Table of Contents

- Key Findings

- Introduction

- Review of State and Local Car Rental Excise Taxes

- — How Rental Car Taxes and Fees Work

- — How Rental Car Excise Tax Revenue Is Used

- Economic and Tax Policy Consequences of Rental Car Excise Taxes

- — Economic Incidence of Car Rental Excise Taxes

- — Tax Exporting

- — Car Rental Excise Taxes and Tax Policy

- Rental Car Taxes and Peer-to-Peer Car Sharing

- — Developments in the State Taxation of Peer-to-Peer Car Sharing

- — Sales Taxes and Peer-to-Peer Car Sharing

- Conclusion

- Appendix: State Rental Car Excise Taxes

Key Findings

- As the travel and hospitality industries recover from the coronavirus pandemic, policymakers have an opportunity to reevaluate and repeal discriminatory excise taxes imposed on rental car transactions.

- Unlike other excise taxes, rental car excise taxes are not imposed to reduce a harm or ensure drivers are paying for infrastructure. Rather, the revenue is used for unrelated purposes and the taxes create a byzantine structure of taxes and fees that dissuade travelers from using rental cars. States relying on these taxes experience lower economic growth when travelers adjust their behavior to avoid the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. .

- Efforts to impose rental car excise taxes onto peer-to-peer car sharing arrangements increases the harm of these taxes and will make it harder for the travel industry to recover from the pandemic.

- Rather than extending rental car excise taxes, policymakers should ensure rental car and peer-to-peer car sharing services are within the state and local sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. base and refine ways to reimburse sales tax paid on a vehicle purchased for personal use but also used for business purposes, such as car sharing or ridesharing.

Introduction

The coronavirus pandemic and related economic downturn impacted the travel, tourism, and hospitality industries hard in 2020. As demand fell for in-person services and government restrictions reduced the feasibility of travel, the need for transportation using rental cars or peer-to-peer car sharing services fell sharply last spring.[1]

As the economy rebounds this year and the public health situation improves, recreational travel, tourism, and business trips will return and with it, an improvement to the fortunes of both rental car firms and app-based methods of transportation like ridesharing and peer-to-peer car sharing.

At the same time, states may be more open to new and alternative sources of revenue after the pandemic abates. For instance, many are looking at ways to apply and reform excise taxes on items like sports betting, tobacco, and sugar, but it is key that these taxes are imposed in a principled manner.[2] Similarly, excise taxes on rental cars and the taxation of app-based industries in the transportation sector such as peer-to-peer car sharing are ripe for reform, which would ensure that the travel, tourism, and hospitality industries can experience a robust recovery post-pandemic.

This paper reviews the policy case against rental car excise taxes and their negative impact on state economies. It also explores key developments in attempts to extend rental car excise taxes to app-based alternatives like peer-to-peer car sharing and the challenges associated with incorporating these new economy transportation options into state sales tax systems. Finally, this paper will argue that excise taxes on car rentals should be repealed and the broader tax regime reformed to conform to the principles of sound tax policy to ensure a strong recovery for the travel sector post-pandemic.

Review of State and Local Car Rental Excise Taxes

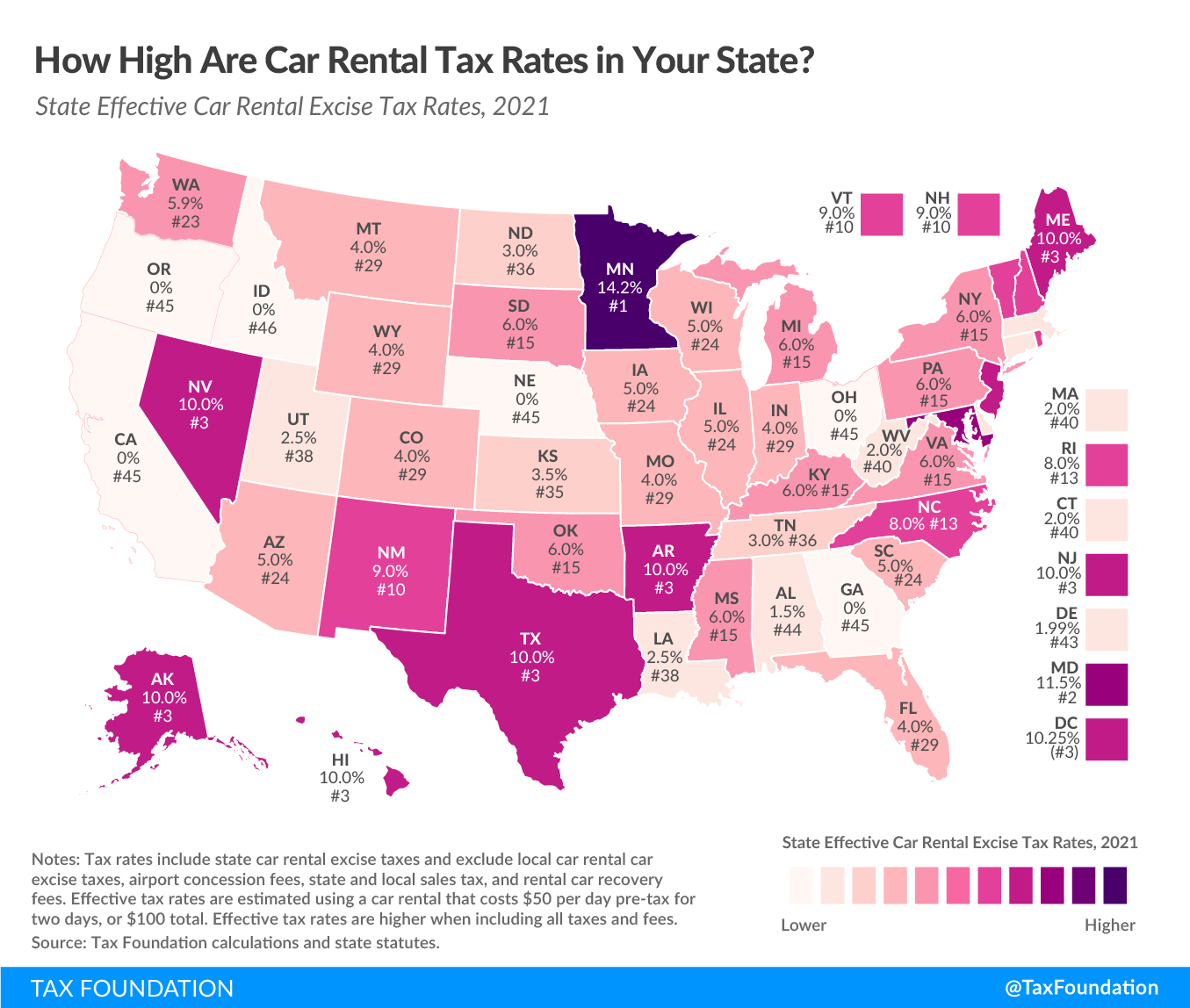

Excise taxes on rental cars are a common source of revenue for states and localities seeking revenue that disproportionately comes from nonresidents. Excise taxes on rental cars are levied at the state-level in 44 states. Local governments at the county and municipal levels also levy separate excise taxes on rental cars (see Figure 1 and Appendix Table 1).

Over the past three years, rental car excise taxes have remained stable across the U.S., including unsuccessful challenges to local rental car taxes. For example, local rental car excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. imposed in Maricopa County, Arizona was challenged before the Arizona Supreme Court in 2019 but was held as constitutional by the court.[3]

How Rental Car Taxes and Fees Work

As one can see in any rental car contract, car rentals are subject to several layers of taxes and fees that make up a large portion of the total bill. These fees may be levied directly by rental car firms to recoup certain costs or imposed by governments. Many rental car excise taxes are imposed on the gross receipts earned by rental car companies and are passed along to consumers.

Consumers often pick up rental cars at airports. Local airports may be miles from a traveler’s destination, and in the absence of quality public transit, car rentals are one of the only options available to travelers looking for reliable transportation. Car rentals also afford travelers flexibility that public transit or taxicabs may not provide.

To accommodate consumer demand, airports across the country have built infrastructure for car rental firms, including dedicated facilities, airport transit, and parking areas. In return, airports impose several fees on car rental companies doing business at airports. The revenue from these fees may also be shared by municipal and county governments, though this varies by jurisdiction.

The most common types of fees are customer facility charges and airport concession fees, which help fund the direct expenses associated with rental car infrastructure at airports and indirect funding needs for the airport. Rental car companies frequently pass these fees along to the consumer, and they are often known as “recovery fees.” Rental car companies are regulated by state governments, which often charge these firms higher fees to register and title their vehicles as a method of funding motor vehicle departments. The companies will in turn also pass along these costs to the consumer in the form of license and registration recovery fees.

In addition to airport-related charges and recovery fees, state and local governments levy excise taxes on car rentals. Often, there are multiple excise taxes on car rentals by state, county, and city governments (see Table 1). In Chicago, for example, car rental customers pay a 5 percent Illinois state car rental tax, a 6 percent excise tax levied by the city’s Metropolitan Pier and Exposition Authority (MPEA), and another 9 percent personal property lease transaction tax levied by the city of Chicago.[4]

State car rental excise taxes are applied either on an ad valorem basis, where the tax applies to a percentage of the sale price, or as a flat dollar amount. Thirty-five states and the District of Columbia use ad valorem taxes; only seven states assess a flat surcharge; and two states levy both an ad valorem tax and a flat-dollar surcharge.

States using a flat-dollar surcharge may levy a one-time surcharge, such as in Massachusetts, or may charge a flat amount per-day, as Hawaii, New Jersey, and West Virginia do. Flat-dollar rates can create higher effective tax rates on less expensive rentals and lower tax rates on more expensive rentals.

| State | Locality | Car Rental Excise Tax | Funding Purpose |

|---|---|---|---|

| Alaska | Anchorage | 8% | City general fund |

| Arizona | Maricopa County (Phoenix) | The greater of 3.25% or $2.50 per rental | Glendale Stadium; youth & amateur sports |

| Arizona | Pima County (Tucson) | $3.50 | Kino Sports Complex |

| Colorado | Denver | 7.25% | Colorado Convention Center |

| Georgia | Atlanta | 10% | State Farm Arena |

| Illinois | Chicago | 6% and 9% transaction tax (a) | City general fund |

| Indiana | Marion County (Indianapolis) | 6% | County general fund |

| Massachusetts | Boston | $10 fee | Convention centers |

| Michigan | Detroit | 2% | Comerica Park |

| Missouri | Kansas City | $4 per day | Sprint Center |

| Nevada | Clark and Washoe Counties (Las Vegas and Reno) | 2% | General fund |

| New Jersey | Newark | 5% | Redevelopment Projects |

| New York | New York City | 5% | City general fund |

| North Dakota | Grand Forks, Bismarck, Minot | 1% at airports | City general fund |

| Oregon | Multnomah County (Portland) | 17% | County general fund |

| Pennsylvania | Philadelphia | 2% | Transportation funding |

| Pennsylvania | Allegheny County (Pittsburgh) | $2 per day | Transportation funding |

| Tennessee | Shelby County (Memphis) | 2% | County general fund |

| Texas | Amarillo, Austin, Euless, El Paso, and Harris County (South Houston) | 5% | Sun Bowl game (El Paso); venues (stadiums, arenas, convention centers); tourist development |

| Utah | Salt Lake County | 7% tourism tax | Tourism, recreation; cultural & convention fund |

| Washington | Pierce (Tacoma), King (Seattle), and Spokane Counties | 1% plus 0.8% transit authority tax | Regional transit (0.8%); sports stadiums or amateur sports activities (1%) |

|

Note: (a) Chicago’s Metropolitan Pier and Exposition Authority (MPEA) levies a 6 percent rental car tax and the city of Chicago levies a 9 percent personal property lease transaction tax. Sources: State departments of revenue, state budget offices, and county tax departments. |

|||

States often treat car rentals differently depending on the length of the rental agreement; they may specify that long-term lease arrangements are exempt from car rental excise taxes or they may levy a different rate. For example, Alaska’s 10 percent vehicle rental tax applies to passenger vehicle rentals of 90 consecutive days or less in duration. Leases lasting longer than 90 days are exempt from the tax.[5]

Most states also incorporate car rental transactions into their sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . This is the correct policy, as this moves the tax base toward taxing all final consumption, raising revenue collection and permitting policymakers to lower sales tax rates on items included in the tax base.[6]

Seven states exclude car rentals from state sales tax—Illinois, Kentucky, Maine, Maryland, Texas, Vermont, and Virginia. Other states offer a state sales tax rate below the general rate. For example, in Mississippi, car rental transactions face a 5 percent state sales tax, not the 7 percent general state sales tax rate.

The large number of taxes and fees can make it difficult for consumers to determine what taxes they are paying and how tax revenue will be used. For example, consider a traveler who flies to Salt Lake International Airport in Salt Lake City, Utah. The traveler books an economy rental car, paying $144 before taxes and fees. After taxes and fees, the traveler pays a total of $70.27, an effective tax rate of 40.5 percent (see Table 2).

| Rental, Taxes, and Fees | Amount |

|---|---|

| Economy Rental Car (1 Day) | $50.00 |

| Concession Recovery Fee (11.11%) | $5.59 |

| Customer Facility Charge ($5.00/day) | $5.00 |

| License Cost Recovery Fee ($1.05/day) | $1.05 |

| State Rental Car Tax (2.5%) | $1.25 |

| City Tourism Tax (7%) | $3.50 |

| State and Local Sales Tax (7.75%) | $3.88 |

| Total | $70.27 |

|

Sources: Tax Foundation calculations and two online rental car company sample bookings. |

|

Each fee or tax may be remitted to a different tax authority for a variety of uses. For example, the concession recovery fee and customer facility charge are remitted to the airport for the rental car company’s use of the premises and airport infrastructure to facilitate the transaction.

Governments often levy license fees on the gross receipts earned by rental car firms, who then pass these fees along to consumers. These are often called “license recovery fees.” Added on top of that are state and local rental car excise taxes, which are used in Utah to support tourism, recreation, and a cultural & convention fund. Finally, state and local sales taxes are levied over and above the excise taxes and other fees.

How Rental Car Excise Tax Revenue Is Used

Some states, like North Carolina and Montana, contribute the revenue into the general fund. Others, like New York and Washington, use the revenue to fund transportation projects.[7] Montana raised its rental car tax in 2017 to offset a structural budget deficit.[8] Some state and most local excise taxes on car rentals are used to finance local projects, including stadiums and sports arenas. Over 35 sports stadiums have been funded in part from car rental excise tax revenue.[9]

In addition to stadiums, states and municipalities use the revenue to support tourism-related events. For example, Atlanta appropriated $350,000 from its 10 percent car rental tax to support the 2019 Atlanta Jazz Festival.[10] Texas has developed a framework determining how localities can use their rental car excise tax revenue, allocating it to building civic venues, including arenas, stadiums, convention centers, and watershed protection.[11] Localities are permitted to levy a rental car tax on top of Texas’ 10 percent state car rental tax.

Relying on revenue from rental car taxes is not without issues though, as these taxes can be a volatile source of revenue if travel and tourism are reduced during economic downturns. For example, the credit rating for some bonds issued by the city of Atlanta was threatened after rental car tax collections were anticipated to drop steeply in 2020 due to the pandemic.[12]

State and local revenue stabilized better than expected by early 2021,[13] but the pandemic’s impact on the rental car industry likely depressed revenue from rental car taxes over the medium term.

Economic and Tax Policy Consequences of Rental Car Excise Taxes

As car rental taxes and fees have become commonplace, less attention has been paid to the economic effects of these sources of revenue. Unlike other excise taxes, rental car excise taxes are not levied to reduce the use of rental cars or eliminate a negative externalityAn externality, in economics terms, is a side effect or consequence of an activity that is not reflected in the cost of that activity, and not primarily borne by those directly involved in said activity. Externalities can be caused by either production or consumption of a good or service and can be positive or negative. . While passenger vehicles may create a negative externality in the form of carbon emissions, this is not a special feature of car rentals and is not the justification for the additional tax. Instead, rental car excise taxes are used to export a portion of the tax base onto nonresidents.

Economic Incidence of Car Rental Excise Taxes

Firms offering cars for rent are legally required to collect and remit car rental excise taxes as part of their business obligations. As the example of the visitor at Salt Lake City International shows, however, the economic incidence of the tax is realized by consumers in the form of higher prices.

Economic theory suggests that the burden of a tax is borne on those who make few adjustments to their behavior in response to the tax. The demand for car rentals is relatively inelastic. This means that consumers will be less sensitive to the change in price introduced by the tax, as they may have few options other than renting a car to get to their destination. The availability of substitutes is one factor that determines a good or service’s elasticity; with car rentals, they are often one of the only options for transport in rural or suburban areas in the United States.

Though consumers of car rentals may be less sensitive to car rental taxes than those choosing among transit options in their hometowns, this does not mean that car rental taxes have no economic impact. These taxes distort the decision-making of consumers and the economies of the taxing jurisdictions.

For example, tax scholars William Gale and Kim Rueben found that a $4 per day rental car levy in Kansas City, Missouri—an effective tax rate of about 13 percent on an economy vehicle—reduced the number of customers at affected branches by 9 percent relative to branches that were unaffected.[14] While consumers had less than a proportionate response to the tax, they altered their behavior by using other transportation options.[15]

Tax Exporting

Car rental excise taxes are a great example of tax exporting, which occurs when state and local governments create tax burdens for nonresidents. Excise taxes on car rentals can be grouped with hotel occupancy taxes, meal taxes, commuter taxes, and tourism taxes as examples of states and localities exporting their tax burden to nonresidents. In 2019, about 21 percent of taxes collected from states and localities were from nonresidents.[16]

Tourists paying gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. , out-of-state corporations paying corporate income taxes, and visitors paying state sales taxes are other examples of tax exporting. Policymakers have an incentive to export tax burdens, as it reduces the political pressure involved when levying new taxes on constituents.

Nonresident travelers and tourists make up a large segment of those using car rental services, though residents also rent cars for their own travel needs. Travelers and tourists bear most of the tax burden, as car rental firms pass on most of the tax burden to consumers. This form of tax exporting is indirect, as it would be a violation of the U.S. Constitution’s Commerce Clause to directly impose a tax burden on nonresidents that is not imposed on residents.[17]

Some jurisdictions have tried to go further by enacting car rental taxes that only affect nonresidents, though this tactic was struck down in 2017 when Chicago tried to do so.[18] Hawaii previously assessed a $3 per day fee for those with a Hawaii driver’s license, but a $5 per day fee for those without one. As of July 1, 2019, Hawaii imposed a $5 per day fee for all rental car services, as the previous arrangement effectively levied a higher tax for nonresidents of Hawaii renting cars.[19] This posed a legal risk because of the discriminatory treatment based on one’s place of residence.

While tax exporting may succeed in disproportionately burdening nonresidents with a rental car tax, the taxes have negative economic effects for the taxing jurisdiction. In addition to lowering the quantity of car rental services demanded, there is evidence that consumers will travel to lower tax jurisdictions nearby, as was the case when Kansas City, Missouri levied a $4 per day rental car tax. Residents and nonresidents alike traveled across the state line to nearby Kansas City, Kansas, which offered a lower effective tax rate, to avoid the tax in Missouri.[20] This harmed Kansas City, Missouri’s economy, resulting in missed tax revenue, lower output, and potentially lost jobs in the rental car industry.

Rental car excise taxes, while having a disproportionate effect on nonresidents, also affect residents. Residents may rent cars to avoid adding mileage to their own vehicles during long-haul travel, or may rent a vehicle in lieu of owning one for occasional travel needs. In this case, the tax burden is directly felt by residents, who may adjust their behavior and use second-best travel options. This may increase their commuting time, lowering economic growth.

Car Rental Excise Taxes and Tax Policy

In addition to being economically damaging, car rental excise taxes are an example of bad tax policy for multiple reasons: they violate the tax principle of neutrality, are not connected to taxpayer use of government services, and pose high administrative costs.

Ideally, car rental services would be subject to the same sales and use tax that other goods and services are subject to in a state or locality. Most states have done so, avoiding the broad exemptions that typically apply to other services. By levying additional excise taxes, however, policymakers are narrowly targeting one industry, distorting consumer decision-making, and affecting one mode of transportation more heavily than others.

Car rental excise taxes are also disconnected from the benefits the taxpayers receive. As Table 1 shows, counties and cities allocate revenue from rental car taxes to unrelated projects, including sports stadiums, amateur sports initiatives, and cultural events. While some of these projects may benefit nonresidents, residents receive most of the benefits given their long-term proximity to the taxing jurisdiction.

Contrast the use of rental car tax revenue with airport concession fees, which are directly tied to a visitor’s use of the airport facilities. Car rental tax revenue that is used for transportation projects has a closer connection with the benefits visitors receive. Visitors also pay gas taxes and tolls, which also fund infrastructure they use while traveling, just like residents. There is no tax policy rationale for why nonresidents should bear a greater cost of infrastructure than residents.

Car rental excise taxes and related fees also pose high administrative costs for localities, firms, and consumers. For example, airport concession fees are used to support airport operations, but occasionally customers are charged these fees even when they book a rental car in a non-airport location.[21] Determining one’s potential tax liability before a trip and weighing different options presents a challenge for consumers, as is the administrative complexity introduced to rental car firms which operate in overlapping tax jurisdictions.

It is appropriate for policymakers to ensure that nonresidents are supporting the government services they benefit from while visiting their city or state. Nonresidents often pay gas taxes and sales taxes while traveling and provide economic benefits in the form of new jobs, businesses, and economic development. These are the same taxes residents pay when using public infrastructure or purchasing goods and services.

Rental car taxes are often dedicated to certain causes that overlap with tourism, such as sports stadiums or festivals. While these activities can have a connection to the rental car tax paid in some situations, this is often not the case for many visitors. It would be better for tax revenue collected from nonresidents to have a clear connection to the activities they engage in, such as sales taxes collected from attending events while visiting a locality.

Rental Car Taxes and Peer-to-Peer Car Sharing

Over the past few years, there has been an ongoing debate about whether rental car excise taxes should apply to peer-to-peer car sharing services. Peer-to-peer car sharing services arose as part of the broader sharing economy but have several unique features that make them different from rental car firms.

Peer-to-peer car sharing firms create a marketplace for vehicle owners to contract with those seeking temporary transportation options. Rather than owning vehicles directly, the primary service of peer-to-peer car sharing firms is to provide a digital platform for those contracts.

Peer-to-per car sharing can be compared to ridesharing and short-term rental platforms, which also connect users together. The car-sharing platform charges a fee to users for using it, but otherwise remits income earned to individuals sharing their vehicles with others. Other forms of car sharing also exist, including roundtrip car sharing services that provide hourly access to shared vehicles.[22]

While car sharing arrangements are only one of many options for transportation, about 11 percent of consumers expect to use them for commuting over the next five to 10 years, suggesting continued growth for these services.[23] This makes it important to get the tax treatment of these services right for their continued growth.

Developments in the State Taxation of Peer-to-Peer Car Sharing

As peer-to-peer car sharing has gained popularity, there have been ongoing debates in over 30 states about whether and how to treat peer-to-peer car sharing within rental car excise tax regimes.

One trend in proposals to tax peer-to-peer car sharing is to incorporate the platforms under marketplace facilitator laws that were established after the Wayfair decision made it easier for states to tax remote sales.[24] The decision by the U.S. Supreme Court in South Dakota v. Wayfair, Inc. in June 2018 permitted states to levy sales tax on out-of-state purchases, even if a seller has no physical presence in a state. This makes it easier for states to make peer-to-peer car sharing platforms responsible for both rental car excise tax and sales tax collections, even if the tax is technically a liability of vehicle owners and the platform does not have a physical presence in the state or locality.

Many of the proposals to tax peer-to-peer car sharing apply the car rental excise tax rate in full. However, some states have opted to tax peer-to-peer car sharing at a reduced excise tax rate. For example, beginning in 2020 Indiana taxed vehicle sharing through a marketplace facilitator at 2 percent, rather than at the state’s general rental car excise tax rate of 4 percent.[25]

Maryland imposed 8 percent state sales and use tax on peer-to-per car sharing through fiscal year 2021, which is above the state’s 6 percent sales tax levied on other goods and services. Maryland recently passed House Bill 1209, which will extend the 8 percent tax beyond fiscal year 2021 but would also impose the 11.5 percent rental car tax rate for individuals with a fleet of 10 or more vehicles in lieu of the 8 percent rate.[26] This is meant to provide an 8 percent rate for peer-to-peer car sharing while applying the full rental car excise tax rate of 11.5 percent for larger enterprises participating in that market.

Virginia taxes peer-to-peer car sharing services at 6.5 percent, but this will rise to 7 percent beginning on July 1, 2021.[27] This rate is also below the combined state tax rate on rental cars, which stands at 10 percent.

Some states have explicitly stated that rental car excise taxes are inapplicable to the peer-to-peer car sharing industry. For example, Georgia, Iowa, Louisiana, Tennessee, and West Virginia have passed bills that differentiate peer-to-peer car sharing from rental car excise tax regimes, though they often also include rules related to items like insurance requirements.[28]

Likewise, Arizona and Kansas recently passed legislation establishing peer-to-peer car sharing rules related to insurance and recordkeeping without imposing rental car excise taxes onto them.[29] This is a more constructive alternative to imposing the rental car tax onto peer-to-peer car sharing.

Other states are moving more aggressively to tax peer-to-peer car sharing for the entire rental car excise tax. Bills are currently being considered in six states that would impose the excise tax in full (see Table 3). These bills also have implications for local rental car excise taxes, which are added on top of the state rates. For example, certain cities in Texas impose local rental car taxes of 5 percent, and this could apply to peer-to-peer car sharing if the state rental car excise tax is applied.

| State | Proposal | Status |

|---|---|---|

| Alaska | House Bill 90 | Applies the 10 percent state rental car tax |

| Arkansas | House Bill 1904 and Senate Bill 351 | Both bills apply the 10 percent state rental car tax |

| Florida | House Bill 365 and Senate Bill 566 | Applies $1/day tax onto peer-to-peer car sharing, half the rate for rental cars ($2/day) |

| Hawaii | House Bill 333 | Applies the $5/day rental tax |

| New Hampshire | House Bill 15 | Imposes the 9 percent state rooms and meals tax |

| Texas | House Bill 2415 | Imposes the state 10 percent rental car tax; provides a credit for sales tax paid for purchasing a vehicle on excise tax paid |

|

Sources: State legislatures and Tax Foundation research. |

||

States have also attempted to include peer-to-peer car sharing services within existing statutes. For example, Hawaii’s Department of Taxation adopted rules in February 2021 to levy the state’s rental car tax onto peer-to-peer car sharing by interpreting car sharing platforms as being the lessor of the vehicles on the marketplace.[30] It would be preferable for state legislatures to clarify the legal status of peer-to-peer car sharing, as regulatory guidance and temporary rules lack stability and may be challenged in court, creating uncertainty in the market.

Attempts to impose the rental car excise tax on to peer-to-peer car sharing often neglect the differences between rental car firms and peer-to-peer car-sharing arrangements. Peer-to-peer car sharing firms do not rent vehicles to consumers but instead provide a platform for consumers to connect with one another over vehicle rentals. Individual owners are responsible for the maintenance, upkeep, and expenses associated with their vehicles, including the legal responsibility to withhold and file income taxes.

Advocates of applying rental car taxes to peer-to-peer car sharing services argue that there is little difference between car rental firms and sharing services, and applying the tax ensures equal treatment between the industries. Policymakers should be mindful of the important differences, however, and consider ways to phase out rental car taxes altogether. That would be the more appropriate way to ensure a level playing field between the two industries.

In addition to facing state and local-level rental car taxes, peer-to-peer car sharing platforms and customers are also dealing with fees related to transactions at airports. Owners may park their cars in airport garages for pickup or meet at an airport curbside for a vehicle. There is a case for these owners to pay a fee to use airport infrastructure, though this may not look the same as rental car firms as they make greater use of dedicated spaces to maintain customer service and a fleet.

Policymakers and airport authorities could use the example set by working with ridesharing firms at airports to determine a fee structure that makes sense for this type of arrangement.[31] Travelers can use digital apps to be driven to their final destinations using ridesharing from many airports, and it would make sense for peer-to-peer car sharing to become another common option. It is important for effective collaboration between peer-to-peer car sharing platforms and airports, as individuals participating on the platforms may not know if they are permitted to use airport premises and what the associated fees may be.

Sales Taxes and Peer-to-Peer Car Sharing

Like other forms of consumption, peer-to-peer car sharing services should be subject to the state and local sales tax. While many states and localities have incorporated these services into sales tax bases through marketplace facilitator laws, jurisdictions remain where this is not the case. For example, Florida is considering levying the 6 percent state sales tax onto peer-to-peer car sharing transactions in addition to imposing a $1 per day excise tax.[32]

A related policy challenge surrounds the sales tax treatment of vehicles used for mixed-use purposes like peer-to-peer car sharing. Rental car firms are usually exempt from paying sales tax when they purchase new rental vehicles. This is the proper tax treatment, as rental vehicles are business inputs. If rental car companies paid sales tax on rental cars, the tax may be passed forward to consumers and generate many of the problems associated with tax pyramidingTax pyramiding occurs when the same final good or service is taxed multiple times along the production process. This yields vastly different effective tax rates depending on the length of the supply chain and disproportionately harms low-margin firms. Gross receipts taxes are a prime example of tax pyramiding in action. .[33]

However, individuals who rent their cars on peer-to-peer car-sharing apps may not receive the same exemption, despite also using a vehicle for business purposes. The problem is that sales tax provisions are not designed to apply to assets with a mix of business and personal use: either one is an exempt business or a consumer who pays the sales tax.[34]

There are several options to reform the sales tax treatment of vehicles used partly for business purposes, but each has trade-offs and imperfections. For example, sales tax could be pro-rated and refunded based on how the asset is used, potentially through existing provisions to apportion vehicle expenses based on business use for income tax purposes. However, that is complicated to administer and track.

Alternatively, proposals in some states, like Texas, would provide a tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. for sales taxes paid on a vehicle purchase that would reduce taxes imposed through the state rental car excise tax.[35] The problem with this approach is it still may require an owner to retain paperwork related to sales taxes paid, and replaces the problem of sales taxes with a new ongoing tax that continues well after the sales taxes have been completely offset. This is unlikely to be a positive trade for peer-to-peer car sharing users.

Until a solution is found, peer-to-peer car sharing arrangements remain at a relative disadvantage compared to rental car firms as their owners are paying sales tax on assets used for business use.

Conclusion

While some policymakers may view car rental excise taxes as a viable revenue source by shifting the tax burden onto nonresidents, these taxes harm residents by driving up the price of local rental cars and curtailing economic growth. The economic evidence shows that travelers and tourists are sensitive to price changes for rental cars and adjust their behavior to avoid the tax, harming state economies and the travel sector right as the industry is trying to recover from the effects of the coronavirus pandemic.

The debate over whether rental car excise taxes should apply to peer-to-peer car sharing firms is unlikely to end soon, but there is a lesson to be learned from those fights. Discriminatory taxes that target specific firms and industries are bound to be challenged by specific constituencies which have a vested interest in the policy process. States with broad, equitable tax bases that apply to all actors are less likely to be affected by industry lobbying, have fewer economic distortions in their tax codes, and have lower administrative costs.

As state economies reopen and travelers consider options for their first travel experience since the pandemic started, states should ensure that their tax codes and revenue options do not stand in the way of a robust recovery. Instead of looking at how rental car excise taxes can be extended onto new business arrangements, states and localities should ensure that rental car and peer-to-peer car sharing transactions are incorporated into the sales tax base and repeal targeted excise taxes.

Appendix

| State | State Car Rental Excise Tax Rate | Within State Sales Tax Base? | State Sales Tax Rate | State Statute |

|---|---|---|---|---|

| Alabama | 1.50% | Yes | 4.0% | Ala. Code § 40-12-222 |

| Alaska | 10% | N/A | N/A (a) | Alaska Stat § 43.52.010. |

| Arizona | 5% | Yes | 5.6% | Ariz. Rev. Stat § 28–5810 |

| Arkansas | 10% | Yes | 6.5% | Ark. Code § 26-63-302 |

| California | None | Yes | 7.25% | N/A |

| Colorado | $2 fee/day | Yes | 2.9% | Colo. Rev. Stat. § 43-4-804(1)(b)(I)(A) |

| Connecticut | $1 tourism surcharge/day | Yes | 9.35 (b) | Conn. Gen. Stat. §12-692 |

| Delaware | 1.99% | N/A | N/A (a) | Del. Code Ann. tit. 30, §4302 |

| District of Columbia | 10.25% | Yes | 6.0% | D.C. Code § 47:20-22 |

| Florida | $2/day | Yes | 6.0% | Fla. Stat. §212.0606 |

| Georgia | None | Yes | 4.0% | N/A |

| Hawaii | $5/day | Yes | 4.0% (c) | Hawaii Rev. Stat. §18-251-2 |

| Idaho | None | Yes | 6.0% | N/A |

| Illinois | 5% | No | 6.25% | 35 ILCS 155 |

| Indiana | 4% | Yes | 7.0% | I.C. § 6-6-9 |

| Iowa | 5% | Yes | 6.0% | Iowa Code § 423.2 |

| Kansas | 3.50% | Yes | 6.5% | Kan. Stat. Ann. § 79-51-17 |

| Kentucky | 6% | No | 6.0% | Ky. Rev. Stat Section 138.460 |

| Louisiana | 2.50% | Yes | 4.45% | LSA-RS 47:551 |

| Maine | 10% | No | 5.50% | 36 M.R.S. §§ 1481-1491 |

| Maryland | 11.50% | No | 6.0% | Md. Code, Tax Law § 03.06.01 |

| Massachusetts | $2 surcharge | Yes | 6.25% | Mass. Gen. Laws ch. 10 §35 EEE |

| Michigan | 6% | Yes | 6.0% | MCL 205.94 |

| Minnesota | 9.2% + 5% fee | Yes | 6.88% | Minnesota Stat § 297A-64 |

| Mississippi | 6% | Yes | 5.0% (d) | Miss. Code Ann. §27-65-231 |

| Missouri | 4% | Yes | 4.23% | Mo. Rev. Stat. §144.020.1 |

| Montana | 4% | N/A | N/A (a) | Mont. Code Ann. §15-68-102 |

| Nebraska | None | Yes | 5.5% | N/A |

| Nevada | 10% | Yes | 6.85% | NRS 482.313 |

| New Hampshire | 9% | N/A | N/A (a) | RSA 78-A |

| New Jersey | $5 fee/day | Yes | 6.63% | N.J.S.A 18:40-1.1 e |

| New Mexico | 5% (“Leased”) + $2/day | Yes | 5.13% | N.M. Stat. Ann. §7-14A-3 |

| New York | 6% | Yes | 4.0% | N.Y. U.C.C. Law § 28-A |

| North Carolina | 8% | Yes | 4.75% | N.C. Gen. Stat § 105-187 |

| North Dakota | 3% | Yes | 5% | N.D. Cent. Code § 57-39.2-03.7. |

| Ohio | None | Yes | 5.75% | N/A |

| Oklahoma | 6% | Yes | 4.5% | Okla. Stat. Ann. tit. 68, § 2110(A) |

| Oregon | None | N/A | N/A (a) | N/A |

| Pennsylvania | 2% + $2 fee/day | Yes | 6.0% | 61 Pa. Cons. Stat. § 47.20 |

| Rhode Island | 8% | Yes | 7.0% | R.I. Gen. Laws § 31-34.1-2(a) |

| South Carolina | 5% | Yes | 6.0% | S.C. Code § 56-31-50 |

| South Dakota | 4.5% and a 1.5% tourism tax | Yes | 4.5% | S.D. Codified Laws §32-5B-20. |

| Tennessee | 3% | Yes | 7.0% | Tenn. Code Ann. § 67-6-102, 67-6- 202 |

| Texas | 10% | No | 6.25% | Tex. Admin. Code § 34 1-3.78 |

| Utah | 2.50% | Yes | 6.1% | Utah Code §59-12-1201 |

| Vermont | 9% | No | 6.0% | 32 V.S.A. § 8903 |

| Virginia | 10% (4% rental tax, 4% local tax, 2% rental fee) | No | 5.3% | V.A. Code Ann. § 58.1-1736 |

| Washington | 5.90% | Yes | 6.5% | RCW 82 14-049 |

| West Virginia | $1-$1.50/day | Yes | 6.0% | W. Va. Code §17A-3-4 |

| Wisconsin | 5% | Yes | 5.0% | Wis. Stat. § 77.995 |

| Wyoming | 4% | Yes | 4.0% | Wyo. Stat. § 31-19-105(a) |

|

Note: Excludes local rental car excise taxes and local sales taxes.

Sources: State statutes and state departments of revenue. |

||||

[1] Nora Naughton, “Covid-19 Slammed Rental-Car Firms, Then Business Turned Around,” The Wall Street Journal, Nov. 2, 2020, https://www.wsj.com/articles/with-more-americans-hitting-the-road-for-travel-rental-car-companies-revive-11604317493.

[2] See generally, Ulrik Boesen, “Excise Tax Application and Trends,” Tax Foundation, Mar. 16, 2021, https://www.taxfoundation.org/excise-taxes-excise-tax-trends/.

[3] Ryan Randazzo and Russ Wiles, “Rental-car tax that supports sports facilities is legal, Arizona Supreme Court says,” AZ Central, Feb. 25, 2019, https://www.azcentral.com/story/news/politics/arizona/2019/02/25/rental-car-tax-support-sports-facilities-legal-arizona-supreme-court-says/2980418002/.

[4] Brendan Bakala, “Planes, Trains, and Automobiles: Chicago’s High Travel Taxes,” Illinois Policy Institute, Dec. 20, 2017, https://www.illinoispolicy.org/planes-trains-and-automobiles-chicagos-high-travel-taxes/.

[5] Alaska Department of Revenue – Tax Division, “Vehicle Rental Tax Historical Overview,” http://www.tax.alaska.gov/programs/programs/reports/Historical.aspx?60255.

[6] Nicole Kaeding, “Sales Tax Base BroadeningBase broadening is the expansion of the amount of economic activity subject to tax, usually by eliminating exemptions, exclusions, deductions, credits, and other preferences. Narrow tax bases are non-neutral, favoring one product or industry over another, and can undermine revenue stability. : Right Sizing a State Sales Tax,” Tax Foundation, Oct. 24, 2017, https://taxfoundation.org/sales-tax-base-broadening/.

[7] Allison Hiltz and Luke Martel, “Rental Car Taxes,” National Conference of State Legislators, April 2015, http://www.ncsl.org/research/fiscal-policy/rental-car-taxes-lb.aspx.

[8] The Associated Press, “The Latest: Businesses Oppose Hotel, Rental Car Tax Increase,” in The Seattle Times, Nov. 13, 2017, https://www.seattletimes.com/nation-world/the-latest-committee-hears-little-opposition-to-budget-cuts/.

[9] William G. Gale and Kim Rueben, “Taken for a Ride: Economic Effects of Car Rental Excise Taxes,” Heartland Institute, July 17, 2006, https://www.heartland.org/publications-resources/publications/taken-for-a-ride-economic-effects-of-car-rental-taxes.

[10] David Pendered, “Atlanta Jazz Festival Funded, Again, with Proceeds of Car Rental Tax at Airport,” Saporta Report, Feb. 5, 2019, https://saportareport.com/atlanta-jazz-festival-funded-again-with-proceeds-of-car-rental-tax-at-airport/.

[11] City of Austin, “Legal Framework for Funding Venues Under the Texas Local Government Code Chapter 334,” http://www.austintexas.gov/edims/document.cfm?id=271689.

[12] Leon Stafford, “Moody’s may downgrade Atlanta bonds on weak car rental tax collections,” The Atlanta Journal-Constitution, Apr. 22, 2020, https://www.ajc.com/news/local/moody-may-downgrade-atlanta-bonds-weak-car-rental-tax-collections/FIMvdCNYGZzo6SyVCjDWzN/.

[13] Jared Walczak, “State Aid in American Rescue Plan Act Is 116 Times States’ Revenue Losses,” Tax Foundation, Mar. 3, 2021, https://www.taxfoundation.org/state-and-local-aid-american-rescue-plan/.

[14] Ibid, 5.

[15] If car rental services were elastic, a 13 percent increase in the effective tax rate of the rental car service would yield at least a 13 percent decrease in consumer demand.

[16] Erica York and Jared Walczak, “State and Local Tax Burdens, Calendar Year 2019,” Mar. 18, 2021, https://www.taxfoundation.org/state-tax-burden-2019/.

[17] William G. Gale and Kim Rueben, “Taken for a Ride: Economic Effects of Car Rental Excise Taxes,” 12.

[18] Jared Walczak, “Illinois Supreme Court Strikes Down Chicago Tax on Car Rentals Outside Chicago,” Tax Foundation, Jan. 23, 2017, https://www.taxfoundation.org/illinois-supreme-court-strikes-down-chicago-tax-car-rentals-outside-chicago/.

[19] Hawaii Department of Taxation, “Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax,” Jan 4, 2021, https://www.tax.hawaii.gov/forms/a1_b2_3rvst/.

[20] William G. Gale and Kim Rueben, “Taken for a Ride: Economic Effects of Car Rental Excise Taxes,” 19. Prospective rental car customers may choose to pay the car rental excise tax if the time or monetary cost associated with traveling to a lower-tax jurisdiction is greater than the benefit of avoiding the higher tax.

[21] Christopher Elliott, “Why this trick for saving money on a rental car may not work anymore,” The Washington Post, Aug. 29, 2019, https://www.washingtonpost.com/lifestyle/travel/why-this-trick-for-saving-money-on-a-rental-car-may-not-work-anymore/2019/08/29/23bec702-c814-11e9-be05-f76ac4ec618c_story.html.

[22] National Conference of State Legislatures, “Car Sharing,” Jan. 14, 2020, https://www.ncsl.org/research/transportation/car-sharing-state-laws-and-legislation.aspx.

[23] Ericsson Blog, Andres Laya and Neha Vyas, “Shared mobility: Why ‘they’ should all be sharing their cars,” Mar. 24, 2021, https://www.ericsson.com/en/blog/2021/3/shared-mobility-they-should-share-cars/

[24] Joseph Bishop-Henchman, Hannah Walker, and Denise Garbe, “Post-Wayfair Options for States,” Aug. 29, 2018, https://www.taxfoundation.org/post-wayfair-options-for-states/.

[25] Indiana Department of Revenue, “Information Bulletin #47: Sales Tax,” September 2020, https://www.in.gov/dor/files/reference/sib47.pdf.

[26] Maryland State Legislature, “House Bill 1209 – Sales and Use Tax – Peer to Peer Car Sharing – Alternations,” http://www.mgaleg.maryland.gov/mgawebsite/Legislation/Details/HB1209?ys=2021RS.

[27] Virginia Department of Taxation, “Peer-to-Peer Vehicle Sharing Tax,” https://www.tax.virginia.gov/peer-peer-vehicle-sharing-tax.

[28] For example, see Georgia General Assembly, House Bill 337, “Georgia Peer-to-Peer Car Sharing Program Act,” https://www.legis.ga.gov/legislation/55035.

[29] See, for example, Kansas State Legislature, House Bill 2379, “Enacting the peer-to-peer vehicle sharing act to provide insurance, liability, recordkeeping and consumer protection requirements for peer-to-peer vehicle sharing,” http://www.kslegislature.org/li/b2021_22/measures/hb2379/, and Arizona State Legislature, Senate Bill 1720, “Peer-to-peer car sharing,” https://www.legiscan.com/AZ/text/SB1720/id/2269130.

[30] Hawaii Department of Taxation, “Department of Taxation Announcement No. 2021-04,” Feb. 10, 2021, https://files.hawaii.gov/tax/news/announce/ann21-04.pdf.

[31] For an example, see Kelly Yamanouchi, “Uber X, Lyft Set for Legal Pickups at Atlanta Airport,” The Atlanta Journal-Constitution, Dec. 29, 2016, https://www.ajc.com/business/uber-lyft-set-for-legal-pickups-atlanta-airport/XRVgS1swlof0a1FVQ0bPOO/.

[32] Scott Powers, “Bill amended for car-sharing surcharges, minimum insurance,” Mar. 24, 2021, https://www.floridapolitics.com/archives/414446-bill-amended-for-car-sharing-surcharges-minimum-insurance/.

[33] Garrett Watson, “Resisting the Allure of Gross Receipts Taxes: An Assessment of Their Costs and Consequences,” Tax Foundation, Feb. 6, 2019, https://www.taxfoundation.org/gross-receipts-tax/.

[34] For an overview of similar challenges in the tax code, see Shu-Yi Oei and Diane M. Ring, “Can Sharing Be Taxed?” Washington University Law Review 93:4 (2016), http://openscholarship.wustl.edu/law_lawreview/vol93/iss4/7.

[35] Garrett Watson, “Imposing New Taxes on Peer-to-Peer Car Sharing Will Not Help Texas Economic Recovery,” Tax Foundation, Apr. 19, 2021, https://www.taxfoundation.org/texas-car-sharing-tax-2021/.

Share this article