Pass-through businesses—businesses like sole proprietorships, S corporations, and partnerships that “pass” their income “through” to their owner’s income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. returns and pay the ordinary individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. —make up a majority of U.S. businesses. Marginal tax rates vary for pass-throughs depending upon the state in which they operate because of differences in how states tax individual income.

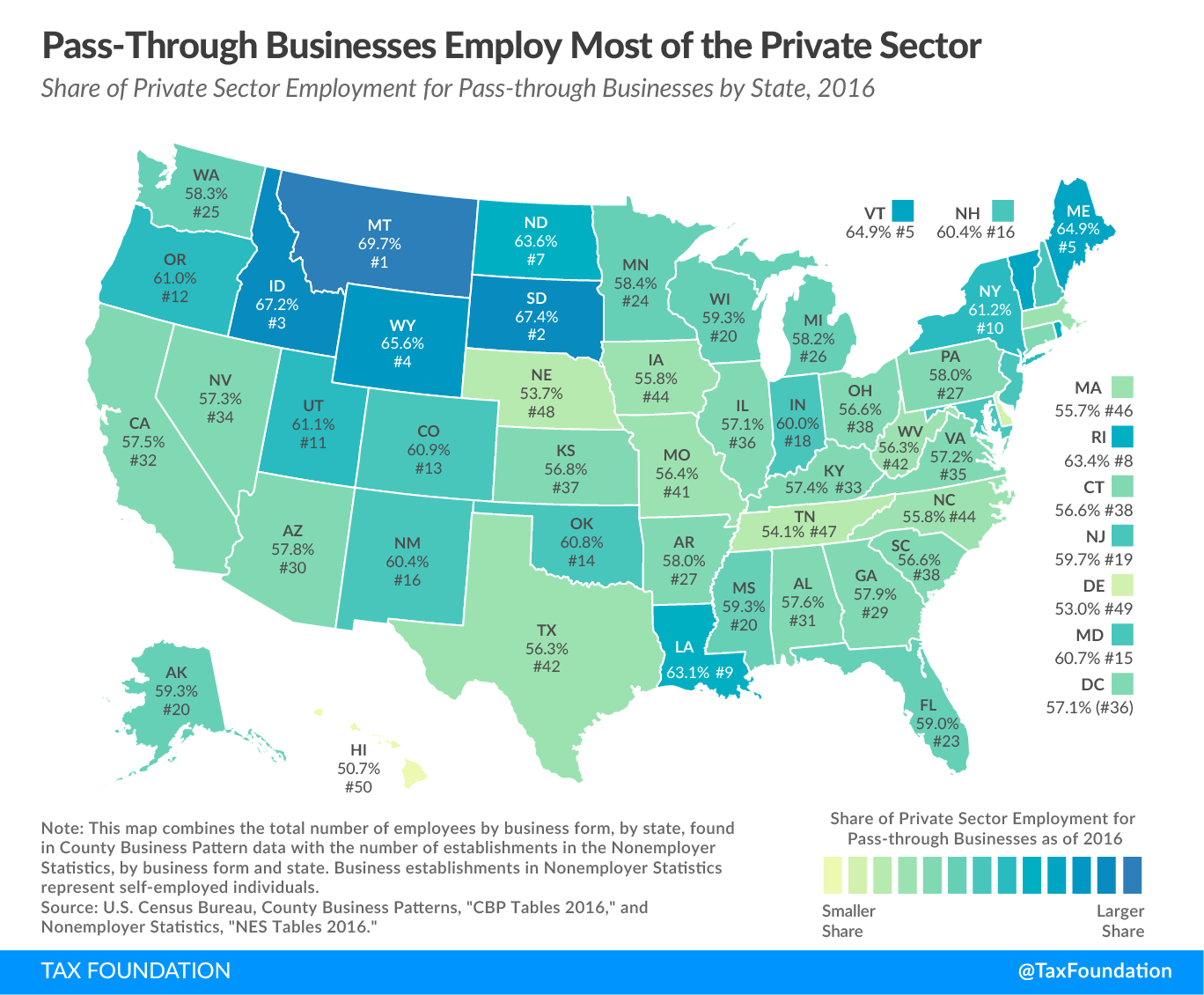

In 2016, pass-through businesses made up at least half of each state’s private sector workforce. The share of pass-through businesses as a percent of all businesses ranges from 50.7 percent in Hawaii to nearly 70 percent in Montana.

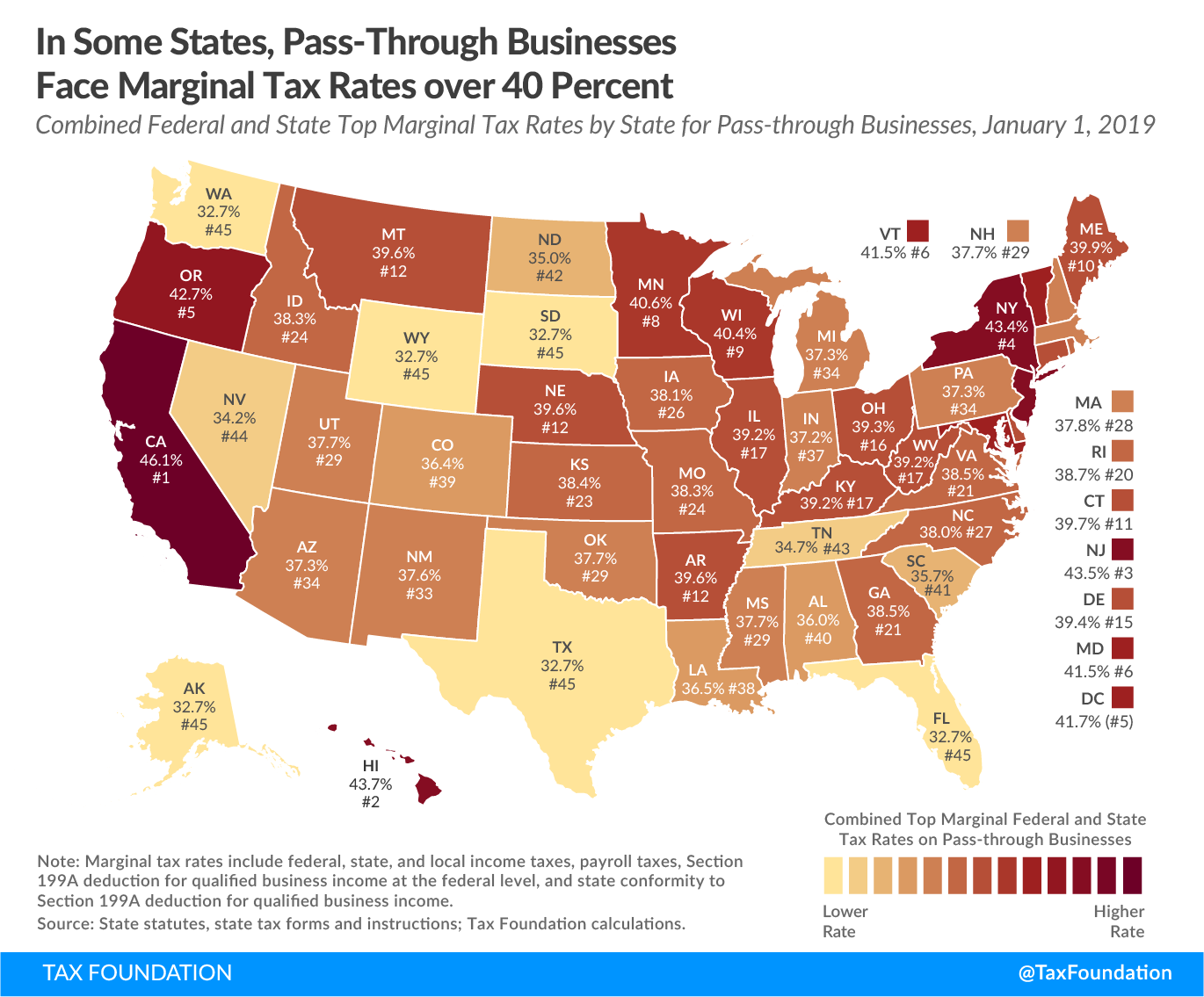

Pass-through businesses’ marginal tax rates vary by state, from a low of 32.7 percent (in seven states) to a high of 46.1 percent (in California). These rates include both state and federal taxes.

One factor driving this variation in marginal rates is the extent to which states tax individual income, since pass-through businesses pay taxes under the ordinary individual income tax. In states with higher individual income tax rates, such as California, pass-through businesses face higher marginal rates. In states without individual income taxes, such as Alaska, Florida, South Dakota, Texas, Washington, and Wyoming, pass-through businesses face the lowest marginal rates. (Nevada does not have an individual income tax, but has an uncapped payroll tax called the modified business tax that is levied on wages at a rate of 1.475 percent, which increases its top tax rate for pass-through businesses).

Additionally, three states (Alabama, Iowa, and Louisiana) allow taxpayers to deduct a portion of their federal taxes paid from their taxable income. By lowering the amount of income subject to state income tax, this provision reduces marginal rates for pass throughs.

But while state tax policies impact marginal rates, most of a pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. ’s tax burden is set by the federal government. For instance, the owners of pass-through businesses have to remit payroll taxes to fund programs like Social Security and Medicare, as well as pay the federal individual income tax.

The Tax Cuts and Jobs Act (TCJA) reduced marginal rates for pass throughs by reducing the top marginal income tax rate from 39.6 percent to 37 percent, and by eliminating the Pease limitation on itemized deductions that reduced the value of itemized deductions for high-income taxpayers. The TCJA also enacted Section 199A, which allows qualifying taxpayers to deduct 20 percent of their qualified business income from federal income tax, which has further reduced marginal rates for pass throughs.

Importantly, five states (Colorado, Idaho, Iowa, Minnesota, and North Dakota) have chosen to conform to this pass-through deduction, either in part or in whole. This means pass-through businesses in these states can also deduct a portion of their qualifying income from their state’s individual income tax, resulting in another reduction to marginal rates at the state level.

Pass-through businesses are now the dominant business form in the U.S., making up more than half of the private sector workforce in every state. Federal taxes on income set a minimum tax rate for pass throughs, but marginal rates for pass throughs vary based on how states tax individual income. Policymakers at both levels should keep in mind the tax burden levied on these businesses.

Erratum: The map posted previously on May 14, 2019, did not account for South Carolina’s lower income tax rate of 3 percent for pass-through businesses, Illinois’ higher income tax rate of 6.45 percent, and caps to federal deductibility in Missouri, Montana, and Oregon.

Note: This is part of our “Business in America” blog series

- The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

- Corporate and Pass-through Business Income and Returns Since 1980

- Firm Variation by Employment and Taxes

- 2017 GDP and Employment by Industry

- Pass-Through Businesses Q&A

- State Corporate Income Taxes Increase Tax Burden on Corporate Profits

- Taxes on Capital Income Are More Than Just the Corporate Income Tax

- Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

- Not All Tax Expenditures Are Equal