Workers in the United States face federal individual income taxes and payroll taxes on their labor income. The individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. system is progressive, as taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates rise as taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. rises. The payroll tax system is regressive, as part of the payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. is subject to a wage cap that reduces the payroll tax faced by higher earners.

In addition to examining statutory tax rates, it is important to look at marginal tax rates on labor income, which is what would apply to earning one more dollar of income, and this can differ from the statutory rate. Examining marginal rates shows how workers may be discouraged to work additional hours and earn higher incomes. Higher marginal tax rates disincentivize additional work at the margin, which translates into lower productivity and economic growth.

The Tax Cuts and Jobs Act (TCJA) cut individual income tax rates and doubled the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. from $12,000 to $24,000 in tax year 2018, which has risen to $24,800 for tax year 2020. However, workers face a wide range of marginal tax rates on their labor depending on their income level. The differences in marginal tax rates are driven by the graduated individual income tax schedule, payroll tax rates, and tax credits meant to offset tax liability, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). While half of the payroll tax is levied on employers statutorily, workers bear the full burden of the payroll tax in the form of lower wages.

The benefits of the EITC and CTC depend on a taxpayer’s filing status and their number of children. Taxpayers with multiple children and married taxpayers tend to receive more benefits under both credits than taxpayers without children and single taxpayers. Both credits have separate phase-in and phaseout rates, thresholds, and refundability rules, which create changing marginal tax rates as taxpayer income rises. Credit phase-ins and phaseouts help minimize large spikes in marginal tax rates but have the trade-off of creating multiple points where the marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on labor changes rapidly as income rises.

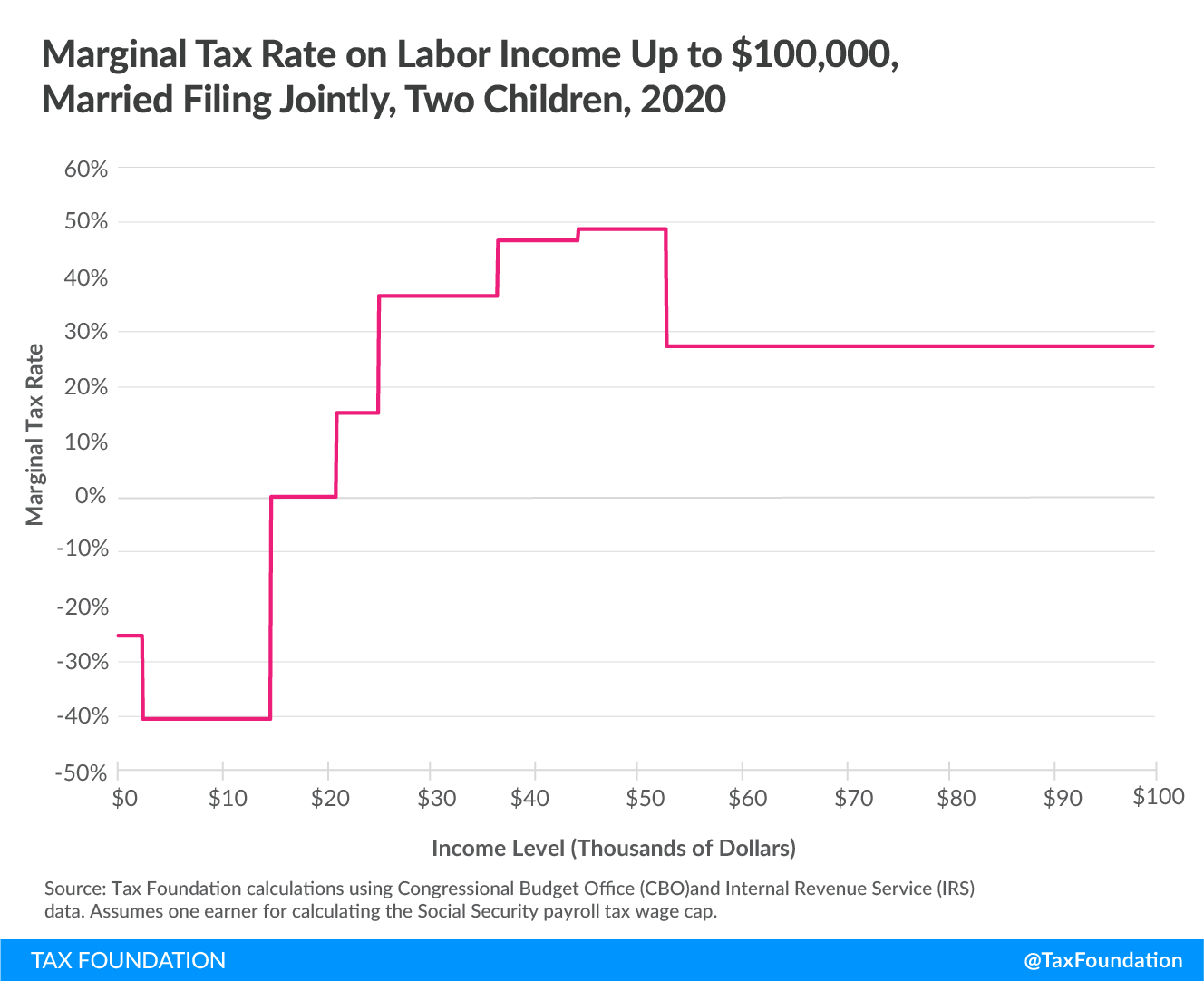

Take, for example, two taxpayers filing jointly with two children. At low levels of income, the taxpayers face negative marginal tax rates as the EITC and CTC phase in (see Chart 1 and Table 1). As income rises above $15,000, the CTC and EITC phase-ins end, and the marginal tax rate rises above 0. Eventually, the taxpayers face a marginal tax rate of up to 46.36 percent when earning over $36,801 on the margin due to the phaseout of the EITC, the 15.3 percent payroll tax, and the 10 percent individual income tax.

Above $53,330 in income, the marginal tax rate evens out to equal the marginal individual income tax rate and the payroll tax. This falls slightly after the Social Security payroll tax wage cap, which drops the payroll tax rate from 15.3 percent to 2.9 percent on income above $137,700. Higher earners face a 0.9 percent additional Medicare tax on income over $250,000 and a 5 percent CTC phaseout on income above $400,000.

The EITC phaseout between incomes of $36,801 and $44,550 means these lower-income taxpayers face a higher marginal tax rate during the phaseout (46.36 percent) than high-income earners do (40.8 percent on income above $646,850). This is because as the EITC phases out at that income band, it raises the marginal tax rate on additional labor through a reduced EITC amount.

| Income Level | Statutory Bracket | Marginal Tax Rate | Comments |

|---|---|---|---|

| $0 to $2,500 | 0% | -24.7% | EITC Phase-In at 40% of each dollar earned with 15.3% payroll tax |

| $2,501 to $14,800 | 0% | -39.7% | CTC phases in at 15% of each dollar earned |

| $14,801 to $21,166 | 0% | 0.3% | EITC phase-in ends and plateaus |

| $21,167 to $25,220 | 0% | 15.3% | Refundable CTC phase-in ends, payroll taxes no longer cancelled out (15.3%) |

| $25,221 to $36,800 | 10% | 36.36% | EITC phase-out of 21.06% of each dollar earned begins |

| $36,801 to $44,550 | 10% | 46.36% | 10% income tax paid on the margin above $36,800 as refundable CTC is fully phased-in |

| $44,551 to $53,330 | 12% | 48.36% | 12% individual income tax bracket |

| $53,331 to $105,050 | 12% | 27.3% | EITC fully phased-out |

| $105,051 to $137,700 | 22% | 37.3% | 22% individual income tax bracket |

| $137,701 to $195,850 | 22% | 24.9% | Social Security payroll tax wage cap – 2.9% Medicare payroll tax remains |

| $195,851 to $250,000 | 24% | 26.9% | 24% individual income tax bracket |

| $250,001 to $351,400 | 24% | 27.8% | 0.9% additional Medicare payroll tax on income above $250,000 |

| $351,401 to $400,000 | 32% | 35.8% | 32% individual income tax bracket |

| $400,001 to $439,500 | 32% | 40.8% | 5% CTC phase-out |

| $439,501 to $480,000 | 35% | 43.8% | 35% individual income tax bracket |

| $480,001 to $646,850 | 35% | 38.8% | CTC fully phased-out |

| $646,851+ | 37% | 40.8% | 37% individual income tax bracket |

| Source: Tax Foundation calculations using Congressional Budget Office (CBO) and Internal Revenue Service (IRS) data. Assumes one earner for calculating the Social Security payroll tax wage cap. | |||

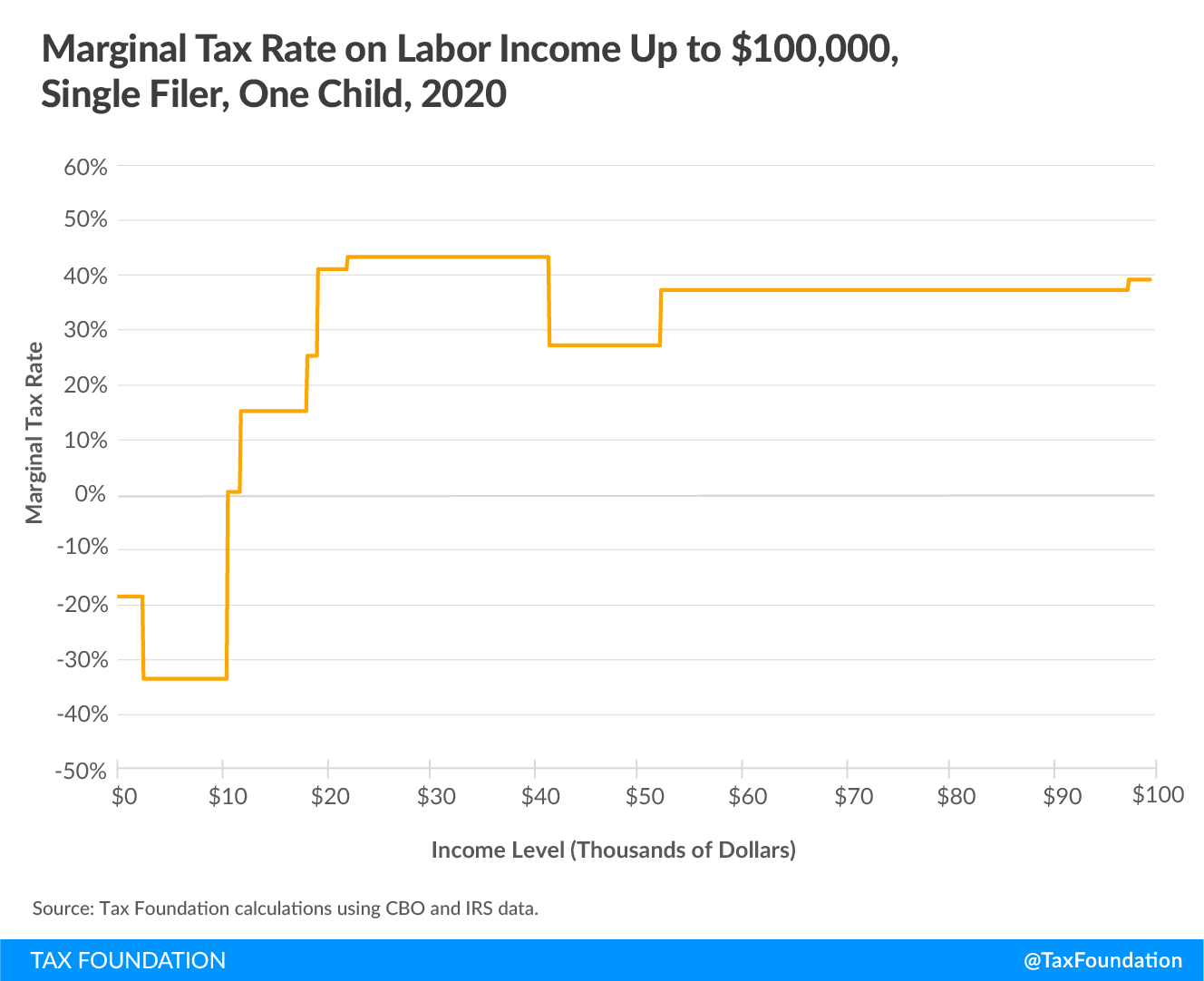

Single filers with children also face marginal tax rate changes as their income rises. Marginal tax rates rise faster for single filers, as the EITC plateaus and phases out at a lower income level for them.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe| Income Level | Statutory Bracket | Marginal Tax Rate | Comments |

|---|---|---|---|

| $0 to $2,500 | 0% | -18.7% | EITC Phase-In at 34% of each dollar earned with 15.3% payroll tax |

| $2,501 to $10,540 | 0% | -33.7% | CTC phases in at 15% of each dollar earned |

| $10,541 to $11,833 | 0% | 0.3% | EITC phase-in ends |

| $11,834 to $18,400 | 0% | 15.3% | Refundable portion of the CTC phase-in ends at $11,833. Non-refundable portion of CTC used from $12,401 to $18,400 to offset 10% income tax. |

| $18,401 to $19,330 | 10% | 25.3% | Non-refundable portion of the CTC fully phased in at $18,400. 10% income tax paid on the margin above $18,400. |

| $19,331 to $22,275 | 10% | 41.28% | EITC phase-out of 15.98% of each dollar earned begins |

| $22,276 to $41,756 | 12% | 43.2% | 12% individual income tax bracket at $22,275 |

| $41,757 to $52,525 | 12% | 27.3% | EITC phaseout ends at $41,756. |

| $52,526 to $97,925 | 22% | 37.3% | 22% individual income tax bracket |

| $97,926 to $137,700 | 24% | 39.3% | 24% Individual income tax bracket |

| $137,701 to $175,700 | 24% | 26.9% | Social Security payroll tax wage cap at $137,700 – 2.9% Medicare payroll tax remains |

| $175,701 to $200,000 | 32% | 34.9% | 32% individual income tax bracket |

| $200,001 to $219,750 | 32% | 40.8% | 0.9% additional Medicare payroll tax on income above $200,000. 5% CTC phaseout begins. |

| $219,751 to $240,000 | 35% | 43.8% | 35% individual income tax bracket |

| $240,001 to $530,800 | 35% | 38.8% | CTC phase-out ends at $240,000 |

| $530,801+ | 37% | 40.8% | 37% individual income tax bracket |

| Source: Tax Foundation calculations using Congressional Budget Office (CBO) and Internal Revenue Service (IRS) data | |||

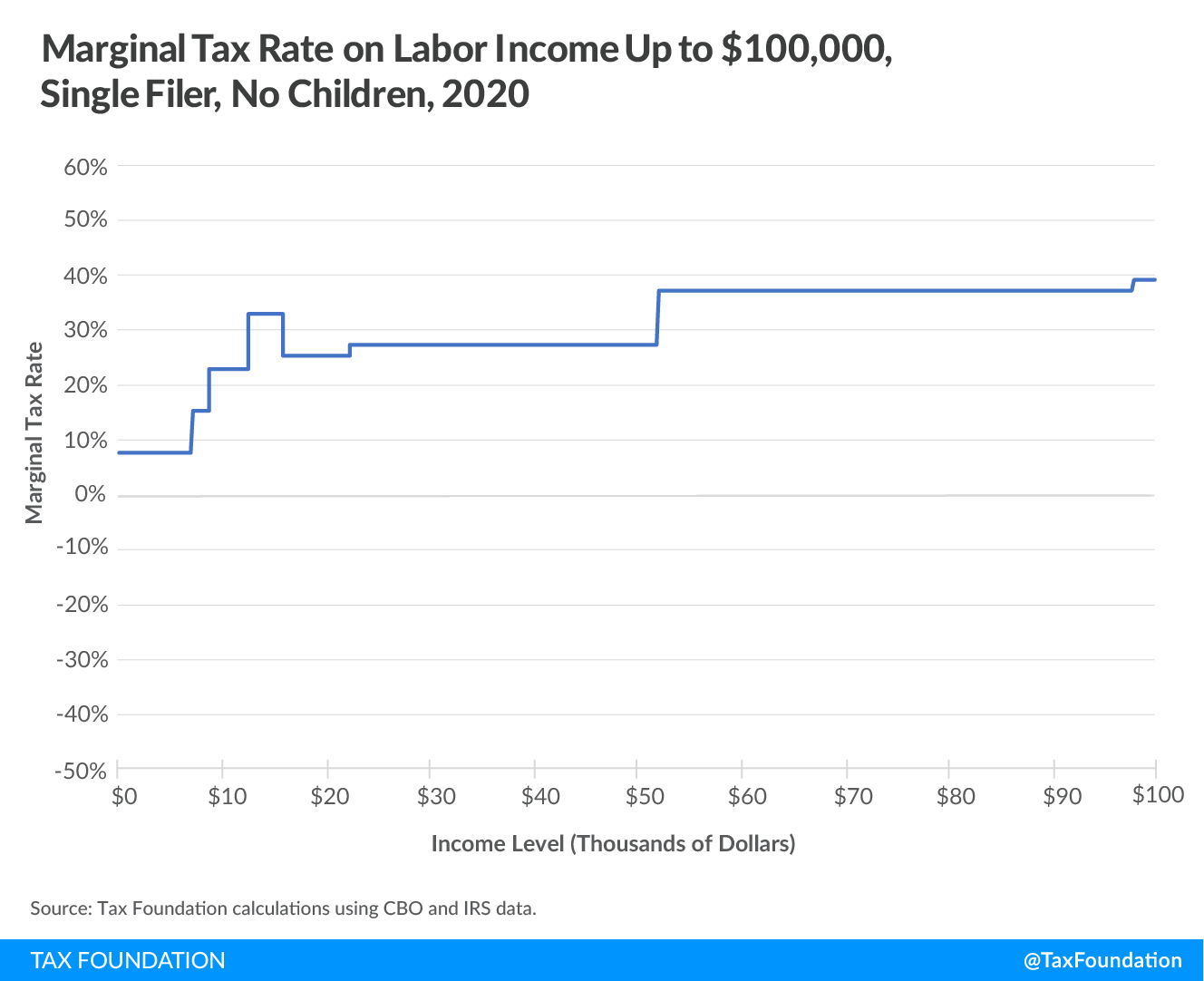

Single filers without children receive no benefit from the CTC and limited benefits from the EITC, which phases in at a lower rate—7.65 percent—to help offset the employee-side of the payroll tax (see Chart 3 and Table 3). The marginal tax rate on labor rises from 7.65 percent on the first dollar of income to 32.95 percent for income earned between $12,401 and $15,820, where the EITC phaseout occurs and the 10 percent individual income tax bracket begins.

After the EITC is fully phased out, single filers without children experience rising marginal tax rates as they move up individual income tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. , although single filers see a drop in the marginal tax rate after the Social Security payroll tax wage cap kicks in above $137,700.

| Income Level | Statutory Bracket | Marginal Tax Rate | Comments |

|---|---|---|---|

| $0 to $7,030 | 0% | 7.65% | EITC Phases-in at 7.65% of each dollar earned with 15.3% payroll tax |

| $7,031 to $8,790 | 0% | 15.3% | EITC phase-in ends at $7,030 |

| $8,791 to $12,400 | 0% | 22.95% | EITC phase-out begins at 7.65% of each dollar earned |

| $12,401 to $15,820 | 10% | 32.95% | 10% individual income tax bracket |

| $15,821 to $22,275 | 10% | 25.3% | EITC phase-out ends at $15,820. |

| $22,276 to $52,526 | 12% | 27.3% | 12% individual income tax bracket at $22,275 |

| $52,526 to $97,925 | 22% | 37.3% | 22% individual income tax bracket |

| $97,926 to $137,700 | 24% | 39.3% | 24% Individual income tax bracket |

| $137,701 to $175,700 | 24% | 26.9% | Social Security payroll tax wage cap at $137,700 – 2.9% Medicare payroll tax remains |

| $175,701 to $200,000 | 32% | 34.9% | 32% individual income tax bracket |

| $200,001 to $219,750 | 32% | 35.8% | 0.9% additional Medicare payroll tax on income above $200,000. |

| $219,751 to $530,800 | 35% | 38.8% | 35% individual income tax bracket |

| $530,801+ | 37% | 40.8% | 37% individual income tax bracket |

| Source: Tax Foundation calculations using Congressional Budget Office (CBO) and Internal Revenue Service (IRS) data | |||

The many marginal tax rates on labor income create complexity in the tax code and disincentives to work at the margin, showing that there is an opportunity to simplify tax credits for low-income taxpayers.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe