All Content

8846 Results

State Corporate Income Tax Rates and Brackets, 2017

Corporate income taxes are levied in 44 states. Though often thought of as a major tax type, corporate income taxes account for just 5.4 percent of state tax collections and 2.7 percent of state general revenue. Here’s how corporate income taxes compare across the states.

6 min read

Testimony: The Tax Code as a Barrier to Entrepreneurship

Lawmakers interested in removing barriers to entrepreneurship should consider ways to mitigate 3 distortions in the U.S. tax code: the limited deductibility of business net operating losses, the limited deductibility of capital losses, and lengthy depreciation schedules.

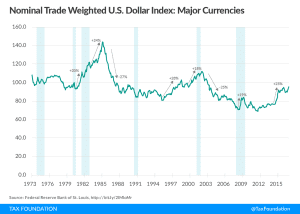

Understanding the House GOP’s Border Adjustment

What is a border adjustment? What are the mechanics of how a border adjustment works, how would one affect U.S. businesses, and what are some pros and cons of enacting one?

29 min read