Most US businesses are not subject to the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. . Instead, most US businesses are pass-through businesses, such as partnerships, S corporations, LLCs, and sole proprietorships. These businesses “pass” their income “through” to their owners, which is reported on the owners’ individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. returns. Overall, pass-through businesses account for more net income than corporations, meaning an increase in individual income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates will impact a majority of US businesses.

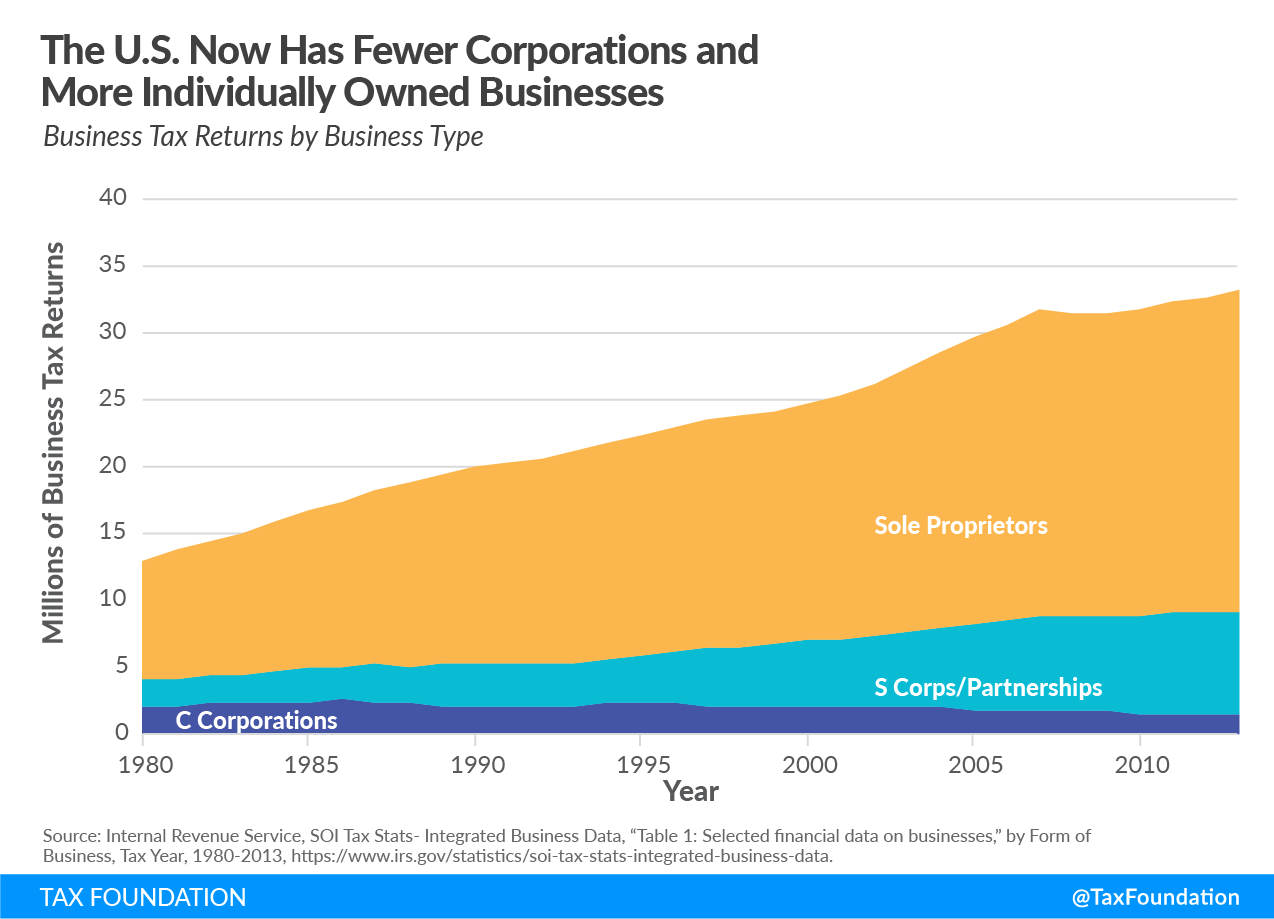

Pass-through businesses represent the ideal tax treatment of a business form. Unlike C corporations, pass-throughs are only subject to one layer of tax, the proper tax structure. Over time, the size of the pass-through sector has increased. Since the 1980s, the number of corporations has decreased from a high of almost 2.6 million in 1986 to about 1.6 million in 2013. On the other hand, the number of sole proprietorships has increased from about 9 million in 1980 to more than 24 million in 2013. The number of S corporations and partnerships increased from 2 million to almost 8 million over the same period.

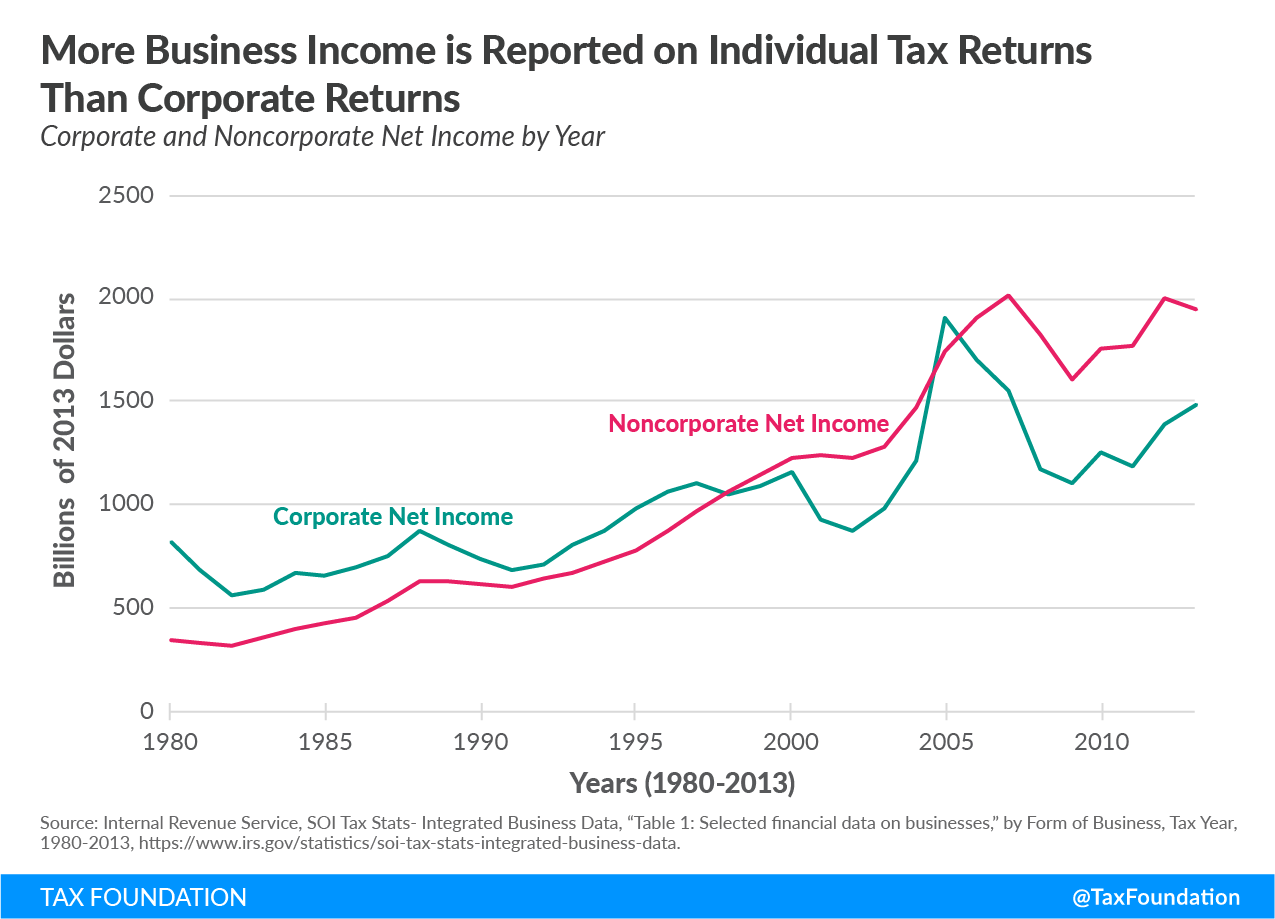

This growth in pass-through businesses relative to C corporations means more net business income is reported on individual income tax returns than on traditional C corporation returns. Aside from a brief period in the mid-2000s when corporate income spiked at the top of a business cycle, noncorporate business income has consistently exceeded corporate income since 1997.

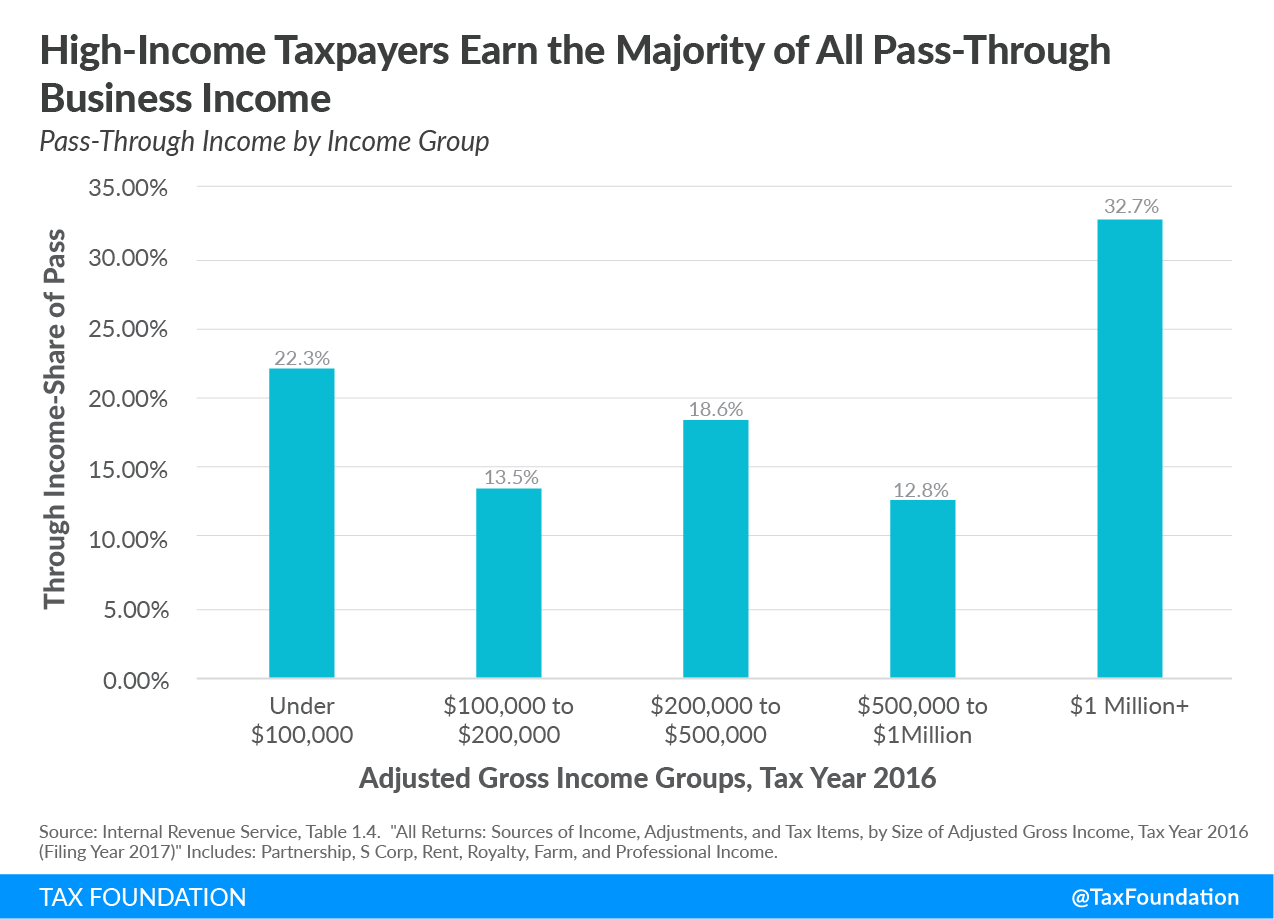

Pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. income is concentrated among high-income taxpayers. In 2016, more than 45 percent of pass-through business income was earned by taxpayers making more than $500,000 annually. Specifically, taxpayers making more than $1 million accounted for nearly a third of pass-through income.

This data shows that a large amount of business income is hit by the high marginal individual income tax rates. As a pass-through business earns more income, higher marginal rates gradually take more out of each dollar. Under the Tax Cuts and Jobs Act, individual income tax rates take 37 cents of every dollar of income earned in the top tax bracket, though this rate is reduced for some qualifying pass-through businesses by the TCJA’s Section 199A provisions which allow qualifying taxpayers to deduct 20 percent of their pass-through business income from federal income tax.

Progressive marginal rates can discourage pass-through business owners from conducting business activities that would increase their income—such as investing in new capital, hiring workers, and producing goods for consumers.

When we think about who is subject to the individual income tax, this data shows us that a significant burden is borne by businesses. Changes to the individual income tax, especially to top marginal rates, can affect a business’s incentives to invest, hire, and produce.

Note: This is part of our “Putting a Face on America’s Tax Returns” blog series

- Who Shoulders the Burden of Federal Income Taxes?

- America Already Has a Progressive Tax System

- The Composition of Federal Revenue Has Changed Over Time

- The Top 1 Percent’s Tax Rates Over Time

- Who Benefits from Itemized Deductions?

- Income Taxes on the Top 0.1 Percent Weren’t Much Higher in the 1950s

- How Do Transfers and Progressive Taxes Affect the Distribution of Income?

- A Growing Percentage of Americans Have Zero Income Tax Liability