OECD Tackling Harmful Tax Practices

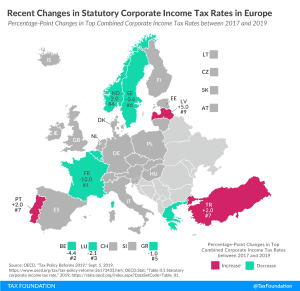

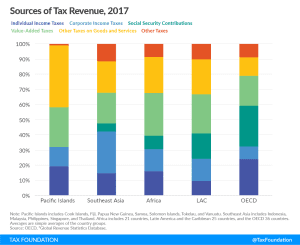

Countries around the world often design their tax policies to become attractive targets for foreign investment. These policies can be anything from a system with special preferences for certain industries to a well-designed tax system based on principles of sound tax policy. Systems that are rife with special preferences and complexities can create distortions in local jurisdictions and across the global economy.

3 min read