concentrated among people with incomes (after other taxes and transfers) of between 75 and 150 percent of the poverty line.[4]

Figure 3.

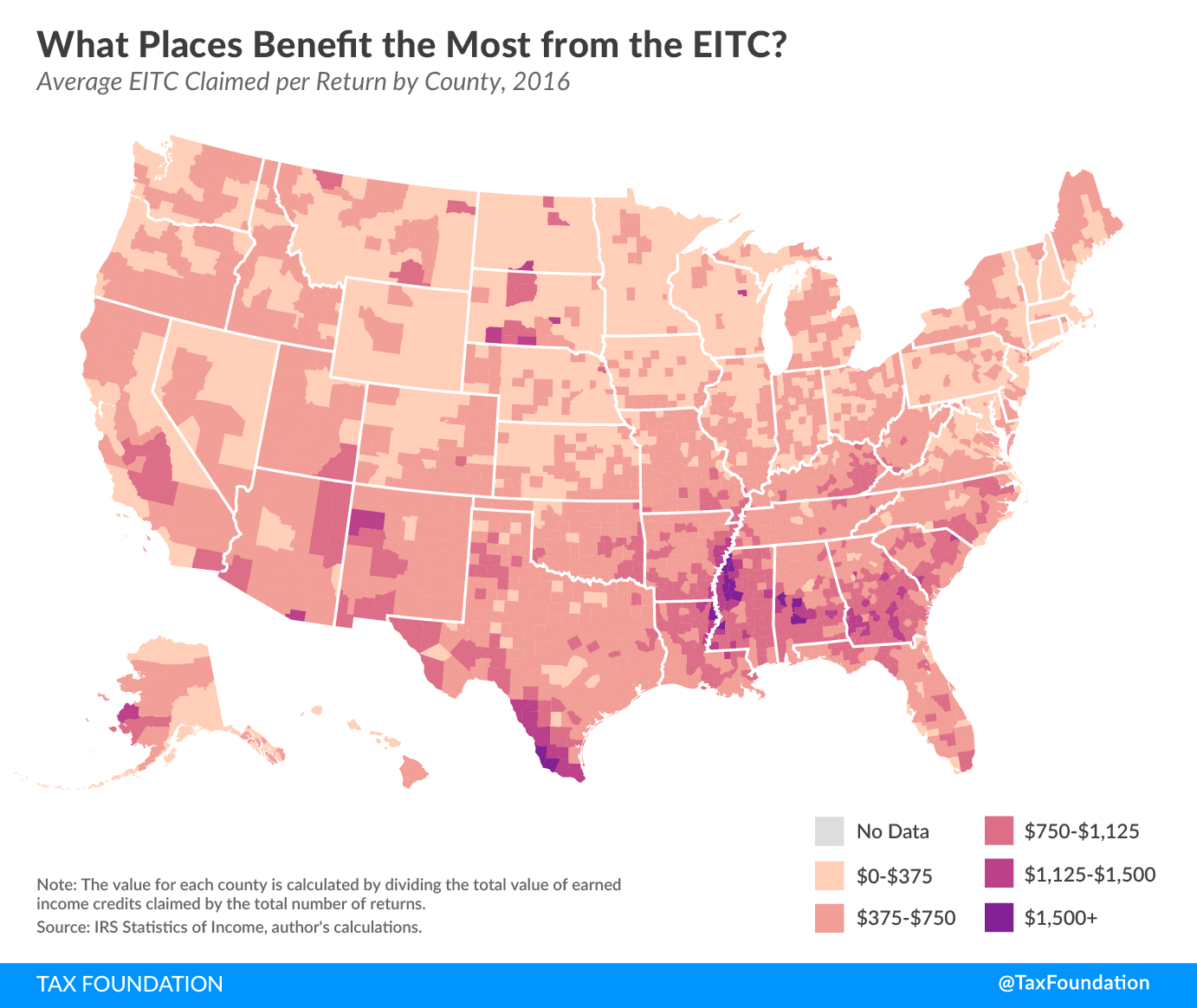

A geographic distribution of the EITC’s impact similarly shows how the EITC’s benefits are concentrated among low-income Americans. Figure 4 shows the average EITC amount claimed per return by county in 2016.[5]

Figure 4.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThe EITC tends to have the highest average value in areas of rural America that generally have lower incomes—for example, the Mississippi Delta, southern Texas, eastern Kentucky, and parts of the South Dakota reservations. It also has a higher average value in some urban counties—for example, Wayne County, Michigan (includes Detroit); Philadelphia; Baltimore; and certain areas of New York City. The EITC thus benefits low-income Americans in both rural and urban counties.

The concentration of the EITC’s benefits among low-income workers helps to make the EITC an effective anti-poverty program. One study estimates that the EITC brought 5.8 million people, including approximately 3 million children, out of poverty in 2016, while the Council of Economic Advisers during the Obama administration estimated that the EITC, along with the Child Tax Credit, reduced poverty more than any other program besides Social Security.[6]

The impact on poverty is far greater on workers with children than on those without. According to one study, for example, in 2016 the EITC reduced the percent of unmarried households with three children in poverty by 20.2 percent, from 40.5 percentage points to 32.3 percentage points. By contrast, it reduced the percent of unmarried childless workers in poverty by 1.5 percent, from 19.9 percentage points to 19.6 percentage points.[7] The significant difference in poverty reduction between workers with and without children is partly a consequence of the EITC’s design (discussed below).

The EITC is particularly well targeted in comparison to other provisions in the tax code intended to reduce regressivity. For example, sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. exemptions for groceries are sometimes defended on the ground that taxing necessities is unfair to low-income individuals, who spend a higher percentage of their earnings on groceries. However, because it benefits anyone who buys groceries, regardless of income, the exemption is poorly targeted towards low-income consumers.[8] In contrast, only low-income Americans are eligible for the EITC.

Because it is so well targeted, the EITC also helps to offset other instances of regressivity in the tax code, such as payroll taxes, which impose a heavier burden on low-income individuals.[9] As the EITC and other refundable tax credits have grown in recent decades, a growing percentage of Americans have zero or even negative income taxes, and the EITC, by being so well targeted toward low-income workers, makes the tax code more progressive.[10]

Encourages Workforce Participation

The EITC promotes workforce participation, at least among select groups. There is strong evidence that the EITC encourages work among low-income households, particularly single mothers. One study found that the Tax Reform Act of 1986’s expansion of the EITC, along with other provisions, was responsible for single mothers increasing their labor force participation by 1.4 percentage points in the 1980s.[11] Further expansions in the 1990s increased employment for single mothers by 3.1 percentage points and were responsible for 34 percent of the increase in employment among single mothers between 1993 and 1999.[12] The increased workforce participation among EITC recipients shows that they are responsive to the credit’s implicit marginal subsidy in the phase-in “region” or stage.

While the impact on entering the workforce is strong, there is less evidence that the EITC affects the number of hours worked—in other words, the evidence suggests that the EITC encourages people to start working more than it encourages them to work more. As one study summarizes, “There is overwhelming evidence that the EITC encourages work among single mothers but little evidence that eligible working women adjust their hours in response to the EITC.”[13]

There is also less evidence of the EITC increasing workforce participation among demographics other than single mothers.[14] However, as with the difference in impact between workers with and without children, the difference in impact between single mothers and childless workers can partly be ascribed to the EITC’s design (discussed below).

Weaknesses of the EITC

Despite its strengths, the EITC has several flaws: it is complicated, has a high error rate, discourages work past a certain income threshold, imposes a marriage penalty, and creates disparity between workers with and without children.

Complexity and Error

The EITC is a complicated program, leading to administrative difficulties and a high error rate. Eligibility requirements for the EITC depend on several factors, resulting in confusion and improper payments. The Congressional Research Service lists the following criteria for eligibility:[15]

- The tax filer must file a federal income tax return [in other words, one cannot be a dependent on someone else’s tax return].

- The tax filer must have earned income.

- The tax filer must meet certain residency requirements.

- The tax filer’s children must meet relationship, residency, and age requirements to be considered qualifying children for the credit.

- Childless workers who claim the credit must be between ages 25 and 64. (This age requirement does not apply to EITC claimants with qualifying children.)

- The tax filer’s investment income must be below a certain amount.

- The tax filer must not be disallowed the credit due to prior fraud or reckless disregard of the rules when they previously claimed the EITC.

- The tax filer must provide the Social Security number for themselves, their spouse, if married, and any children for whom the credit is claimed.

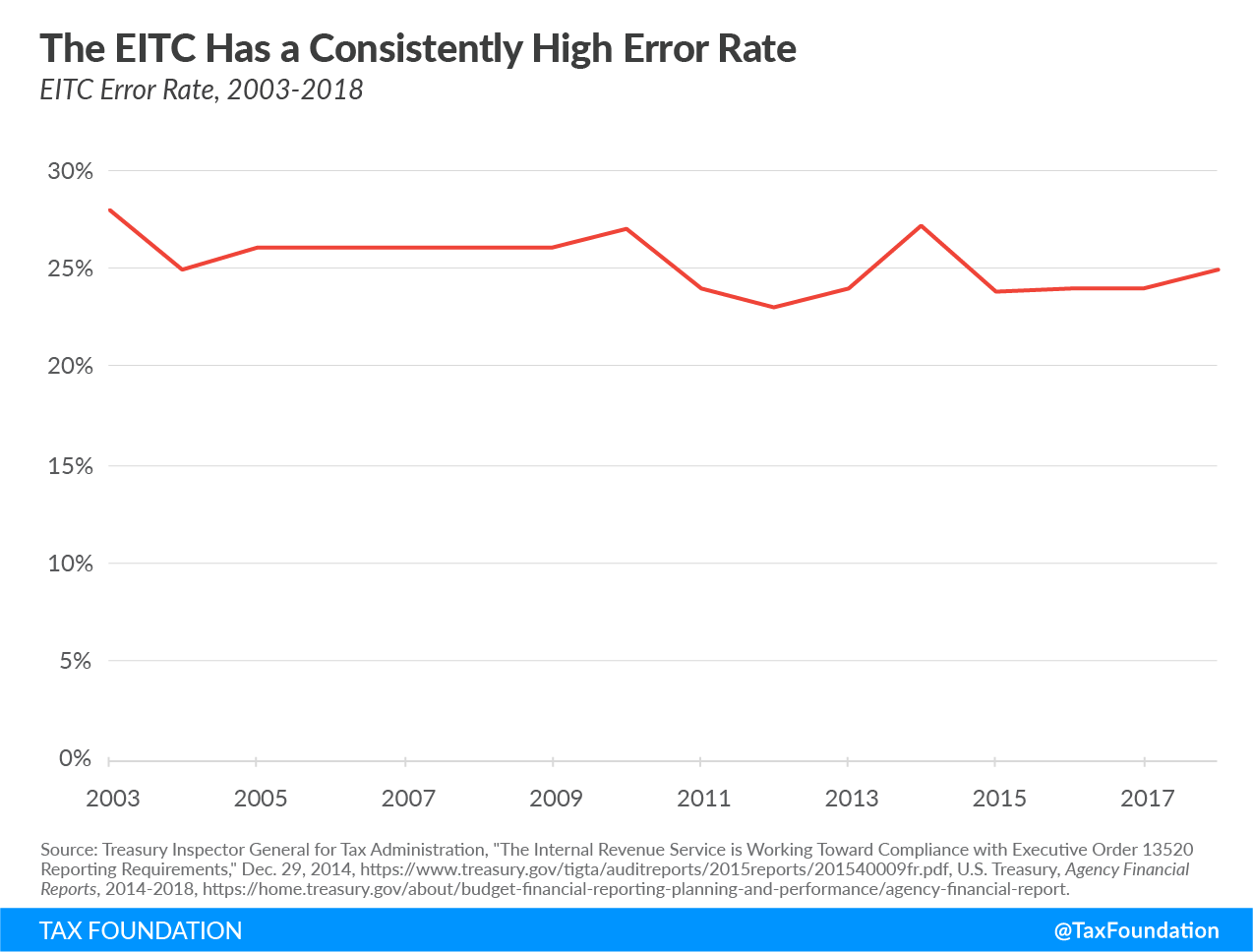

The EITC’s complexity contributes to a consistently high error rate. According to the Internal Revenue Service (IRS), $18.4 billion of the program’s $73.6 billion in outlays, or 25 percent, were improper in 2018.[16] As Figure 5 illustrates, this number is not out of the ordinary: since 2003, the error rate has not fallen below 23 percent.

Figure 5.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIn 2014, the IRS identified three major reasons for error: claimants incorrectly claimed children for the credit, misreported their income, and/or used an incorrect filing status when they claimed the credit.[17] The EITC’s complexity, and people’s confusion about how the EITC operates, likely contributed to all three mistakes. The Treasury has also identified several factors contributing to error, including complexity of eligibility requirements, lack of correctible error authority, high turnover of eligible claimants, unscrupulous tax return preparers, and fraud.[18]

While the high error rate is sometimes treated as evidence of a significant amount of fraud, the IRS and Treasury research shows that fraud is only one of many factors.[19] The Treasury Inspector General for Tax Administration defines an improper payment as “a payment that should not have been made or that was made in an incorrect amount or to an ineligible recipient.”[20] Cases in which people mistakenly claim the EITC could result in improper payments, but they do not involve fraud.

Given the EITC’s complexity, people for any number of reasons might mistakenly think they are eligible. For example, a non-custodial parent might claim the EITC for a child, without realizing that the child does not technically match the relationship requirements to qualify for the credit. Or, two parents might both claim the EITC for a child, without realizing that only one parent is eligible. In these scenarios, incorrect claims could lead to improper payments. However, those payments would not be the result of fraud, but rather of people’s confusion about eligibility requirements as a result of the EITC’s complexity. Even unintentional incorrect claims can be penalized, however. Claiming the EITC in error can result in delayed or denied refunds and in being banned from claiming the credit for two to 10 years.[21]

Work Disincentives

Just as the EITC strengthens the incentive to work for people in the phase-in stage through an implicit marginal subsidy, it weakens the incentive to work in the phaseout stage through an implicit marginal tax increase. The EITC affects people’s incentives to work through what are known as the income and substitution effects.

The income effect is the change in consumption as a result of a change in income—for example, buying more of a good after receiving a raise. The substitution effect is the change in consumption as a result of changing relative income and prices—for example, buying less of a good when the price rises.

Through the substitution effect, the EITC, by increasing the value of working, creates an incentive to increase the number of hours worked. But through the income effect, the EITC, by boosting income, allows workers to reach a given level of consumption while working fewer hours than they could otherwise, creating an incentive to reduce the number of hours worked. Economists Nada Eissa and Hilary Hoynes provide the following summary of the EITC’s incentive effects:

[I]n the phase-in region, the EITC leads to an ambiguous impact on hours worked due to the negative income effect and positive substitution effect. In the flat region, however, the EITC produces a negative income effect leading to an unambiguous reduction in hours worked. In the phase-out region, the EITC produces a negative income and negative substitution effect leading again to an unambiguous reduction in hours worked.[22]

In other words, in the phase-in stage, the income effect creates an incentive to work less, while the substitution effect creates an incentive to work more, and it is uncertain in theory which will be stronger. In the flat stage and phaseout stage, both effects create an incentive to work less, and there is no counteracting incentive to work more. Thus, while the EITC can encourage work by rewarding entry into the workforce or additional hours of work, it can also discourage work by declining in value as the worker’s income increases. Workers therefore have an incentive to work less in order to maintain the larger EITC payment.

Marriage Penalty

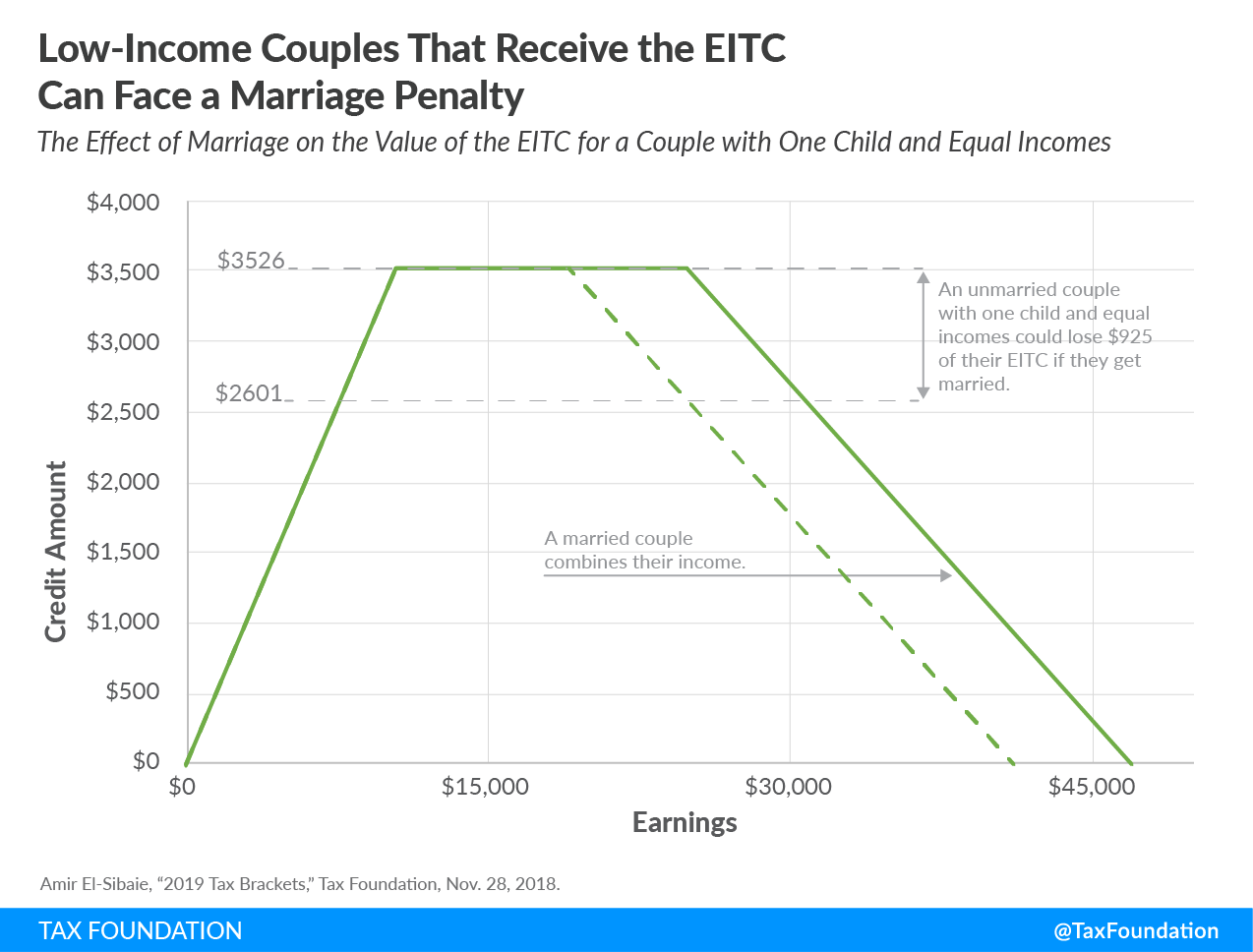

The EITC can also distort people’s incentives through the marriage penalty, by which a couple’s total tax bill after marrying and filing their taxes jointly is greater than it was when the couple filed their taxes individually. Adding one partner’s income to the other’s can push the couple’s combined income into the phaseout range, reducing the couple’s combined after-tax income. The penalty is possible because the EITC is based on household income, unlike the minimum wage, which is based on the earnings of individual household members.

Figure 6 illustrates the marriage penalty for a couple with incomes of $15,000 each ($30,000 combined) and one child in 2019. If the individuals are unmarried, one parent could claim the child for the EITC and receive the full amount of $3,526. However, when married, the couple’s total income of $30,000 pushes them into the phaseout range of the EITC, reducing the credit amount by $925. The EITC thus penalizes marriage for low-income working couples.

Figure 6.

Disparity Between Workers with and Without Children

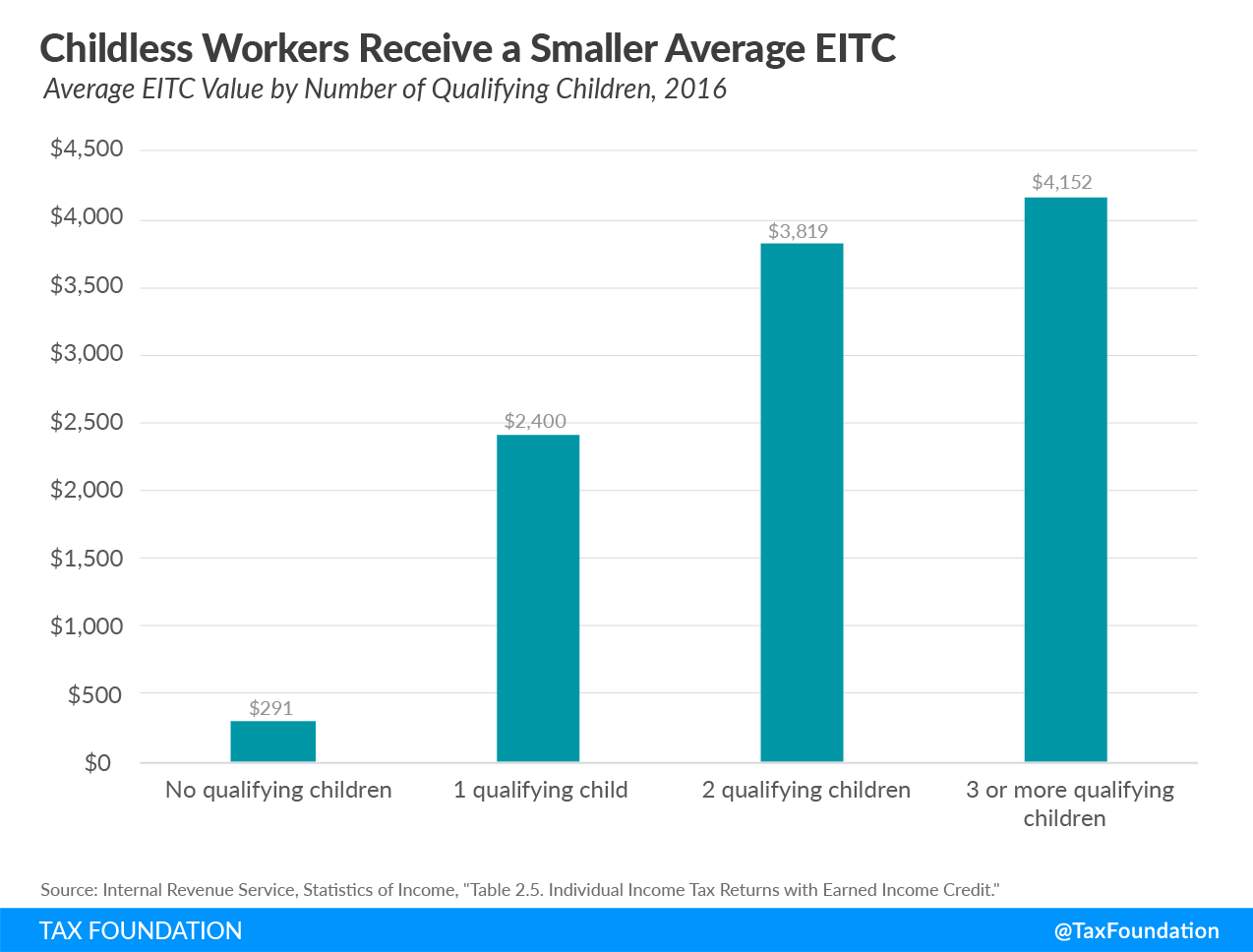

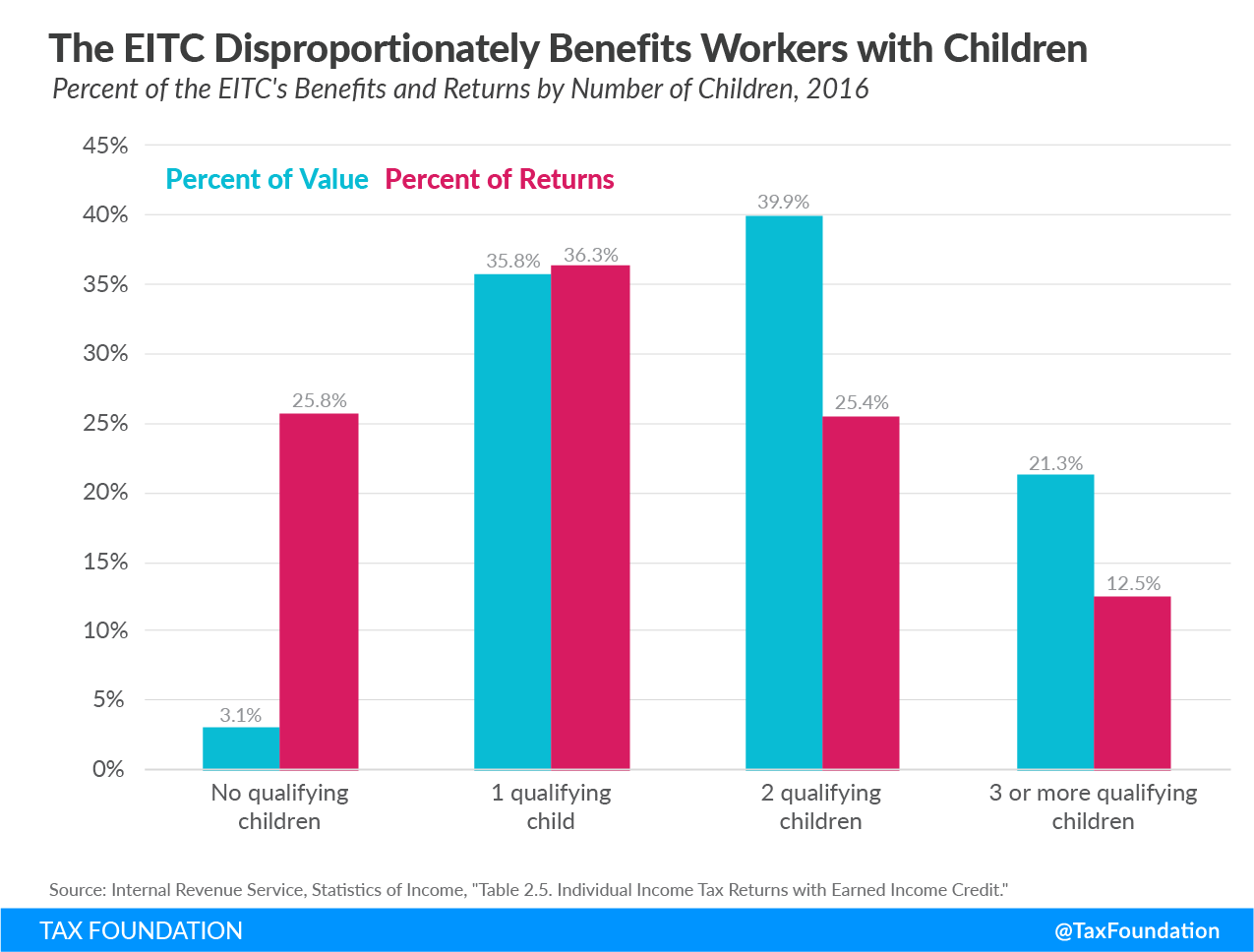

Finally, the EITC benefits workers with children far more than it does those without, creating a family-status differential. As previously illustrated in Figure 1 and Table 1, the EITC’s value varies widely with the number of children in the family. For example, the maximum credit amount for childless workers is $519, while the maximum for workers with one child is $3,461, more than six times as much.

The following two charts illustrate the disparity between workers with and without children. As Figure 7 shows, benefits are heavily concentrated among workers with children. For example, childless workers account for 25.8 percent of EITC returns but receive only 3.1 percent of the benefits. Similarly, Figure 8 shows that on average there is a large disparity between workers with and without children. The average credit is $291 for childless workers, compared to an average credit of $3,181 for workers with children, more than 10 times as much. A simpler and fairer EITC would pursue the same objectives—workforce participation and poverty reduction—for all workers, regardless of family status.

Figure 7.

Figure 8.

Options for Reform

Several of the EITC’s drawbacks are the result of the credit’s design and could be addressed through reform. As with the EITC overall, options to address these drawbacks would involve trade-offs, which policymakers should consider in assessing reform proposals.

One option for improving the EITC is to simplify the eligibility rules. As noted previously, complicated eligibility requirements, especially concerning relationships between parents and children, can lead to confusion and mistaken claims. The EITC could have fewer, more transparent rules for how parents, and especially separated parents, can claim the EITC. For instance, eligibility rules could be changed so that filers living with a qualifying child but who do not claim the child for the EITC could claim the childless EITC.[23] In addition to the benefit of making the EITC more understandable to workers, simplifying reforms would also likely reduce the error rate, as fewer people would make mistakes when claiming the credit. With a lower error rate, more of the EITC’s value would reach its target.

Another option for reform is to eliminate the marriage penalty, so that marriage would not reduce the value of the credit. Ending the marriage penalty—effectively shifting out the solid lines in Figure 1—would end the EITC’s unfair disincentive to marry for low-income workers.

A third option is to expand the EITC for childless workers, reducing the disparity between workers with and without children. By reducing the gap in the EITC’s value between the two groups, this reform would move the EITC closer to its goals of workforce participation and poverty reduction and would lessen any effects the EITC may have on workers’ decision to have children.

Eliminating the marriage penalty and expanding the EITC for childless workers would increase the cost of the EITC, as that would increase the credit’s value for some workers without reducing it for others. For example, one recent study proposing to double the phase-in and phaseout rates of the EITC for childless workers, among other changes, estimated that it would reduce federal revenue by $95.3 billion from FY 2018 to FY 2027.[24] Policymakers assessing these options should therefore consider whether the benefits of these reforms outweigh the costs.

Conclusion

The EITC is an important, but imperfect, policy. On the one hand, the credit is well targeted towards low-income workers, helps to counter instances of regressivity in the tax code, and has encouraged workforce participation among certain groups. On the other hand, it has complicated eligibility rules, has a consistently high error rate, can create negative economic incentives for workers, penalizes workers for marrying, and creates disparity between workers with and without children. As with any policy, the EITC comes with trade-offs, which lawmakers must keep in mind when evaluating proposed expansions and reforms.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Office of Senator Sherrod Brown, “Brown, Khanna, Watson Coleman Propose ‘Cost-Of-Living Refund’ To Help Lift Millions of Americans into Middle Class,” Feb. 13, 2019, https://www.brown.senate.gov/newsroom/press/release/brown-khanna-watson-coleman-propose-cost-of-living-refund_to-help-lift-millions-of-americans-into-middle-class; Office of Senator Kamala D. Harris, “Harris Proposes Bold Relief for Families Amid Rising Costs of Living,” Oct. 18, 2018, https://www.harris.senate.gov/news/press-releases/harris-proposes-bold-relief-for-families-amid-rising-costs-of-living. See also Kyle Pomerleau and Huaqun Li, “Analysis of the Cost-of-Living Refund Act of 2019,” Tax Foundation, March 6, 2019, https://taxfoundation.org/cost-of-living-refund-act-2019-analysis/; and Kyle Pomerleau, “Analysis of Sen. Kamala Harris’s ‘LIFT the Middle-Class Act,’” Tax Foundation, Oct. 24, 2018, https://taxfoundation.org/kamala-harris-tax-plan/.

[2] Technically, someone could modify her tax withholding to limit the EITC being paid in a lump sum, but this is less common.

[3] Internal Revenue Service, Statistics of Income, “Table 3.3 All Returns: Tax Liability, Tax Credits, and Tax Payments,” https://www.irs.gov/statistics/soi-tax-stats-individual-income-tax-returns-publication-1304-complete-report. Recipients previously had the option to receive the EITC in monthly installments, but because few took advantage of it, the option was ended in 2010. See Oren Cass, “The Wage Subsidy: A Better Way to Help the Poor,” Manhattan Institute for Policy Research, August 2015, 6, https://media4.manhattan-institute.org/pdf/ib_37.pdf.

[4] Hilary W. Hoynes and Ankur J. Patel, “Effective Policy for Reducing Inequality? The Earned Income Tax Credit and the Distribution of Income,” NBER Working Paper no. 21340, July 2015, https://www.nber.org/papers/w21340.

[5] Internal Revenue Service, “Statistics of Income Tax Stats – County Data – 2016 (all States, does not include AGI),” https://www.irs.gov/statistics/soi-tax-stats-county-data-2016.

[6] Center on Budget and Policy Priorities, “Policy Basics: The Earned Income Tax Credit,” April 19, 2018, https://www.cbpp.org/research/federal-tax/policy-basics-the-earned-income-tax-credit; The Council of Economic Advisers, “The War on Poverty 50 Years Later: A Progress Report,” January 2014, 27, https://obamawhitehouse.archives.gov/sites/default/files/docs/50th_anniversary_cea_report_-_final_post_embargo.pdf.

[7] Gene Falk and Margot L. Crandall-Hollick, “The Earned Income Tax Credit (EITC): An Overview,” Congressional Research Service, April 18, 2018, 17, https://fas.org/sgp/crs/misc/R43805.pdf.

[8] Katherine Loughead, “Sales Taxes on Soda, Candy, and Other Groceries, 2018,” Tax Foundation, July 11, 2018, https://taxfoundation.org/sales-taxes-on-soda-candy-and-other-groceries-2018/.

[9] Robert Bellafiore, “New Report Shows the Burdens of Payroll and Income Taxes,” Tax Foundation, March 26, 2019, https://taxfoundation.org/payroll-income-tax-burden/.

[10] Robert Bellafiore and Madison Mauro, “A Growing Percentage of Americans Have Zero Income Tax Liability,” Tax Foundation, March 14, 2019, https://taxfoundation.org/growing-percentage-americans-zero-income-tax-liability/.

[11] Nada Eissa and Jeffrey B. Liebman, “Labor Supply Response to the Earned Income Tax Credit,” NBER Working Paper no. 5158, June 1995, https://www.nber.org/papers/w5158.

[12] Austin Nichols and Jesse Rothstein, “The Earned Income Tax Credit (EITC),” NBER Working Paper no. 21211, May 2015, 41, https://www.nber.org/papers/w21211; Jeffrey Grogger, “The Effects of Time Limits and Other Policy Changes on Welfare Use, Work, and Income Among Female-Headed Families,” NBER Working Paper no. 8153,

March 2001, 30, https://www.nber.org/papers/w8153.

[13] Nada Eissa and Hilary Hoynes, “Behavioral Responses to Taxes: Lessons from the EITC and Labor Supply,” NBER Working Paper no. 11729, November 2005, 11 , https://www.nber.org/papers/w11729.

[14] Austin Nichols and Jesse Rothstein, “The Earned Income Tax Credit (EITC),” 5.

[15] Gene Falk and Margot L. Crandall-Hollick, “The Earned Income Tax Credit (EITC): An Overview.”

[16] Department of the Treasury, “Agency Financial Report: Fiscal Year 2018,” Nov. 15, 2018, 43, https://home.treasury.gov/system/files/236/AFR_Full%20111518_clean_508.pdf.

[17] Internal Revenue Service, “Compliance estimates for the Earned Income Tax Credit Claimed on 2006-2008 Returns,” August 2014, https://www.irs.gov/pub/irs-soi/EITCComplianceStudyTY2006-2008.pdf, 27.

[18]Department of the Treasury, “Agency Financial Report: Fiscal Year 2018,” 200.

[19] For example, Representative Kenny Marchant (R-TX) has said of the EITC, “The biggest problem is that there’s a 25 percent fraud rate, meaning the people that are supposed to get it aren’t getting it.” See Gabe Rubin, “Ways and Means Republicans Willing to Play Ball on EITC,” Morning Consult, Jan. 13, 2016, https://morningconsult.com/2016/01/13/earned-income-tax-credit-expansion-possible/.

[20] Treasury Inspector General for Tax Administration, “The Internal Revenue Service Fiscal Year 2013 Improper Payment Reporting Continues to Not Comply With the Improper Payments Elimination and Recovery Act,” March 31, 2014, 1, https://www.treasury.gov/tigta/auditreports/2014reports/201440027fr.pdf.

[21] Internal Revenue Service, “EITC Fast Facts,” https://www.eitc.irs.gov/partner-toolkit/basic-marketing-communication-materials/eitc-fast-facts/eitc-fast-facts.

[22] Nada Eissa and Hilary Hoynes, “Behavioral Responses to Taxes: Lessons from the EITC and Labor Supply,” 7.

[23] See Robert Greenstein, John Wancheck, and Chuck Marr, “Reducing Overpayments in the Earned Income Tax Credit,” Center on Budget and Policy Priorities, Jan. 31, 2019, https://www.cbpp.org/research/federal-tax/reducing-overpayments-in-the-earned-income-tax-credit.

[24] Elaine Maag, “Who Benefits from Expanding the EITC or CTC? Understanding the Intersection of the EITC and CTC at the Household Level,” Urban Institute, July 30, 2018, https://www.urban.org/sites/default/files/publication/98829/who-benefits-from-expanding-the-eitc-or-ctc_understanding-the-intersection-of-the-eitc_0.pdf.

Share this article